What are the top claims trends with CPL?

Paul Lucas 09:07:18

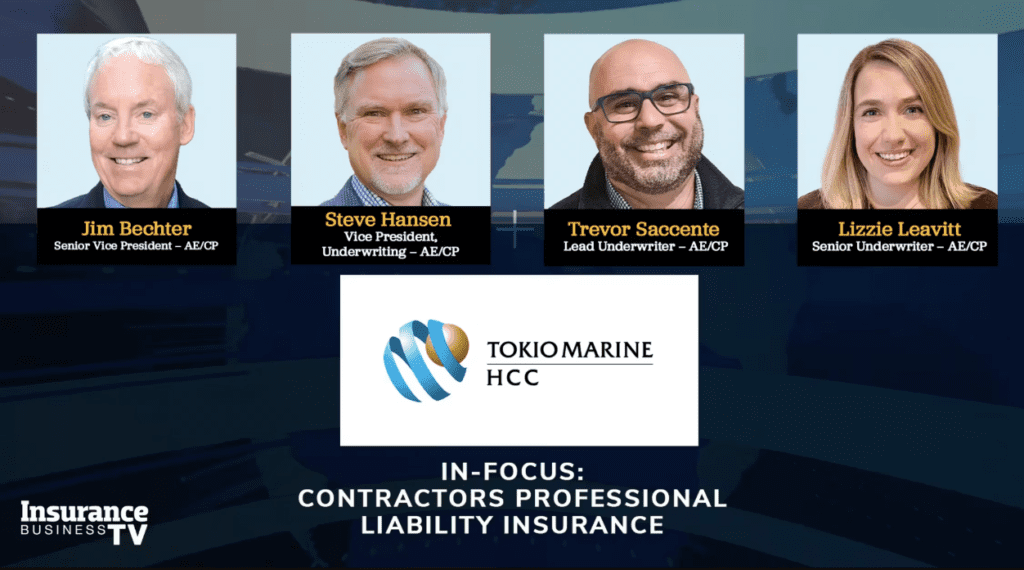

Hello everyone and welcome to the latest edition of Insurance Business TV a contractor’s liability special brought to you in association with Tokio Marine, HCC, cyber and professional lines group. Construction and contracting professionals from general contractors to electrical or plumbing contractors through to design or build contractors, of course all face a host of challenges in their day to day roles and are often at considerable financial risk because of the types and quality of services that they deliver to their clients. As such, they need a specialist solution for the unique exposures. But where do they get it? What are the risks they should be protecting against? And which coverages should they be looking out for? To answer all of these questions and more Tokio Marine, HCC cyber and professional Lyons group has put together an expert panel from its ranks, who I am delighted to welcome now. Jim Bechter, senior vice president architects and engineers and contractors professional liability, Lizzie Leavitt senior underwriter. Also from the architects and engineers and contractors Professional Liability segments of the group, we have Steve Hansen, Vice President of underwriting and Trevor Saccente lead underwriter. So welcome everyone. And to start us out, this is a complex segment. So I want to make sure everyone watching truly understands it. So Jim, I’m going to come to you tell us why the contractors need professional liability insurance.

09:08:49

Kind of a little bit of a history lesson. In the old days, you know, there was design bid build, which is kind of a traditional type of project delivery, where an owner would hire an architect and the architect would get provide plans and specifications to an owner. And you know, the owner would take those plans and ask contractors to bid on them. The contractors would not be providing professional services, they would just be taking the plans from the owner and building them per the plans provided by the architect. Well, more recently, and I’ll go back into relatively recent time, let’s just say the 90s, there was a bit of a growth in what’s known as design build project delivery, where owners were looking to a single point of responsibility in this case, in most cases, contractors to bribe both design and construction. So it was a single source of both a design exposure and professional liability exposure that comes from that, and the build exposure. So with that there was a need in the marketplace, that to create an insurance product that would address a professional liability exposure that contractors had. And you know, contractors are used to carrying general liability, workers compensation, auto insurance, you know, builders risk, that sort of thing. But now when they were taking on design build responsibility, they had a professional liability exposure. So the impetus there with the growth of design build was for contractors to not only carry those traditional coverages that they had, but to also carry contractors Professional Liability coverage. And what we were seeing is that more and more owners were requiring contractors to carry contractors professional liability in their contracts, their contracts of hire, and to fill that need various insurance companies created contractors Professional Liability coverage. And, you know, this growth of design builds where the contractor is responsible for design now placed an exposure on the contractors for design services. So with that growth of design build, and with that growth of contractual requirements were for contractors to carry that a number of carriers did respond, we in turn, developed an insurance product back going back into the early 90s To address this exposure. And, you know, kind of how does that benefit a contractor? Well, a contractor could have design exposure either through in house employees that could have employed architects employed engineers, employed construction managers, or they could more more commonly they’ll sub out the design exposure to licensed architects or licensed engineers to provide those plans and specifications. But you know, with that exposure, they had to have the coverage and there’s other duties that the contractors are also taking on they might take on electrical or mechanical or HVAC or fire protection design services and and not only have those would be Design, they will also have to build them. So we developed a policy form to not only address the design exposures, but also some of the ancillary exposures that contractors have, they might be involved in building information modelling, Value Engineering constructability review design assists. So the idea was that as the services that contractors would have to render for design, build engagements, or just contracting activities encompass such things that may not be adequately addressed by general liability, but more appropriately addressed by contractors professional liability. And, you know, we think that having contractors Professional Liability allows the contractor to demonstrate to the owner, that they’re risk management savvy, and that they carry all the appropriate coverages that an owner really needs that there to make sure that they exposures presented by by design, build construction, are adequately addressed. And I think that’s a good message for contractors to send owners that they can demonstrate that they have contractors professional liability insurance. Now, in our program, we provide limits of liability, up to $5 million per claim, or $5 million in the aggregate. It’s what’s known as claims made and reported coverage. We offer it on a surplus lines basis in all 50 states of the United States. And it’s a very broad coverage, again, encompassing primarily contractors, professional liability, but also pollution liability, and other related coverages that will be addressed later. But it’s, you know, it is a very broad coverage. And our program, which is available in all 50 states can address the need of contractors. So the need is there. And we provide the coverage,

Paul Lucas 09:14:08

Strong message and a fantastic overview as well. Jim, thank you very, very much, Trevor, if I can turn the conversation over to you. If you don’t mind, just give us some insights into the claims trends, perhaps some common claims that you’ve seen within the segments of the market.

09:14:23

Well, claims are where the rubber meets the road. We have a saying on our team, concrete cracks, soils, and roofs leak. Contractors specializing in building envelopes, roofing and waterproofing can be problematic due to water intrusion, which leads to claims involving bold, rotted wood in the related claims. Also contractors involved in or specializing in foundations, or retaining walls can present with different potential types of claims, such as retaining wall collapses or failures, or differential foundation settlement, which leads to cracking or deflection in the building envelope. We consider general contractors involved in condominiums and residential construction as a higher risk. For most people, their home is their most expensive investment. As such, if someone finds a problem with their home, especially a new construction, they’re more likely to take legal measures to obtain what they hoped they were buying. Some of our severe claims involve bodily injury where a construction worker is injured on the job site, or or a motorist has a traffic accident in a construction zone. We also see typical claims you would expect with construction such as cost overruns, delay claims and poor construction. Let me give you a couple of real claims that we have seen in the past. A fire protection contractor defaulted on the project and the surety completed the project. It was discovered that the fire protection contractor failed to verify the elevations on the plans and then recommended to the general contractor that a fire pump was not necessary. The fire pump was deemed necessary on the project and caused delays in the opening of the facility. The fire protection contractor did not carry professional liability insurance. Another example is a general contractor hired or hired an electro coal consultant to provide design services for the installation. Installation of lighting fixtures, the lighting fixtures caught fire, the cause was determined to be a design error. The sub consultant did not carry professional liability insurance and refuse to respond claim claiming he was going out of business. The professional liability policy for the contractor paid to have the lighting system redesigned and repaired. Now what can a contractor do to avoid being put in this scenario other than buying contractors professional, which we provide? Risk Management for contractors is always important. We have our contract risk management guide that we provide to all our insurance. The pandemic has caused contractors to review their contracts include a force majeure clause or a waiver of consequential damages clause. A force majeure clause is meant to address what happened when an unforeseeable event occurs that is beyond the control of both parties. such unforeseeable events can include acts of terrorism or fire earthquake storms, to name a few, but it should also include pandemics. We have typically recommended that firms use contracts with waiver of consequential damages clauses. Because consequential damages can include loss of use, loss of profits, loss of income and having waiver of consequential damages clauses could help limit liability associated with any unexpected delays. Some additional things a contractor can do to help minimize claims would be properly defined scope of services, good documentation, or good communication, having a risk like selection process and abort in order to avoid bad clients staying away from litigious projects or projects where the contractor has no experience, just to say a few.

Paul Lucas 09:18:00

That’s, that’s the claims element and the risk management segment there as well combined. I’m going to switch it over to Lizzie now and let’s delve into some of the coverage aspects of contractors professional liability, which coverages would you highlight Lizzie as being particularly important to protect the contractor?

09:18:18

Thanks, Paul. The primary purpose of the contractors professional policy is to cover professional services performed by employees as well as the vicarious liability of hiring professional sub consultants. The definition of professional services also includes services that contractor may perform on a construction only project such as building information modeling, building, commissioning, Value Engineering, constructability review and design assist. Therefore, there’s a benefit to contractors who are not involved in the design build to also carry the coverage. Contractors professional forums can include rectification expenses coverage, contractors, pollution and contractors protective rectification expenses coverage is a first party coverage that allows an insurance or product designer to err to the carrier without waiting for a claim to be made by their client. The goal of such coverage is to resolve design issues faster, while minimizing conflicts between an insured and their client. For example, we had a situation earlier this year where a surveying error was made and the concrete foundations of the two buildings report too close together. In such a situation, we don’t want our insurance to wait till third party claim is reported. It was clear a survey error was made and that this situation would eventually result in a third party claim. So this was handled under the rectification expenses coverage. In this scenario, thanks to our claims team, we were fortunate to get a variance from the city to allow the two buildings to be closer together than the building code originally allowed and the contractor was able to keep building without having to remove or replace one of the foundation’s contractors pollution coverage covers pollution arising out a contracting activities at the job site, as well as coverage for transportation pollution liability, and coverage for a pollution incident arising from the treatment storage, recycling or disposal of waste at non owned facilities. Lastly, contractors protective coverage is an optional first party coverage that indemnifies The named insured excess of the design professionals professional liability insurance. For costs the contractor incurs as a result of negligent acts, errors and omissions of design professionals with which the insured contractor holds a written contract. For example, let’s say our insured contractor goes over budget due to their sub consultants design where the contractor would bring suit against the design from the hired and the design firm would put their professional liability carrier on notice. If it is determined that the contractor is legally entitled to recover an amount larger than the limit of the design professionals insurance and the contractors protective coverage would indemnify the contractor for the amount above the design professionals limit of liability. The coverage included in a contractor’s professional policy can vary by Carrier, but those are some of the cons. The coverages that are typically offered in our contractor 7072 Policy Forum.

Paul Lucas 09:21:00

Steve, if I can bring you in as well, I’d just love to get some perspective in terms of you know as underwriters, what you’re looking for and why, you know as underwriters,

09:21:09

We’d like to see submissions that include an application resumes a key principles or designers, or project list showing their five largest current projects and last runs, we often see submissions that mention a contract or project is driving the need for the professional liability insurance. If a contract is driving the need for the insurance, we’d like to review a copy of the contract and the scope of services so that we can better understand the project. What the contractor is doing on the project, who the client is and the revenue they will earn on the project. If they’re just bidding the job in the contract is not yet available, then we’d like to see the RFP or the proposal possible. Now in order to calculate the contractors professional premium, we start with the overall gross revenue and then break down that revenue into how much is from construction only projects. How much is from design build projects and how much is from construction management to taking into consider both cm agency as well as CM at risk. We also tried to determine whether the professional services are performed by in house professionals or by professional consultants, if the professional services are performed by professional sub consultants, we would prefer to see that they hire sub consultants that carry their own professional liability insurance. Once we understand the revenue, we take into consideration the type of contractor when we and we look at the type of projects they work on, as well as their track record. Now, some of the things that we take into consideration will be the location of the contractor, their risk management practices, and the types of contracts they use in contracting for their work. As part of our underwriting. We also review the contractors website if they have one. We’re looking to grow our contractors professional program. If you have any contractors that need professional liability, please think Tokio Marine HCC and send us your submissions to our email address at submissions at tmhcc.com. Or reach out to me directly.

Paul Lucas 09:22:59

Thank you, Steve. And I think you’ve all shed light on a really complex topic. So many thanks to you. My huge thanks, of course to Tokio Marine, HCC cyber and professional lions group for putting together this panel today. And my thanks to each of you individual panelists as well. So one more time, it’s Jim Bechter,

09:23:17

Thank you very much Paul, appreciate it and we appreciate the audience considering Tokio Marine HCC.

Paul Lucas 09:23:23

Thank you, Jim. To Steve Hansen.

09:23:26

Thank you, Paul. It was a pleasure being here.

Paul Lucas 09:23:28

Thank you to Trevor Saccente.

Thanks, Paul. Thank you for the time.

Paul Lucas 09:23:32

And finally to Lizzie Leavitt.

Thank you for having us.

Paul Lucas 09:23:37

All right. Thanks again to all of you and of course to you for watching. Remember, we’ll see you next time right here on Insurance Business TV.