Women Leaders in Insurance in Canada | Elite Women

Jump to winners | Jump to methodology

New roads to success

An unwavering commitment to their craft underpins the accomplishments of Insurance Business Canada’s Elite Women of 2024.

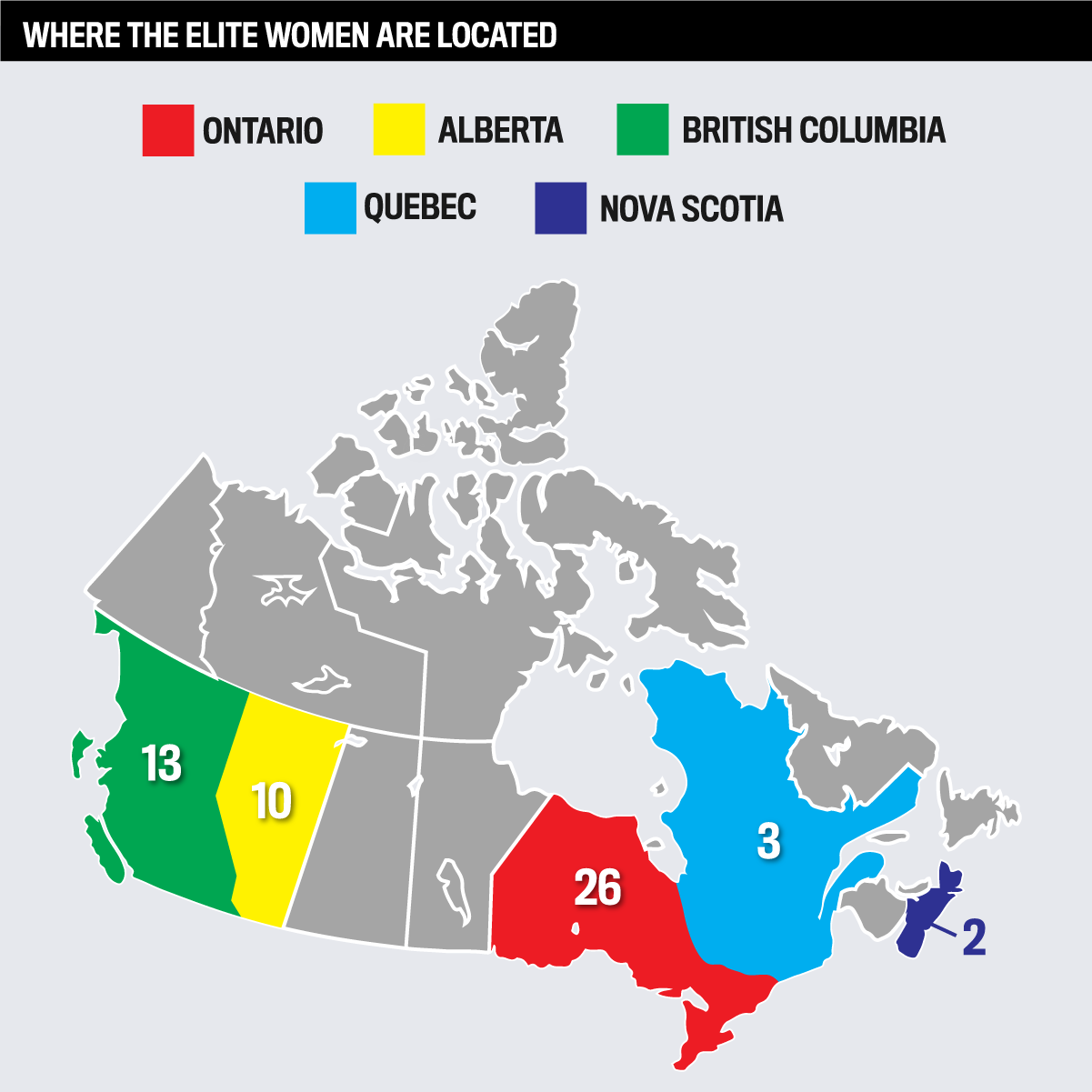

An esteemed panel of judges helped select 54 award winners nationwide, a dynamic and diverse group of top female insurance leaders whose extraordinary contributions and industry impact set new benchmarks.

Judge MaryKate Townsend, marketing development director at Lloyd’s and past president of the Canadian Association of Managing General Agents, noted that while all this year’s nominees were impressive, what set the top female insurance leaders apart were their abilities to:

overcome hurdles to implement changes

balance careers with family life

be integral to their organization’s success

“I appreciate and support these women for being strong, not only for themselves but also their families,” says Townsend. “There are some impressive women on this list who deserve all sorts of recognition, and I admire them for their leadership within their organizations and for becoming respected mentors to others in insurance and life.”

Ingrid Wilson, judge and board director at the Canadian Association of Black Insurance Professionals, echoes those sentiments. She also notes that nominees who focused on equity and inclusion outshone their peers.

“Standing out in the insurance industry as a woman has been challenging,” she says. “Although there is a slight shift with some women in the industry moving to more leadership roles, this, however, is not true for all women in racialized communities.”

As the following four Elite Women demonstrate, while their challenges and business strategies may differ, their wide-reaching impact has resonated across their professional circles.

Anita Morgan – Senior manager of claims at TD Insurance

Trailblazing champion of diversity and inclusion

With a leadership style described by her peers as authentic, influential, and passionate, Morgan has built a reputation as a force to be reckoned with.

Before her current role, she set new standards of success for the organization’s private client advice program, which she successfully established as one of Canada’s foremost high-net-worth insurance carriers.

She is a diversity and inclusion champion and is regarded as an influential leader in her work on various boards and committees, including the Ebony Women International Insurance Network and TD Insurance’s Black Employee Network and Visible Minority Committee.

Praise from her nominators includes:

“Anita is a sought-after speaker, known for provoking thoughtful conversations around diversity, inclusivity, Black excellence, mentorship, and equity.”

“Within her community, Anita volunteers her time helping to feed the homeless and supporting mentorship programs for the youth and newcomers to Canada.”

“I would love to leave a legacy where young people can see that they can have a career in this industry and succeed. If you want and desire more, step outside your comfort zone and take a chance on yourself”

Anita MorganTD Insurance

Andrea Falcioni-Drew – Vice president of commercial enterprise at PROLINK

Driving progress through empowerment

No one succeeds on their own. That’s why Falcioni-Drew prioritizes a team approach and has created a unique workplace culture that empowers colleagues.

While leading a 26-person team, Falcioni-Drew strives to identify improvements in employee capabilities to drive an exceptional client experience. She embodies the essence of a working parent, a woman of action, and excels in balancing a career, leadership, and family.

Her notable achievements include:

membership in Aspire, a part of the ISC Group – a not-for-profit committed to increasing women’s representation in senior leadership roles in the insurance sector

active participation in the Incite Performance Group management mastery series and frequent volunteerism at IBAO and TIWA events

“I hope that I’m creating a workplace where all people feel welcome; they’re always going to get an honest and transparent manager, leader, and colleague”

Andrea Falcioni-DrewPROLINK

Jacqueline Knoblauch – Insurance planning specialist at Raymond James

Passionate advocate for education and reform

Driven by a desire to educate and encourage awareness about the industry, Knoblauch works tirelessly to help clients achieve their financial goals through sound financial management advice.

So moved by the duty to provide competent advice, she acts as the advocacy chairperson for the Greater Vancouver Chapter of Advocis, promoting title protection in British Columbia’s insurance sector.

As a member of various networks and investment teams, she speaks regularly at events about the importance of who to talk with and how to better one’s financial and estate positions.

A client wrote in support of her nomination, saying:

“What I like about working with Jacqueline is that she’s always honest and ensures our family is the priority with her recommendations. While I know I can trust her, it is also wonderful to know she’s trying to make it easier for everyone to be able to know if they are making good, educated decisions.”

“Near and dear to my heart is my advocacy for title protection and providing better advice to families; it’s something I hope to encourage every time I get on stage and talk to people”

Jacqueline KnoblauchRaymond James

Marie-Eve Paquette – Chief Executive Officer of APRIL Marine Canada

Leading the way in modern-day insurance

Regarded as the face of modern-day insurance, Paquette joined the industry at just 17 years old after landing a summer job as an underwriting assistant. Today, she is the organization’s new CEO, with in-depth knowledge and a remarkable understanding of pleasure craft insurance.

Over the last five years, she played a critical role in expanding APRIL Marine, now a Quebec leader in pleasure boat insurance and a significant player in Ontario. Under her guidance, the organization has received several IBC awards, including Digital Innovation in 2022 and Excellence in Claims in 2021.

Buoyed by the parent firm and its management team, of which four out of five members are female, Paquette is focused on enhancing equity and shattering the glass ceiling. She has created a support and mentoring committee for the company’s female employees and managers.

Her supporters highlighted:

“Marie-Eve has excellent managerial skills, which are as much about caring as they are about demanding the highest standards from her teams, making her a legitimate and highly inspirational figure for everyone she works with.”

“I hope to motivate people to do more because life is short, and you’ll be proud of yourself. Insurance can sometimes have a bad image, and we’re trying to make insurance easier but also more fun”

Marie-Eve PaquetteAPRIL Marine Canada

2024’s Elite Women share their thoughts and experiences

IBC asked this year’s leading-edge female leaders in the insurance sector to illuminate what drives them and led to their recognition.

What strategy or approach has served you well throughout your career journey in insurance?

AM: “Two things I would say: growing up in the household that I did, my parents were big on education. It was never good enough to learn something and leave it at that. There’s always something new happening in insurance. Learning has always been a critical strategy. And, always putting myself in the client’s place and prioritizing the small touches that show our value and that we care, and it’s not just about collecting premiums and moving on.”

AFD: “No. 1 is being myself, and that’s about juggling and finding balance as a working mom. Insurance is relationship based, so I rely on the team and network I’ve built in my career and ask for help when needed. Being kind, transparent, and treating others how you want to be treated is what resonates with clients and insurers. Find the mentors so you, in turn, can be that for someone else.”

JK: “Always be curious and ask clients questions so you can make a proper recommendation. If I don’t know something, I try to find the answer and bring someone else to round out the conversation. With that, I don’t think you can be a good insurance agent coming from a place of desperation. It’s OK to tell clients they don’t need more insurance or that you’re not the right fit. Advisors and others from referral networks will know you’re not there to push products but to give good advice.”

MP: “I have seen where we can simplify processes for our people, clients, and brokers. We have created our own internal tools, leveraging technology to develop them from scratch by bringing all our talent around the table. It’s always been my strength to motivate people and get them involved in projects, and we have consistently high employee satisfaction.”

What have you learned from your role model or mentor?

AM: “What was important for me was finding people that looked like me, specifically women that looked like me, and I wanted to see how they were breaking barriers in the insurance industry. I learned that the sky’s the limit. I watched my first leader and one of my best role models work tirelessly, showing me the importance of treating everyone fairly and well.”

AFD: “My mom was my first role model in the insurance industry. She was in claims for more than 40 years, and I witnessed that strong female presence in a male-dominated world. The biggest thing I learned is that hard work pays off. Seeing what you can accomplish when you put your head down and work for it in a compassionate and trustworthy way was eye-opening. I started in construction insurance and had the strong support of male and female supervisors. From all this, I learned to trust myself, use my voice, not shrink down, and go after what I want.”

JK: “Both my parents are accountants and instilled in us a mindset of hard work, kindness, and helping others. That has had a tremendous influence on how I do business and how I work with my associates and others. I don’t have a case size minimum and believe in providing advice to people who need it. To me, that comes directly from my parents. Yes, you have to take care of yourself, but there’s no harm in helping everybody around you, too.”

MP: “I’ve had many inspiring leaders over the years, but I learned a lot from our former CEO, who always listened to and motivated people with his positivity. I also worked with a director for 10 years who is passionate about boating and shares that with the team.”

How have you overcome the barriers that you have faced?

AM: “I can’t say enough how important it is for women to have women in their network of trusted advisors, like their own personal board of directors. Not that you don’t need men there, but you need women who’ve walked that path before, who’ve gone through certain things, and who can say, ‘Hey, this is the mistake I made. Here’s how you need to do better.’ So, I overcome these things by using my network.”

AFD: “You fight through the barriers and keep moving forward. It took inner confidence not to let things get me down and throw me off my game. It took standing tall, putting yourself out there, sometimes in uncomfortable situations, and deciding to shine anyway. It’s a mindset of fighting for what you want, and I think women should be fearless and not let opportunities pass them by.”

JK: “I got my insurance license when I was 24, and I didn’t know what I didn’t know. I had unfounded confidence stepping into the role, so I overcame that by befriending a male colleague older than me, and we started doing joint meetings. He was my entry ticket into many of the meetings, and I am grateful that he recognized the dynamic and let me run with a meeting.”

MP: “I’ve felt that associates doubted my abilities for being young and a woman, especially when presenting to a big insurer. I felt I needed to have all the answers to prove myself. That’s rare now because I’ve built my credibility. Every time that happened, it was an experience that helped me grow, learn, and improve.”

Meet the judges

Alyssa Keyes

Operations Manager

Keyes Real Estate & Insurance

Aneeza Ahmad

Marketing Manager

KASE Insurance

Ann Hildreth

Client Consultant

HSB Canada

Ashley McNeil

Associate Manager

Burns & Wilcox Canada

Beverly Lewis-Hunte

Senior Career Connections Program Officer

Insurance Institute of Canada

Colette Taylor

Chief Operating Officer

Sovereign Insurance

Darlene Hazzard

Vice President, Professional Lines

South Western Insurance Group

Dionne Bowers

Business Owner

D.B. Solutions

Edwina McKennon

Host

Move Her Forward

Geneviève Fortier

Chief Executive Officer

Promutuel Assurance

Ingrid Wilson

Member and Board Director, Governance and Audit

Canadian Association of Black Insurance Professionals

Jacqueline Tremblay

Regional Vice President, BC

Agile Underwriting Solutions

Jen MacBruce

Head of Investment Analysis, Canada

Manulife Investment Management

Jessica Fryer

Chief Underwriting Officer

Special Risk Insurance Managers

Jurenda Landry

Director, Client Solutions

Gallagher

Karen Kilbrei

Managing Partner

Wilson M. Beck Insurance Services (Kelowna)

Karrina Dusablon

Vice President, Member Engagement and Chief Marketing Officer

Équité Association

Kelly McGuinness

Team Lead, Canada, Production Underwriting and Business Development (East)

Coalition

Kerri Tallman

Vice President, Commercial Lines

Wilson M. Beck Insurance Services (Alberta)

Kesha Christie

Associate Director and Senior Cyber Placement Broker

WTW

Kiran Kaur

Insurance Broker

Billyard Insurance Group

Lenora Shipka

Associate Vice President, National Business Development

Echelon Insurance

Marcela Abreu

Head, P&C Solutions Canada and English Caribbean

Swiss Re

MaryKate Townsend

Marketing Development Director, Lloyd’s

Past President, Canadian Association of Managing General Agents

Melanie Hoad

Vice President and Head of Legal, Risk and Compliance

CNA Insurance

Melissa Bajwa

Vice President, Compliance and Broker Network Operations

PROLINK

Mo Kaur

President and Chief Operating Officer

Premier

Natasha Pinto

Senior Vice President, Operations

DKI Canada

Natasha Purnell

Chief Culture Officer

Park Insurance

Patricia Sheridan

Director, Ontario Property and Casualty

Burns and Wilcox Canada

Patty McNeil

Chief Operating Officer

Jones DesLauriers

Robyn Campbell

Managing Director

Marsh Canada

Robyn Young

President and Chief Executive Officer

Excel & Y Insurance Services

Ruby Rai

Cyber Practice Leader, Canada

Marsh McLennan

Sanjika Coorjee

Senior Manager, Information Technology

HSB Canada

Sarah Fleck

Territory Manager

BrokerLink

Saskia Matheson

President and Chief Executive Officer

Facility Association

Sheri Clay

Executive Vice President, Private Client Services

J.T. Insurance Services (Canada)

Shirley Chisholm

President

Ebony Women International Insurance Network

Silvy Wright

President and Chief Executive Officer

Northbridge

Sukhdeep Kang

Chief Executive Officer

Armour Insurance Brokers

Suzanne Pountney

President

Insurance Brokers Association of Ontario

Tara Lessard Webb, BBA, CIP, CRM, RF

Director, Corporate Governance

Intact

Tara Schlosser

Commercial Lines Underwriter

Wawanesa Insurance

Tendai Moyo

Senior Vice President and Cyber Insurance Practice Lead

Hugh Wood Canada

Teresa Rooney

Vice President, Business Operations

BFL Canada

Tracy Laughlin

Chief Human Resources Officer and Senior Vice President

Intact

Wendy Amanda Sinclair

Area President

Gallagher