What’s the key to limiting reinsurance risks in Central Europe?

What’s the key to limiting reinsurance risks in Central Europe? | Insurance Business America

Reinsurance

What’s the key to limiting reinsurance risks in Central Europe?

Howden Re offers its verdict

Reinsurance

By

Kenneth Araullo

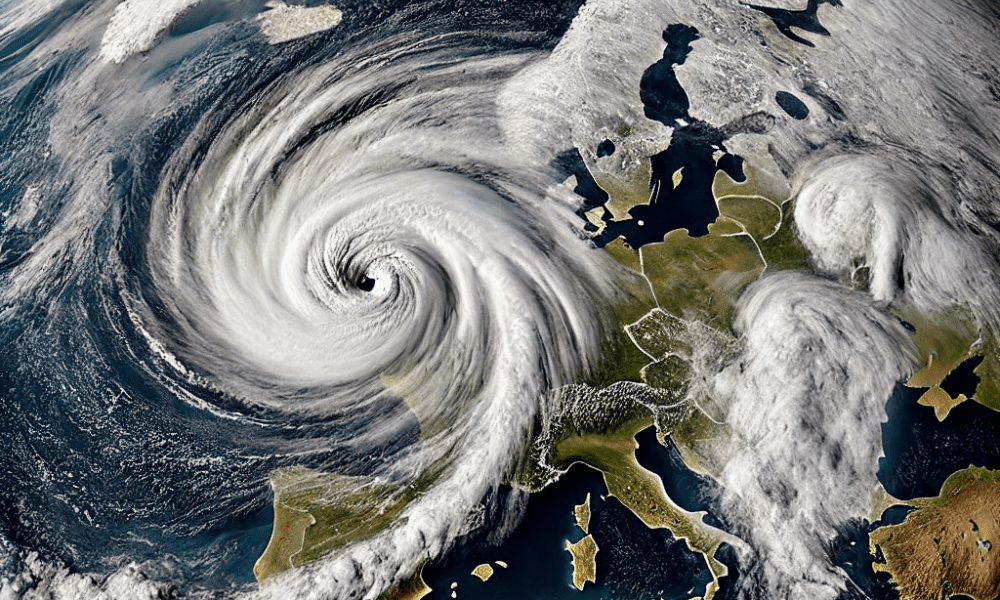

Howden Re has highlighted the positive effects of continued investments in flood resilience across Central Europe, especially in regions recently affected by late September floods. The company’s insights suggest that these investments are making a significant difference compared to historical flood events.

Central Europe is experiencing another season of summer flooding, following last year’s incidents in Italy and Slovenia, the Bernd floods of 2021, and notable floods in 1997, 2002, 2010, and 2013. Earlier this year, Germany and Switzerland faced extraordinary prolonged rainfall attributed to a Vb weather pattern.

As climate cycles evolve, the importance of mitigation measures is increasing. Howden Re’s analysis of precipitation and gauge data across Central Europe has revealed a clear time trend in European rainfall patterns.

Tim Edwards, managing director and head of international catastrophe & actuarial analytics at Howden Re International Treaty, highlighted the results of its study. “As Europe grapples with changing patterns of flood events, it is imperative that we adapt our strategies to stay ahead of emerging risks,” he said. “While floods are commonplace in the region, increased preparedness and investment in societal resilience have been pivotal to mitigating the impact of this event from a reinsurance perspective.”

He emphasized the need for a collaborative approach to risk management, urging all stakeholders – including cedents, reinsurers, intermediaries, and capital providers – to consider the role of flood resilience and leverage advanced risk assessments that focus on current risks, not just historical data.

“By working together, we can better understand and adapt to the changing nature of flood risks and secure comprehensive coverage to these emerging sources of earnings volatility,” Edwards said.

Earlier this month, Howden Re also released a report that emphasized the need for industry collaboration in developing solutions as the global reinsurance sector faces challenges, including natural catastrophes, political violence, and emerging casualty risks.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!