Weather derivative market activity soars on belief extremes to increase: Report

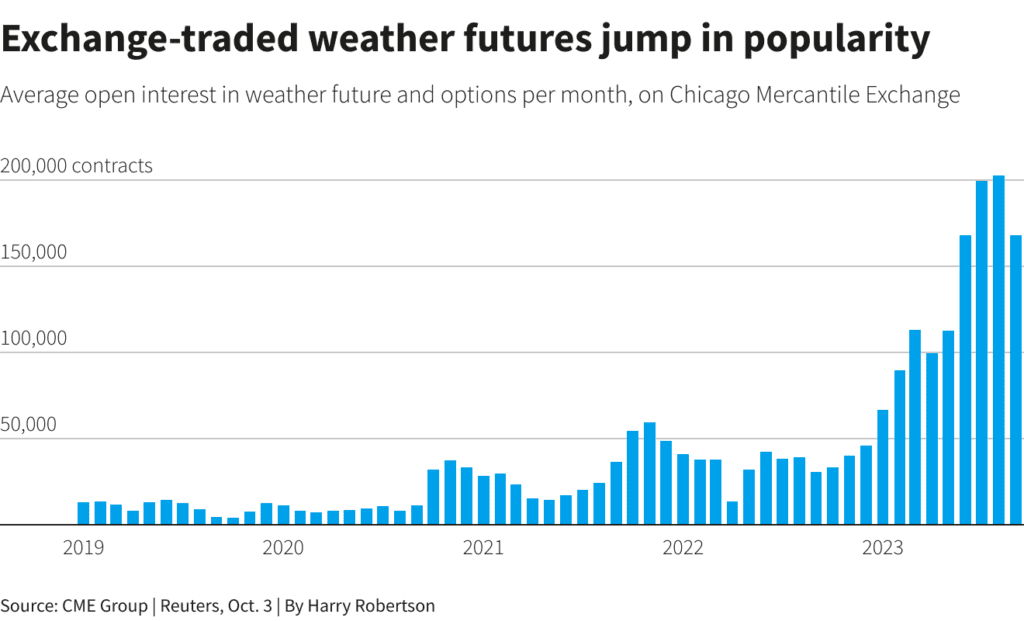

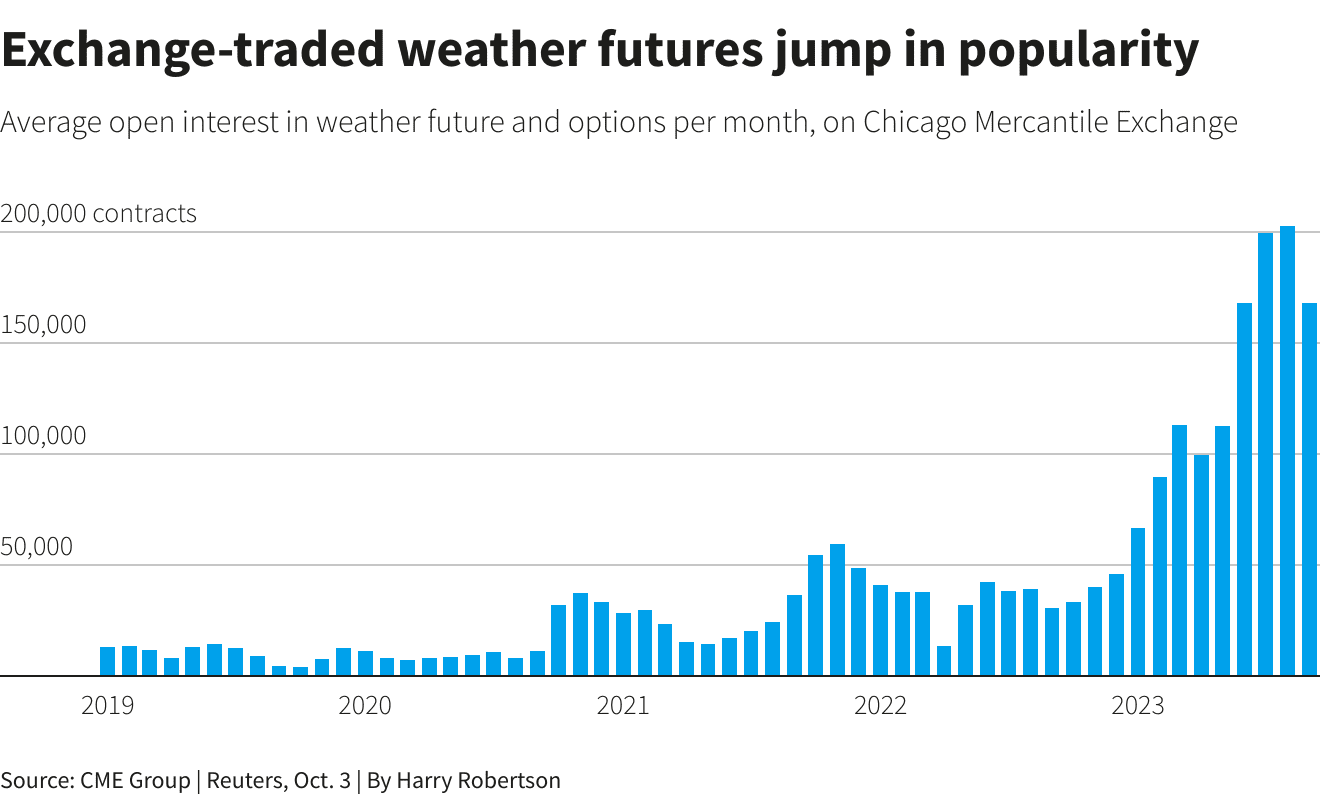

The weather derivatives market has seen activity levels roughly quadruple this year, as trading in weather futures and options on the Chicago Mercantile Exchange (CME) soared, with the main driver said to be the belief that extreme weather events are set to increase.

The desire to hedge the financial effects and impact of weather events is increasing, with buyers of protection seeking to smooth volatility through use of weather derivatives, putting in place hedges that can help them financially offset the effects of inclement, unseasonal and severe weather events.

Reuters has reported on activity at the CME, which remains the main venue for trading in weather derivatives.

The CME sells a wide range of futures and options, linked to heating and cooling degree days, as well as to Cumulative Average Temperature (CAT) Indices.

These are effectively a parametric risk transfer product, where one side is hedging the risk of temperature extremes, or fluctuations that can cause volatility to their businesses.

Weather derivatives can also be customised for wind, solar and other weather variables.

The weather derivative market has been around for longer than catastrophe bonds and there are some players in the insurance-linked securities (ILS) market that provide capacity to the weather derivative market, not least Markel’s ILS manager Nephila Capital.

In fact, some ILS managers, like Nephila and also Coriolis Capital, since acquired by SCOR Investment Partners, have been among the largest providers of capacity to support weather derivative markets in the past.

ILS fund managers and investors see weather risk as a relatively uncorrelated asset, similar to natural catastrophe risk, and so it has been a feature of the ILS market for some years.

That appetite had actually declined in recent years, but this was partly due to the decline in weather trading activity, as well as the fact many of those weather derivative deals now get wrapped up within private insurance or reinsurance arrangements.

Weather derivatives activity has dwindled over the years, while efforts to introduce a wider range of derivative products, including hurricane futures, have failed to gain traction.

Regulation had dented the weather derivatives marketplace, as energy companies (typically one of the main protection buyers in that market) had declined their use of weather futures and options significantly.

But, now there is increasing activity in the CME’s weather derivatives product range, with the expectation that weather extremes will increase and the concern over climate change seen as key drivers.

Reuters reports that average open interest (so the number of unsettled weather future and option contracts) in the CME’s weather futures and options product range reached approximately four times higher in the January to September period, than was seen in the prior year (as seen in the chart below).

More impressive is the fact that the same time period of weather trading activity on the CME this year, is reported to be some 12 times higher than was seen back in 2019.

Weather trading volumes at the CMA have also quadrupled over the last year, Reuters report states.

There are hopes that this signals a return to growth and a more prominent role for weather derivatives going forwards, as businesses and other entities look to protect themselves against the effects of the weather.

“There is a general belief that extreme (weather) events are both going to become more common and more extreme,” Peter Keavey, global head of energy and environmental products at CME Group told Reuters. “That has been the number one driver of this.”

Being parametric in nature, the weather derivative market can extend outside of the exchange-traded product set hosted on the CME.

“If you can measure it, and you can put a dollar amount on it, we can essentially have a product for you,” explained Nick Ernst to Reuters, who joined broker BGC Group in July to launch a weather derivatives desk.

The Ukraine war and how it has demonstrated the fragility of energy supplies is said to be a factor that has driven interest in hedging risk for energy firms, while regulations that encourage companies to understand their climate risks are also noted by Ernst to be a factor.

The market activity is attracting larger players, such as hedge funds, the report states.

Citadel is cited as one such player with a growing appetite for weather risk, a firm that had been more active in the weather space in the past.

Martin Malinow, founder and CEO of Parameter Climate told Reuters that, in the case of hedge funds like Citadel, they “see themselves as a risk warehouse like an insurance or reinsurance company”, adding, “It is a sign of a more functional market, having players like Citadel in it that can play different roles.”

Yet, education is still seen as an issue for growing the weather derivative marketplace, with David Whitehead, co-chief executive of Speedwell Climate telling Reuters that many do not know this product even exists.

But the growth of the renewable energy market has been helping, Whitehead said, “Everyone was worried about how much oil is coming out of the ground. Now people care about how much wind, how much solar.”