US SCS insured losses hit $50bn for first time in 2023: Bowen, Gallagher Re

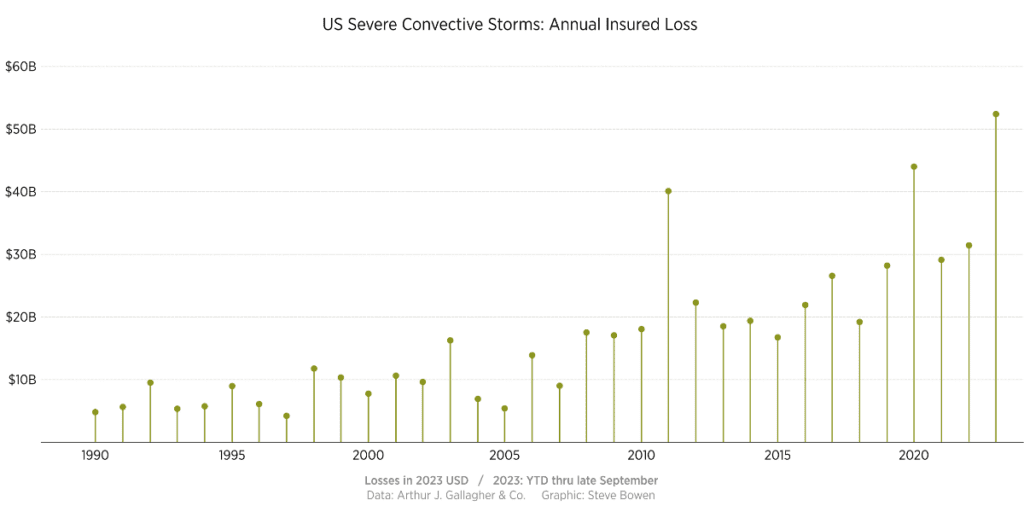

Insured losses from severe convective storms (SCS) in the United States have continued to escalate through the third-quarter of the year, with the annual total for 2023 now reaching a record $50 billion, the first time this peril has ever caused this level of loss for the industry, Gallagher Re’s Steve Bowen has explained.

Bowen, the Chief Science Officer of reinsurance broker Gallagher Re, posted on Linkedin that, “2023 has officially crossed the $50 billion insured loss threshold for US SCS activity for the first time on record — and it will keep rising.”

It’s not just new severe thunderstorm, tornado, hail and straight line wind events either, the loss creep experienced on some of the severe convective storm (SCS) activity from earlier in the year has also been notable.

Bowen said that, “This record is based on either a nominal or adjusted basis. New activity continues into the early autumn months, but we’ve also seen continued loss growth from earlier year events. In several instances we’ve seen loss totals rise by 50% or more from initial estimates.”

As a reminder, Bowen had said back in early August that insurance and reinsurance market losses from US SCS activity was already nearing $40 billion, with 8 multi-billion-dollar US SCS insured events recorded to the end of July 2023.

Now, just under two months on and based on data to late September, Bowen reports that, “There have already been at least 17 individual billion-dollar insured loss events, and 9 multi-billion-dollar events. Both are annual records.”

The chart below, shared by Bowen, shows how 2023 stacks up for US SCS insurance market losses:

Bowen continued to explain the scale of the insurance market impact from thunderstorms and related perils this year, putting it into context alongside other peak perils.

“It is important to put into context how expensive this year has been for US SCS activity. Achieving a $50 billion loss total for a single peril is a big deal. In fact, the US has had six years since 2010 where all annual natural catastrophe losses combined did not reach this threshold,” Bowen said.

Going on to explain that, “We’ve only had three years on record where US mainland hurricane activity resulted in $50+ billion in insured losses: 2005 ($135 billion), 2017 ($69 billion), and 2022 ($60 billion). This year’s SCS activity would actually place as the fourth-costliest year on record for US hurricane losses.”

Hail is once again thought to be a key driver of US SCS insured losses in 2023, continuing a trend that has been seen.

“In any given year, hail can account for 50-80% of insured SCS losses. 2023 is no exception,” Bowen explained.

As we’ve reported, a number of annual aggregate catastrophe bonds that cover severe convective storms and severe thunderstorms in the United States have come under pressure in 2023, as elevated levels of losses push prices for a number of cat bonds lower.

That pressure has continued and those cat bonds are likely to see their secondary market prices remain depressed until the end of their risk periods.

But, increasingly in these hard market conditions, losses from severe convective storms (SCS) in the United States are being retained in the primary insurance market, rather than ceded to reinsurance capital, meaning the impact to ILS funds has been reduced compared to prior years.

Were the ILS terms and conditions and portfolios in place from five years ago, this record level of US SCS losses would likely have already had quite an impact on ILS fund performance for many collateralised reinsurance strategies, especially given the proliferation of aggregate covers at that time.

In 2023, the impact to ILS funds from an aggregation of convective storm losses is greatly reduced, with the market’s main exposure to SCS now being to very large tornado loss events.

Which is a healthier position for the ILS market to be in, as well as for reinsurance more broadly, but does leave primary carriers with a frequency challenge they are likely to be tested on in 2023.

Bowen went on to provide some colour as to the reasons for the significant impacts of SCS activity in the United States this year.

He explained, “What’s driving the losses this year? A number of well-known factors. It’s been an above-average year from a frequency of occurrence perspective as we’ve seen more tornadoes, large hail (≥2”), and damaging straight-line winds. We started 2023 with lingering La Niña conditions that tend to drive an earlier start to SCS activity. The Gulf of Mexico has been at record warmth levels most of the year that helps fuel environmental conditions. We’ve had more “stuck” weather patterns that have resulted in more persistent development of storm systems.

“The bad news is that most of these events have affected populated areas. As I’ve long discussed, the exposure growth and high risk vulnerability (built environment) aspect is a considerable driver in SCS loss costs. There’s simply more stuff in harm’s way to be damaged. As climate change further brings weather pattern shifts, the likelihood of more unusual activity more regularly affecting unprepared areas grows.

“We just aren’t prepared as we should be for SCS events. As an example, in my home state of Illinois, the required code for structural wind speeds is 90 mph. That’s a minimal EF1 tornado. The August 2020 derecho (a largely non-tornadic event) brought wind speeds topping 100 mph into Iowa and Illinois. We can and should do better, especially as there are known engineering methods to improve the structural integrity of homes.

“This doesn’t even begin to touch how hail is the dominant annual driver of SCS losses. In any given year, hail can account for 50-80% of insured SCS losses. 2023 is no exception.

“Bottom line: Give SCS the respect it deserves. This peril continues to affect a lot of people, and leads to more pressure on the insurance industry to accurately price the risk. Let’s get our buildings better prepared.”