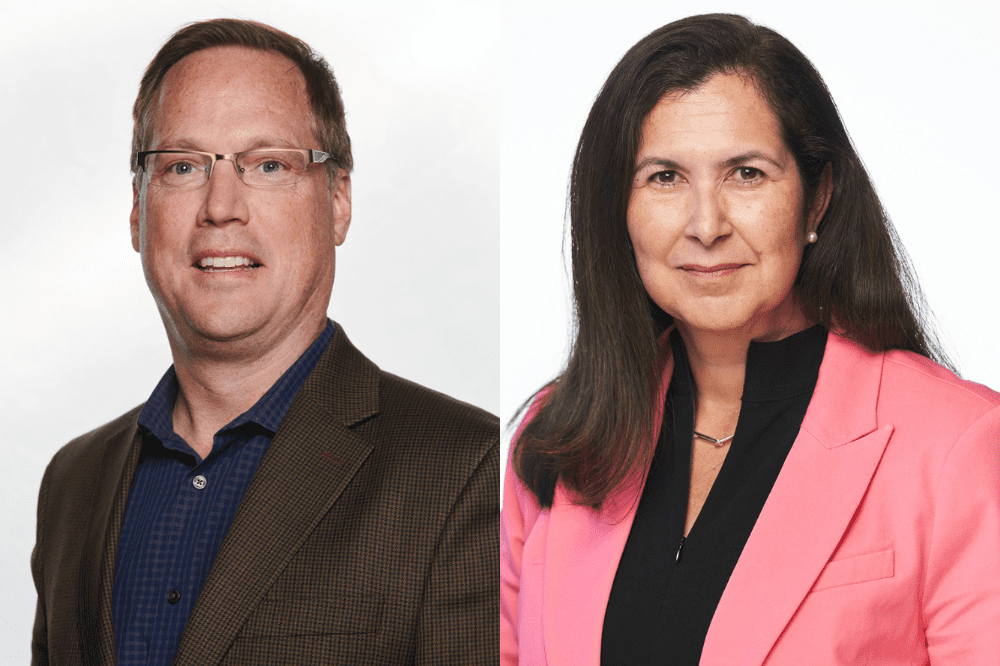

Wawanesa leaders on what structural changes mean for brokers

In January, Winnipeg-based Graham Haigh (pictured, left) was named SVP & chief operating officer, West, while London, Ontario-based Anna McCrindell (pictured, right) was appointed SVP & chief operating officer, East.

“What we like about the regional focus … [is that] there are differences in the two regions – out West, I have three provincial Crown corporations that operate in the auto business, in Manitoba, Saskatchewan, and British Columbia, and then I have Alberta, with a private market focus, and then Anna’s got her own set of unique broker environments out East,” Haigh said.

“We see this as an evolution of our leadership team, and it is designed to better serve brokers and our customers.”

Wawanesa leadership changes come with Jardine prepped to exit

The leadership changes come with Wawanesa president, Canadian P&C operations Carol Jardine gearing up to retire from the business, according to Haigh, who described the outgoing boss as “an incredible mentor”.

“We kept her in the business longer than I think she probably wanted to [be], as she was heading down the retirement path, so this has been in the plans for quite some time now,” Haigh said.

With both new appointees having been mentored by Jardine and coming from within the business, the changes should be seen as a “continuation of the hard work of [the past] 126 years,” Haigh said.

“The other key piece is lots of change, but leaders within our organization just taking that next step,” McCrindell said.

“I think that really speaks to what a strong business and a strong team [we have], so really I’m excited about our evolution.”

Wawanesa revamping farm, targeting telematics and small business

The mutual insurance company is targeting “fairly aggressive” growth in the East, with opportunities presenting themselves in farm and small business insurance. A telematics launch is also on the cards this year.

“We really see great opportunity in Ontario, Quebec, and the Maritimes – we have very strong relationships with our brokers in those regions and we think that represents a great opportunity for us to grow,” McCrindell said.

Wawanesa is one of the largest farm insurance providers in Canada’s West, and it will look to grow its book in Ontario. The mutual is targeting a May launch for a refreshed product, McCrindell said.

Small enterprises make up 98% of Canadian businesses, according to Statistics Canada 2021 figures, and the market is widely viewed as underserved.

“More than half of Canada’s small businesses are in Ontario and in Quebec, and so there’s a great opportunity for us to create more growth in these regions,” McCrindell said.

The mutual is taking a digital approach to help brokers quote, bind and issue small business cover “as quickly as possible”, according to McCrindell.

Technology will be key to further growth and product development at Wawanesa, which recently moved on to Guidewire’s cloud.

“We’d be one of the first insurers in Canada to be top to bottom in our enterprise in Guidewire’s cloud edition, and frankly we’re one of the first in North America to be able to say that,” Haigh said.

“[It also] lets us move forward on some of our product development opportunities in personal auto with a telematics product, so we expect to have our telematics product out this year for the Canadian marketplace.”

Brokers should expect to hear “more” from Wawanesa

Haigh said that changes at the mutual should be seen as an “evolution, not a revolution”.

“I would expect that these changes mean that, as an enterprise, our broker force in the two regions now have two leaders in Anna and I that are going to be very focused on their needs, and we should be more present in the market for them,” Haigh said.

For McCrindell, the adjustments are “really about getting closer to our brokers”.

“They’re going to hear from us more going forward,” McCrindell said.