Zurich adds top-layer cat reinsurance for Europe, US all-perils retention shrinks

European headquartered re/insurer Zurich has further adjusted its catastrophe reinsurance arrangements for 2024, adding a new top-layer of protection in Europe, so lifting the top of that tower, while reducing its US all-perils retention so coverage will attach earlier there.

A year ago, Zurich’s reinsurance renewal for 2023 saw the re/insurer opting not to renew its global aggregate catastrophe treat, while adding more top-layer catastrophe coverage and a US earthquake swap.

For 2024 the changes continue, but appear to reflect a more stable renewal and perhaps easier terms than Zurich had experienced a year earlier.

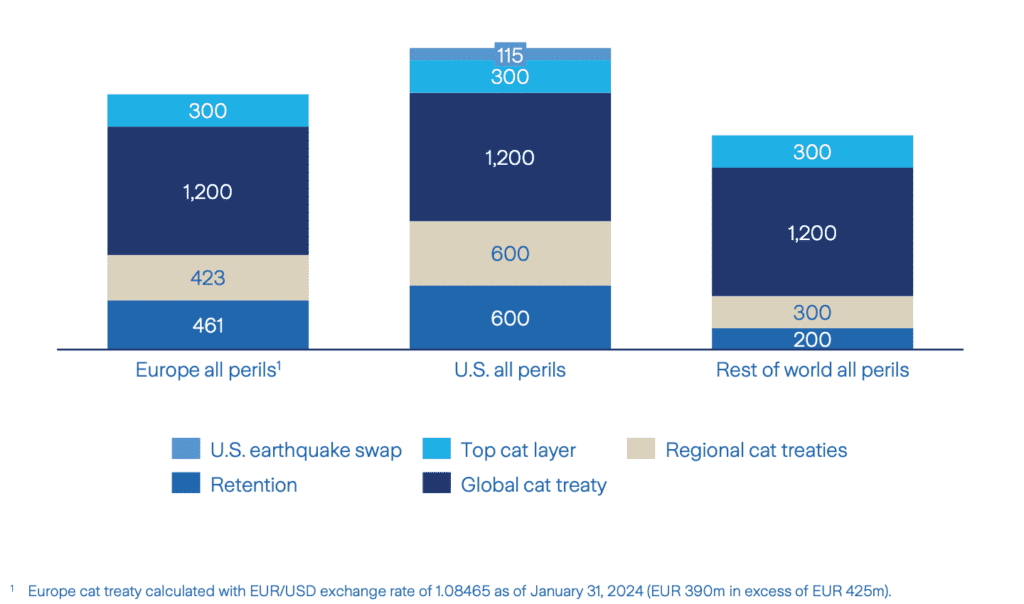

The most notable change to Zurich’s reinsurance towers for 2024, is the addition of a new top-layer catastrophe reinsurance cover for Europe, taking the top of its European all-perils tower to $2.384 billion.

On the European side, the retention sits at practically the same level of $461 million, above which are $423 million of cover from Zurich’s regional catastrophe treaties, then an unchanged global cat treaty of $1.2 billion, but now with a $300 million top-layer European cover that did not exist a year ago.

This move likely reflects the heavy catastrophe toll being felt in Europe in recent years, as well as a recognition that exposure growth must be covered.

You can see the latest 2024 catastrophe reinsurance tower for Zurich below and see the 2023 version in last year’s article here.

The middle tower, which is Zurich’s US all-perils catastrophe reinsurance cover for 2024, the most notable changes are that the retention has shrunk from last year’s $650 million to now $600 million for 2024, while the only other change is that the US earthquake swap has dropped-down and now attaches much lower, but it has also shrunk from $200 million to now $115 million.

A year ago, Zurich introduced the US earthquake swap for the first time, but it sat much higher up and attached at $3.25 billion, where as for 2024 this has dropped down to $2.7 billion.

There haven’t been any changes to the rest of world all-perils catastrophe reinsurance tower for Zurich.

Overall, the global catastrophe reinsurance treaty remains at $1.2 billion for 2024, across Europe, the U.S., and rest of the world, covering all perils.

The attachment for the global cat treaty has stayed the same, it is Zurich’s US regional catastrophe reinsurance treaty that benefits from the $50 million reduction in retention.

The extension of the top of the European reinsurance tower and reduction in US retention imply continued exposure growth at Zurich and a better experience in renewing its catastrophe reinsurance arrangements for 2024.

One other reinsurance change worth noting for Zurich, is the fact that its Farmers Reinsurance all lines quota share treaty from the Farmers Exchanges has increased at its renewal for 2024, from an 8.5% quota share to 10.0%.

That’s now well up on the 2022 quota share of just 1.75%, as Zurich looks to manage volatility within the results of the Farmers Exchanges through the use of aligned reinsurance participation with its own dedicated carrier.