US corp pensions have biggest funding surplus in decades: Milliman

Despite the well-publicised impacts to pensions because of the global decline in asset values through 2022, US corporate pension funds actually ended the year with their largest funding surplus in decades.

The decline in pension asset values has driven some churn in the insurance-linked securities (ILS) market, as a number of large ILS asset class investors breached their allocation limits, resulting in a need for adjustment and some downsizing of allocations to reinsurance-linked assets.

As we reported last September, relatively strict asset allocation protocols in the pension community can become a driver for some investors to downsize their allocations to insurance-linked securities (ILS).

We then reported that pension investor PGGM’s ILS portfolio had grown substantially above its target allocation percentage, resulting in a need to manage down the allocation to remain within the target range.

While this was a much-discussed topic through the end of 2022, as it drove some changes in ILS capital levels towards the all-important end of year reinsurance renewal season, there is another story in pension funding that looks a lot more positive for potential investor flows to alternative and diversifying assets such as ILS.

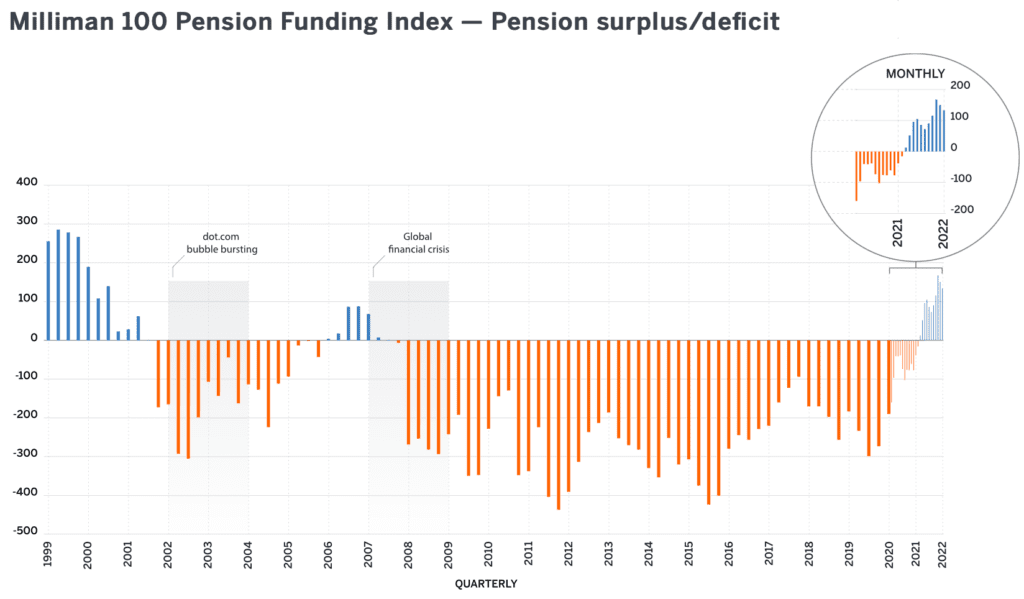

Milliman reports that despite negative investment returns of -13.53% for 2022, the funded status of US corporate pension plans actually experienced a 12.1% boost.

This is based on its findings from an annual study of the 100 largest defined benefit pension plans sponsored by US public companies.

“Increasing discount rates and the corresponding liability (e.g. the projected benefit obligation) decrease of 22.57% more than offset the asset losses, resulting a funded status improvement of $172 billion for the year,” the company explained.

Corporate pension plan assets lost $321 billion for the year in 2022, but on the other side of their operations, pension plan liabilities decreased $493 billion, helping to lift the overall funded status.

“The resulting $172 billion funded status gain during 2022 lifted the year-end funded status surplus to $133 billion. The last time the Milliman 100 plans had a surplus at year-end was in December 2007, at $68 billion,” Milliman said.

The chart below from Milliman’s 100 Pension Funded Index shows the increase in pension surplus and this is the largest year-end surplus for over two decades it appears.

Milliman said that the funded status of these pension plans could improve further over the next two years, if they meet their return targets and the discount rate remains relatively stable.

While this is a pension funding surplus, not a pension asset surplus, it does have possible implications for investment managers, given these pensions could find themselves with excess capital they need to allocate. Surplus funding can drive more capital for allocations further down the line, as pensions need to put money to work rather than hold it in cash.

So, while most of the commentary on the status of pension investors, in relation to insurance-linked securities (ILS), has been focused on the target allocation limits being breached in some cases.

The underlying picture of pensions, their surplus funding and the potential for that to be turned into capital to allocate, paints a more positive picture.

In addition, these corporate pensions are not typically the biggest allocators to ILS in the United States, those tend to be the state pension system entities.

But increasingly, corporate pensions are looking at ILS as a new asset class with interest, based on our own contact and interaction with these types of investors which has been increasing over the last year.

Separately, pensions are showing increasing demand for diversifying asset classes that have an element of their return that is linked to interest rates.

With catastrophe bonds and other ILS typically delivering a return on the collateral, as well as the risk premia, this suggests ILS should prove even more attractive to those allocators looking for an alternative asset whose return floats above the risk-free rate.