What’s the difference between treaty and facultative reinsurance?

What’s the difference between treaty and facultative reinsurance? | Insurance Business Asia

Guides

What’s the difference between treaty and facultative reinsurance?

Treaty vs facultative reinsurance – both help insurers cover risks beyond their financial capacity. But which one suits you? Find out in this guide

Often described as “insurance for insurance companies,” reinsurance acts as a form of financial shock absorber, allowing insurers to take on risks far beyond what they’re willing to bear. For many of these firms, reinsurance also serves as a vital financial tool that enables them to manage risks and the amount of capital needed to assume these risks.

Reinsurance comes in two main categories: treaty vs facultative reinsurance. In this guide, Insurance Business explains the similarities and differences between these reinsurance types, which are also referred to as reinsurance arrangements. We will also discuss the benefits and drawbacks of each to give you an idea of which arrangement fits your needs.

Before we can delve deeper into treaty vs facultative reinsurance, we must first explain what reinsurance is and how it works.

The Insurance Information Institute (Triple-I) describes reinsurance as a way for an insurance company to transfer some of its financial risks to another insurance company. This type of arrangement involves two parties:

the insurer, also called the cedent or ceding company, is the one transferring the risk

the reinsurance company or reinsurer, which assumes a portion or the entirety of one or multiple policies issued by the ceding company

The institute adds that reinsurance is designed primarily to protect insurers against circumstances where they don’t have enough money to pay out all the claims owed.

“By law, an insurer must have sufficient capital to ensure it will be able to pay all potential future claims related to the policies it issues,” Triple-I explains. “This requirement protects consumers but limits the amount of business an insurer can take on.

“However, if the insurer can reduce its responsibility, or liability, for these claims by transferring a part of the liability to another insurer, it can lower the amount of capital it must maintain to satisfy regulators that it is in good financial health and will be able to pay the claims of its policyholders.”

The capital an insurance company frees up through reinsurance can then be used to support more insurance policies.

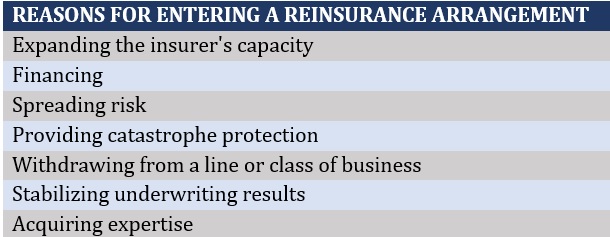

But apart from spreading risk and expanding an insurer’s capacity, there are several other reasons for entering into a reinsurance agreement, according to the National Association of Insurance Commissioners (NAIC). The table below lists the common reasons why insurance companies enter a reinsurance contract.

Just like a typical insurance policy, reinsurance can be taken out directly from a reinsurer or arranged through a third-party or an intermediary, aptly called a reinsurance broker. In some instances, reinsurers also purchase reinsurance to avoid taking on too much risk in one location. This type of arrangement is also referred to as retrocession.

Florida has a unique insurance market that relies heavily on reinsurance. Check out our guide to reinsurance in Florida if you want to learn more about how the system works there.

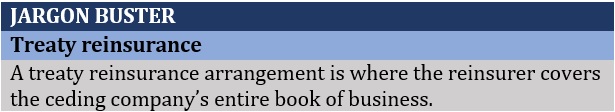

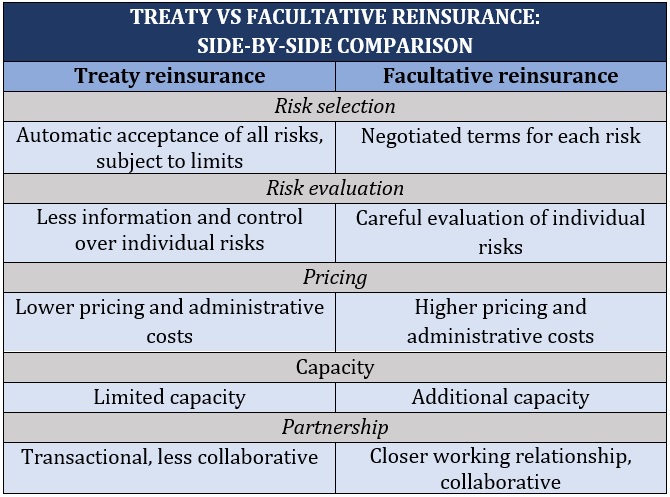

Facultative reinsurance is designed to cover single risks or defined packages of risks. Treaty reinsurance, on the other hand, covers a ceding company’s entire book of business – for example an insurer’s homeowners’ insurance book.

These two types of reinsurance arrangements work differently and come with their own benefits and drawbacks. We will discuss these in more detail in the succeeding sections.

Treaty vs facultative reinsurance – treaty reinsurance definition

Treaty vs facultative reinsurance – facultative reinsurance definition

Under a facultative reinsurance agreement, the ceding company offers an individual risk or a defined package of risks to a reinsurer. The reinsurer then retains the right to accept or reject the risk, just like an insurer has the right to decide whether to insure a policyholder.

Additionally, the reinsurer performs its own underwriting for some or all policies, with each policy considered a single transaction.

A facultative reinsurance arrangement is typically used for high-value or hazardous risks because the policies can be tailored to specific circumstances. This type of reinsurance agreement can be less attractive to ceding companies – reinsurers may insist that the cedents retain some level of liability on the riskiest policies. In these scenarios, the ceding company may need to approach multiple reinsurers to transfer any remaining liability.

Let’s assume that an insurance company has been approached to insure a major project worth $25 million. This means that if a huge disaster causes the project to fail, the insurer will be on the hook for the same amount.

But what if the insurer only has $18 million in capital available to underwrite the policy?

This is where a facultative reinsurance arrangement comes into play. So, before agreeing to issue the policy, the insurer must take out facultative reinsurance for the remaining $7 million. It can get a single reinsurer to cover the entire amount or approach multiple reinsurance providers to cover portions of the balance until the insurer has enough to cover the full amount.

Only when an agreement (or several agreements) to cover the remaining $7 million is in place can the insurance company issue the policy for the project.

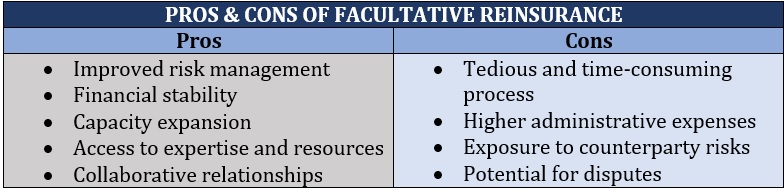

Entering a facultative reinsurance agreement comes with several benefits for an insurance company. These include:

Better risk management: Transferring a portion or the entirety of a large or complex risk to a reinsurer enables ceding companies to better manage their overall risk exposure.

Financial stability: Cedents can improve their financial stability and solvency by diversifying risk portfolios and sharing losses with reinsurance companies. Having a stable financial standing also plays a crucial role in helping insurers maintain a strong market presence and comply with regulatory requirements.

Capacity expansion: Facultative reinsurance can provide insurance companies with additional underwriting capacity. This allows them to take on larger or more complex risks that may exceed their internal risk capacity.

Access to expertise and resources: Ceding companies can benefit from the resources, expertise, and underwriting capacity of their reinsurance partners. This can enable them to better handle complex risks.

Collaborative relationships: A facultative reinsurance arrangement offers an opportunity for ceding companies and reinsurers to develop a successful professional partnership.

A facultative reinsurance arrangement, however, comes with its share of limitations. These include:

Tedious process: Because the cedent and the reinsurer need to carefully consider the terms and conditions for each risk, the negotiation and placement process can be tedious and time-consuming.

Higher administrative costs: One major difference between treaty vs facultative reinsurance is the higher administrative expenses incurred in facultative transactions. This is because each arrangement requires individual risk evaluation and negotiation.

Counterparty risk: Ceding companies must practice due diligence when choosing a reinsurance partner. They may be exposed to counterparty risk if a reinsurer is unable to meet its financial obligations.

Potential for disputes: Facultative reinsurance agreements may result in disputes between the cedent and the reinsurer, especially if the terms and conditions are not clearly defined or understood.

The table below sums up the advantages and limitations of a facultative reinsurance arrangement.

With treaty reinsurance agreements, the ceding company transfers all risks within a book of business to the reinsurer. For example, the insurer may transfer its entire book of commercial auto or all its homeowners’ risk. The two parties then enter into an agreement, also called the treaty, in which the reinsurer is obliged to accept all covered business.

Unlike facultative transactions, treaty reinsurance arrangements are typically long-term. Reinsurers also accept policies that ceding companies have not yet written, as long as these fit within the treaty’s pre-agreed risk class.

In addition, reinsurers don’t carry out individual underwriting on the risks assumed. That responsibility is left to the ceding company. This is why reinsurers practice due diligence to ensure the cedents are conducting adequate underwriting processes before entering into a treaty.

The main benefit of entering a treaty reinsurance arrangement for insurance companies is that all risks are automatically accepted, as long as these fall within the predetermined limits. This also means that reinsurers are bound to cover risks even without prior knowledge.

Reinsurance treaties also allow a commission that’s enough to pay a ceding company’s expenses. Provisions for profit sharing are often included in the agreement as well.

But because of the “blind” nature of a treaty reinsurance arrangement, most reinsurers agree to do business only if they’re satisfied with the financial standing and underwriting record of a ceding company. Treaty agreements also allow reinsurance providers to inspect an insurer’s records of any claim of risks.

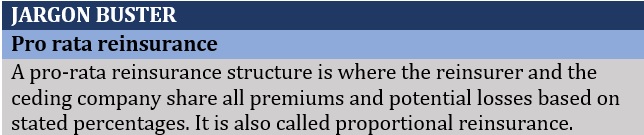

Facultative and treaty reinsurance arrangements can be written on either a pro rata or an excess of loss basis.

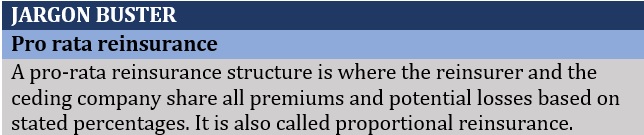

Pro rata reinsurance

Pro rata reinsurance is also known as “proportional reinsurance.” Along with sharing proportionally in premium and losses, the reinsurer typically pays a ceding commission to the ceding company to reimburse for expenses associated with issuing the underlying policy.

Pro rata reinsurance is typically quite easy to administer. It also offers good protection against frequency and severity.

Treaty vs facultative reinsurance – pro rata reinsurance definition

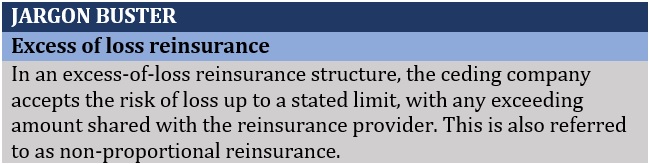

Excess of loss reinsurance

In an excess of loss agreement, also referred to as “non-proportional reinsurance,” the ceding company retains a certain amount of liability for losses. The insurer also pays a fee to the reinsurance company for coverage above that retention, which is generally subject to a fixed upper limit. Excess of loss arrangements are often more economical in terms of reinsurance premium and cost of administration.

Treaty vs facultative reinsurance – excess of loss reinsurance definition

The table below provides a side-by-side comparison of treaty vs facultative reinsurance arrangements.

Our Best in Insurance Special Reports page is the place to go if you’re looking for a reinsurance partner for your coverage needs. The companies featured in our special reports have been nominated by their peers and vetted by industry experts as respected and dependable market leaders.

By choosing to work with these industry leaders, you can be sure that you’re going with a company that you can rely on in times of need.

Which type of arrangement do you think is more beneficial – treaty vs facultative reinsurance? Let us know your thoughts in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!