When it comes to cars, Hagerty keeps the classics covered

When it comes to cars, Hagerty keeps the classics covered | Insurance Business Canada

Motor & Fleet

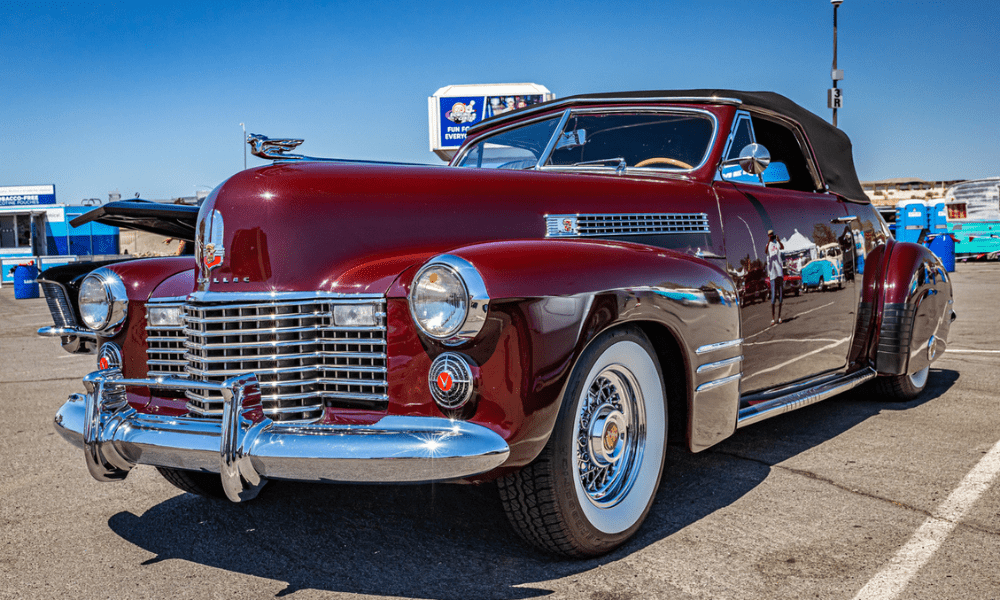

When it comes to cars, Hagerty keeps the classics covered

What type of coverage would Prince’s Little Red Corvette need?

Motor & Fleet

By

Desmond Devoy

This article was produced in partnership with Hagerty Insurance.

Desmond Devoy, of Insurance Business Canada, buckled up to find out more about Hagerty Insurance’s policy offerings for your classic cars.

Your classic car is not a commuter car.

You don’t use your ’57 Chevy to get to work, or make house calls to clients in your ’68 Ford Mustang.

Your classic car is a pleasure to drive, and you drive it for pleasure.

Hagerty Insurance protects the vehicles people love, the vehicles that may be car show ready but are used for scenic drives and weekend road trips and car shows with gearhead buddies.

What does it take to protect a collector vehicle?

There are a few requirements for a client to qualify for a classic car insurance policy – and benefits beyond a lower premium and Guaranteed Value™.

The vehicle cannot be a daily driver and garage storage is preferred, though carports and driveways may also qualify in some provinces. Hagerty also considers vehicles that are under active restoration.

So, what can your car enthusiast client expect from a Hagerty Insurance classic car policy?

Flexible usage and a “Guaranteed Value” of the vehicle, with no appraisal requirement on most stock vehicles.

$750 for spare parts (that goes up to $1,000 in British Columbia and Quebec.)

$500 for car covers.

Expert claims service.

Automatic Ride Coverage of up to $50,000 for new collector vehicle purchases.

30 days coverage for Nova Scotia and New Brunswick.

14 days coverage for British Columbia, Alberta, Manitoba, Ontario, Quebec, New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island and Saskatchewan.

Hagerty also offers additional coverages:

Protection for vehicle trailers and vehicles under restoration.

“Cherished Salvage” and Evacuation coverages.

Now a 1908 Ford Model T is different than a 1990 K-Car, and Hagerty adjusts its coverage for collector vehicles accordingly.

Antique and classic cars – 1989 or older, with a $3,500 minimum insured value

1990 and newer collector cars – $3,500 minimum insured value on special interest vehicles

Exotics – Supercars/exotics or imports

Hot Rods/Street Rods – 15 years or older, $3,500 minimum insured value

Pro-Street – 1990 or older, $15,000 minimum insured value (British Columbia, Nova Scotia and Ontario, New Brunswick, only.)

Tuners/Custom Imports – $15,000 minimum insured value (British Columbia, Nova Scotia and Ontario, New Brunswick, only.)

Collectible race cars and nostalgia dragsters – $15,000 minimum insured value. Comprehensive and trailer and paddock collision may be offered for unregistered collectible race cars. (British Columbia, Nova Scotia, New Brunswick and Ontario only.)

Trucks, SUVs and Jeeps – 15 years or older, $3,500 minimum insured value. Extreme off-road modifications such as brush guards, roll bars, tool boxes, and lift kits with large off-road tires are not accepted.

Hagerty Insurance also has private client insurance, coverage for high-value vehicles and collections. Let’s say your client has a collection of more than six vehicles, valued at more than $250,000 (or one vehicle valued at more than $500,000.) This policy can offer enhanced services and protection, such as:

$2,500 for spare parts.

Market Value Protection – After a total loss, clients get up to 125% of the insured amount for pre-loss market value increases.

Automatic New Ride Coverage – Up to $1,000 in British Columbia, Nova Scotia, or Ontario and up to $750,000 in other provinces for new collector vehicle purchases.

Finding a Guaranteed Value™ for your vehicle

To your client, of course, their vehicle is priceless.

But, for all intents and purposes, you do need to put a price on that ride. That’s why Hagerty has industry-leading tools to determine that classic’s true value.

Now what if there is a total loss? In that case, your client will receive a cheque for the insured amount, guaranteed. *

No games. No hassle.

Plus, no appraisals are required on nearly all stock vehicles. (If Hagerty needs any further documentation in supporting the vehicle’s value, they will contact the owner during the underwriting process.)

How’s Guaranteed Value with Hagerty compare to competitors? Other insurers will typically pay total losses based on Actual Cash Value (ACV), an estimate of a vehicle’s fair market value, after considering factors like depreciation. They can also require an appraisal on the vehicle. Overall, this could mean a lower payout and a bigger headache.

And it’s not just cars…

The call of the open road is alluring, but sometimes you just need to get out on the water. Or get back to the land with your 1950s tractor. Remember our military history with a Korean War jeep? Or feel like you’re hunting ghosts in your “Ghostbusters”-like 1950s ambulance? Whatever your client’s collectible is, Hagerty has them covered:

Classic boats – Boats made of wood, fiberglass, aluminum and steel, including boats under construction.

Military vehicles – 25 years or older, with a minimum insured value of $3,500.

Retired Commercial Vehicles – 25 years or older, with a minimum insured value of $3,500

Tractors – 25 years or older, $3,500 minimum insured value.

Business Insurance – Insurance for collector car restoration shops, collector car dealerships, museums and storage facilities

For complete details regarding program eligibility, including annual mileage, driving record/experience and more, visit the Hagerty website or call 888-349-7834.

(* Less any deductible; Manitoba and Saskatchewan: and after settlement with your government policy. Includes any applicable taxes unless prohibited by law. Alberta and Quebec: Agreed value applies under the Guaranteed Value Plus Endorsement.)

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!