UCITS catastrophe bond fund AuM drops -8% in Q3. Hurricane Ian a factor

Overall assets under management (AuM) of the main UCITS catastrophe bond funds as a group shrank almost -8% during the third-quarter of 2022, with hurricane Ian ending a period of decline with a -4.3% hit to assets of this group of cat bond funds.

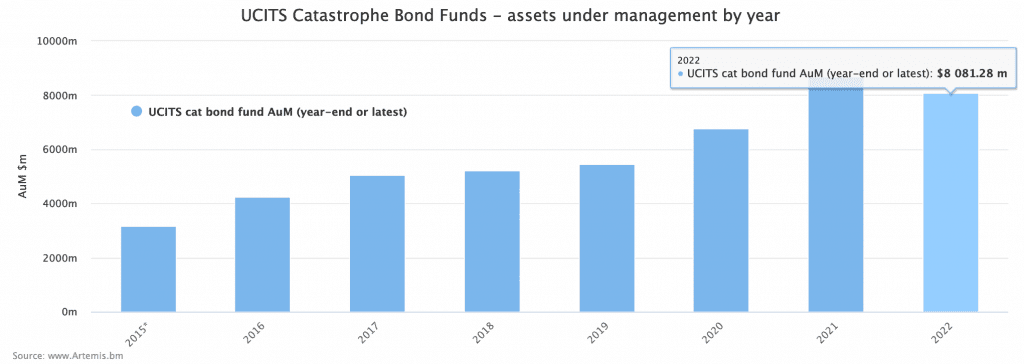

UCITS catastrophe bond funds had been a source of growth through 2021 for the insurance-linked securities (ILS) market, with significant fund raising efforts by managers to match a busy cat bond issuance forward pipeline, taking their assets as a group to new highs.

Growth slowed in 2022, with the main UCITS cat bond funds as a group adding only 1.2% through the first-half of this year, to reach over $8.77 billion under management by the end of June, according to Artemis’ data.

But, the third-quarter of 2022 has seen a decline in assets at the UCITS cat bond funds, with many fund strategies shrinking.

But of course September’s end of quarter asset under management figures have also been depressed by mark-downs related to hurricane Ian.

We track UCITS cat bond fund assets in our charts with the help of partner Plenum Investments AG, a specialist insurance-linked securities (ILS) and cat bond investment manager.

Growth in UCITS cat bond fund assets reached an impressive 28% in 2021, but in the first-half of 2022 that slowed to only around 1.2%, with the group reaching over $8.77 billion by the end of June 2022.

The third-quarter of the year is always a quiet one for catastrophe bond issuance and there were some maturities that rolled out of the market, but still overall UCITS cat bond fund assets had shrunk faster than anticipated in July and August (-1.95% and -1.85%), with mark-to-market spread related effects a key driver here.

But then the UCITS cat bond fund AuM fell a far more substantial -4.3% in September, thanks to hurricane Ian’s impacts.

Which reduced UCITS cat bond fund assets across the main strategies tracked in our charts to just over $8.08 billion at the end of September 2022, down close to -8% just for the quarter.

Analyse the data in our charts (click the image below for an interactive version, where you can also see a month-by-month chart).

Now, after this third-quarter decline in UCITS cat bond fund assets, the total AuM across the group of cat bond funds stands smaller than it did at the end of last year.

In fact, UCITS cat bond fund AuM as a group is now 3% down year-on-year and the last time it was this low was at the end of May 2021.

However, over a two-year horizon, UCITS cat bond fund AuM as a group is still some 43% higher than it was at the end of September 2020.

Hurricane Ian has clearly made a significant dent in the AuM of the group of funds, with some cat bond fund managers seemingly marking their portfolios much harder than others as well.

Assets under management of this group of the main UCITS catastrophe bond funds shrank 4.3% in September 2022 alone.

With Ian making landfall towards the end of the month, it’s clear from the data seen by Artemis that some cat bond funds have marked their portfolios much harder than others at the end of September. Hence it feels likely we’ll see additional declines, at least for some funds, in the next few months data.

At the end of the quarter, the Fermat Capital managed GAM Star Cat Bond Fund remained the largest UCITS cat bond strategy, at just over $2.4 billion in assets under management.

The next three months will be an interesting period to watch how assets under management change at this group of UCITS cat bond funds, as the losses from hurricane Ian get marked down in portfolios and then as any recovered value from cat bonds that turn out not to be loss affected are added back as well.

In addition, the fourth-quarter of the year is normally a time of far busier new catastrophe bond issuance, as too is the start of the new year.

Just how the forward issuance pipeline of cat bonds plays out remains to be seen after hurricane Ian.

But as we’ve explained before, this year more than ever, it’s going to be critical to match capital flows to deal flow, in order to satisfy sponsor needs for protection, so managers of these cat bonds funds are going to be working hard to add to their AuM’s over the coming weeks.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.