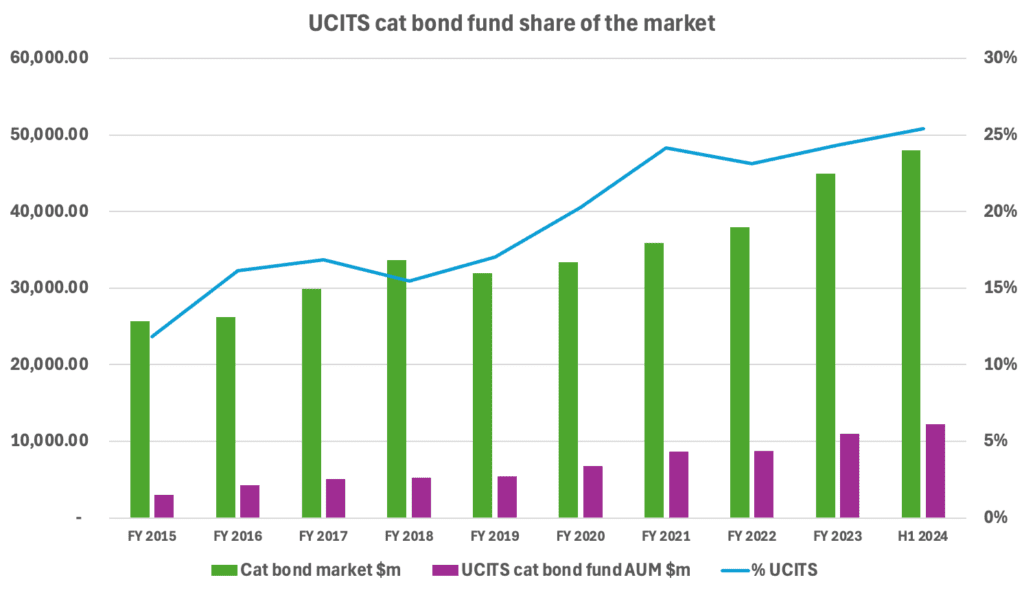

UCITS catastrophe bond funds now make up 25% of the market

Catastrophe bond funds in the UCITS format saw their combined assets under management grow to $12.2 billion by the end of the first-half of 2024, rising 4% in the second-quarter and 11% in the first-half. Impressively, as a share of the outstanding cat bond market, these UCITS fund strategies now make up 25% of risk capital.

In fact, over the last decade UCITS cat bond funds have grown their share of the cat bond market significantly, doubling it from just 12% back at year-end 2015, to now provide the capital to support just over one quarter of the cat bond market’s outstanding issuance.

The $12.2 billion of assets sets another record AUM high for the UCITS cat bond fund sector, which has been growing strongly and providing an increasing share of risk capital to support the outstanding market over the last few years.

The three largest UCITS cat bond funds provide over $8.6 billion of the total, so around 71% of UCITS cat bond capital, while a further 13 cat bond funds make up the rest.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

The rest of the outstanding cat bond market, the remaining three-quarters, consists of other registered or private managed cat bond fund strategies, multi-asset managers that add cat bonds to their diversified fixed income or alternative funds, and direct institutional investors.

The largest UCITS cat bond fund at the end of June 2024 was the Schroder GAIA Cat Bond Fund strategy, growing 14$ over H1 to reach more than $3.28 billion.

The Twelve Cat Bond Fund is next, ending June at $2.91 billion, the the GAM Star Cat Bond Fund at $2.41 billion.

Across the first-half of 2024, the single UCITS cat bond fund strategy that added the most in assets was Fermat Capital Management’s own-branded UCITS cat bond fund strategy that launched this year.

However, while that strategy grew from a standing start in February to $625 million by the end of June, the GAM Star Cat Bond Fund that Fermat is portfolio manager to shrank by $329 million.

Notably, Leadenhall Capital Partners UCITS ILS Fund strategy added over $283 million in assets to grow by 46% to nearly $896 million in the first-half of this year.

The Icosa Cat Bond Fund that launched this year grew from zero to $163 million by June 30th.

Also notable, the Credit Suisse (Lux) Cat Bond Fund grew by 212%, adding almost $73 million in assets this year, while Plenum’s CAT Bond Dynamic Fund grew 24% to $175 million in 2024 so far.

The fact UCITS cat bond funds make up 25% of the market, based on Artemis’ measure of outstanding 144A and private cat bonds, for the first time is significant and shows how important this fund structure has become in the space.

Which makes it even more important that the insurance-linked securities (ILS) industry responds to ESMA’s call for evidence, regarding UCITS eligible assets, with the closing date for responses to be submitted approaching.

As we reported yesterday, UCITS cat bond funds as a group delivered an average return performance of 4.72% for the first-half of 2024.

With the catastrophe bond market pipeline now set to be quieter through the wind season, but the cat bond market yield remaining at a historically high level, we anticipate further AUM growth for the group of UCITS cat bond funds once primary issuance restarts towards the fourth-quarter of the year.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.