US commercial property rates may accelerate on reinsurance & capacity: Marsh

Rates for commercial property insurance in the United States may begin to accelerate again in future quarters, as carriers absorb the costs of higher reinsurance pricing and capacity reductions continue, according to broker Marsh.

In its latest quarterly commercial insurance pricing analysis, Marsh notes that catastrophe exposed property insurance continues to be one of the main areas of increase around the globe.

But, overall the commercial property rate environment is decelerating right now, meaning that property rates are one of the main areas holding that deceleration back a little.

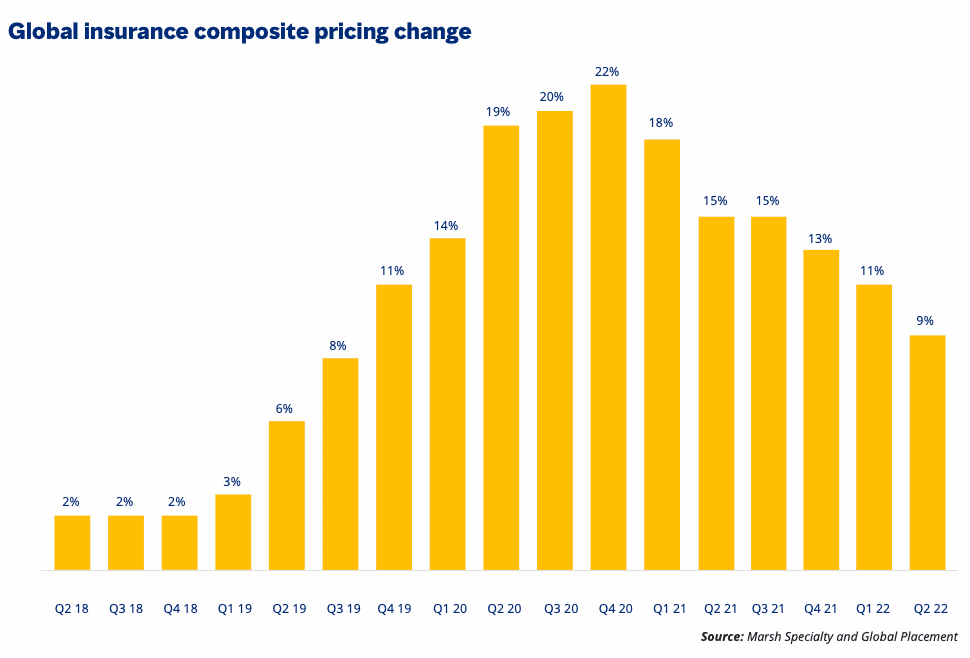

Globally, commercial insurance prices increased 9% in the second quarter of 2022, down from an 11% increase in Q1.

Rates have been either decelerating or flat every quarter since Q4 of 2020 now, but Q2 2022 was the nineteenth consecutive quarter in which composite pricing rose, continuing the longest run of increases since the inception of Marsh’s index in 2012.

Global commercial property insurance rates rose 6% in the second-quarter of 2022, down from 7% in Q1 and continuing a deceleration trend.

But, while this deceleration has also been ongoing since the second-half of 2020, catastrophe exposed property insurance remains one of the firmest parts of the commercial insurance market globally still.

In the key US insurance market, rates for property lines increased 6% in Q2 2022, but Marsh noted that, “Rate increases may accelerate in future quarters, driven by challenging conditions in the reinsurance market and reduced capacity.”

In addition, excess property carriers have been increasing property insurance attachment points in the US, putting pressure on buffer layers, Marsh noted.

While, clients that have experienced significant losses or exposure to secondary catastrophe perils typically experienced above average rate increases.

Insurers have been increasing their focus on secondary catastrophe perils, including wildfire, convective storm, and pluvial flood, Marsh explained, and the property insurance market deteriorated for insureds with heavy exposure to wildfire, the broker said.

There’s also a focus on inflation, with valuation becoming more of a concern for carriers, as they look to ensure they are rating properties at their true values.

In the UK market valuations is also a concern given inflationary factors, but catastrophe losses have been lower so that’s less of a driver.

But still, reinsurance pricing is expected to be a future driver of property insurance, and this is likely to be a global trend, as property catastrophe reinsurance rates have firmed virtually everywhere.

Property rates also increased again in Continental Europe, Asia and Pacific, although deceleration or flattening was evident in each region.

There seems little chance of rates going into decline in any region of the world right now, as property insurers deal with higher reinsurance costs, inflation and other claims inflating factors such as supply chain issues and rising labour costs.

——————————————————————— Tickets are selling fast for Artemis London 2022, our first ILS conference in London. Sept 6th, 2022.

Tickets are selling fast for Artemis London 2022, our first ILS conference in London. Sept 6th, 2022.

Register soon to ensure you can attend.

Secure your place at the event here!

—————————————