United (UPC) to cede $501m of Ian losses to open reinsurance market

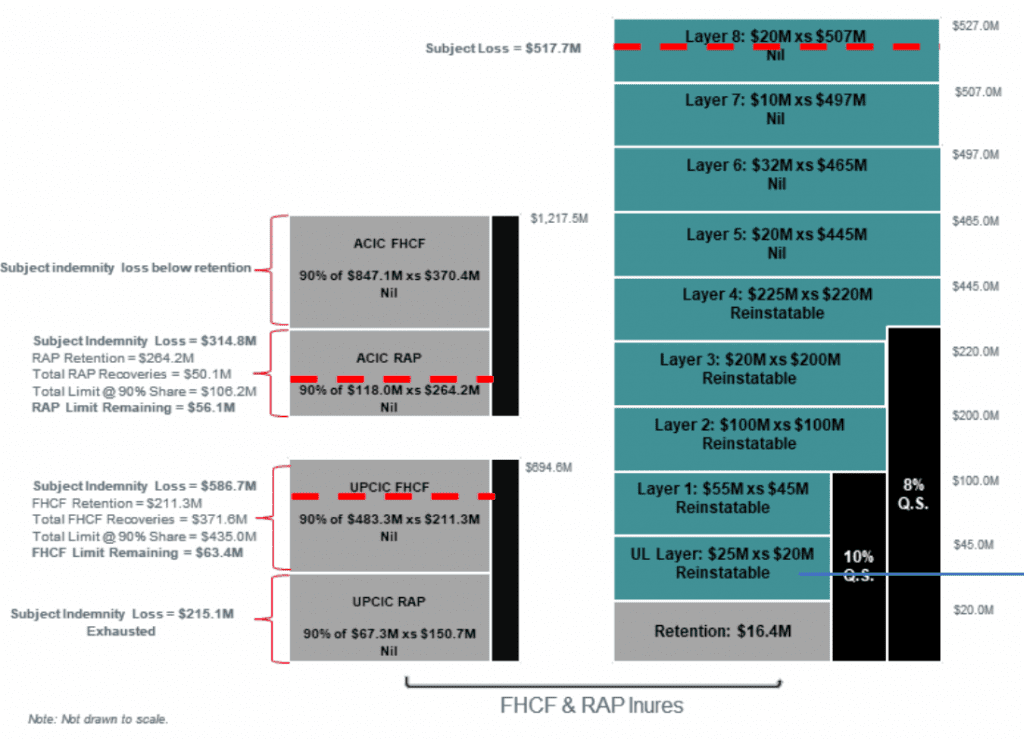

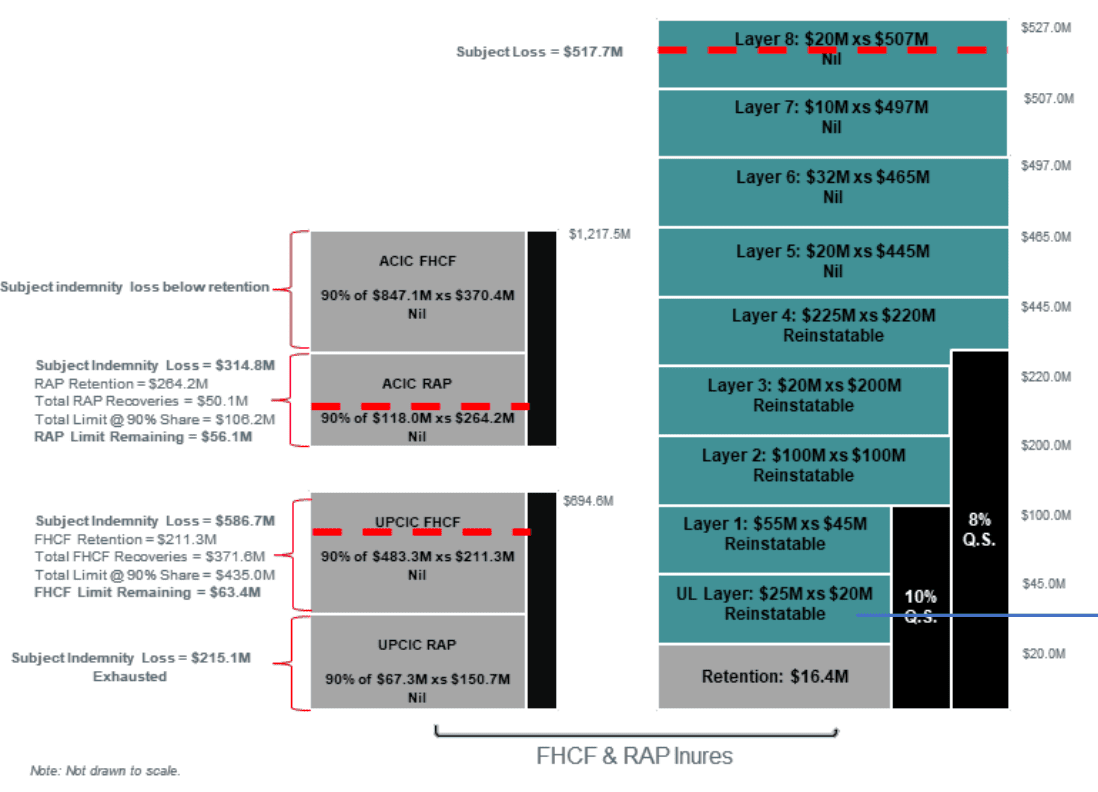

United Insurance Holdings Corp. (UPC Insurance) has revealed that it expects to cede roughly $501 million of its hurricane Ian losses to open reinsurance market partners and for the event only has around $9.3 million of limit left in its main tower.

While United’s (UPC’s) overall hurricane Ian loss remains estimated at around $1 billion gross, it seems that the company will recover a significant $983.6 million of that, reducing its net retained loss from hurricane Ian to just $16.4 million.

After hurricane Ian, United (UPC) has just $9.3 million of open reinsurance market event occurrence limit available for its United Property & Casualty Insurance Company subsidiary, to cover any creep in its hurricane Ian ultimate gross loss.

For future events, the company said it has $1.39 billion of aggregate limit remaining, with significant FHCF and RAP layer reinsurance remaining for its American Coastal Insurance Company subsidiary, but much less available to United P&C.

Speaking yesterday, Brad Martz, United (UPC) CFO, explained, “We have approximately $1.4 billion of aggregate limit remaining after Hurricane Ian, but the majority of that protection is specific to American Coastal’s Florida Hurricane Catastrophe Fund (FHCF) coverage.”

You can see the impact of hurricane Ian losses on the United (UPC) reinsurance tower below, with losses from Ian indicated by the red dotted lines:

Martz went on to say that, “Our expected retention now from a second event is estimated at $31.8 million for the group,” which would be almost double the retained loss from Ian.

As a result, “Hurricane Ian created new uncertainty related to the viability of our previously announced runoff plan for United Property & Casualty and is clearly a significant risk factor going forward,” Martz epxlained.

United (UPC) had previously announced a plan for its personal lines subsidiary United Property & Casualty Insurance Company (United P&C) carrier to withdraw from operations and go into an orderly run-off.

United’s executive team also explained that escalating reinsurance costs in Florida have pressured the business as well, with increasing reinsurance costs, but partly offset by raising insurance pricing on the front-end.

Market conditions for reinsurance are acknowledged to remain a challenge going forwards by the company.

CEO Dan Peed said yesterday that, “We expect the Florida market to remain hard for the foreseeable future, due to a sceptical and hard capital and reinsurance market, recently elevated catastrophe activity, and continued headwinds created by excessive Florida litigation levels.”