UCITS catastrophe bond fund assets surpass $9bn for first time

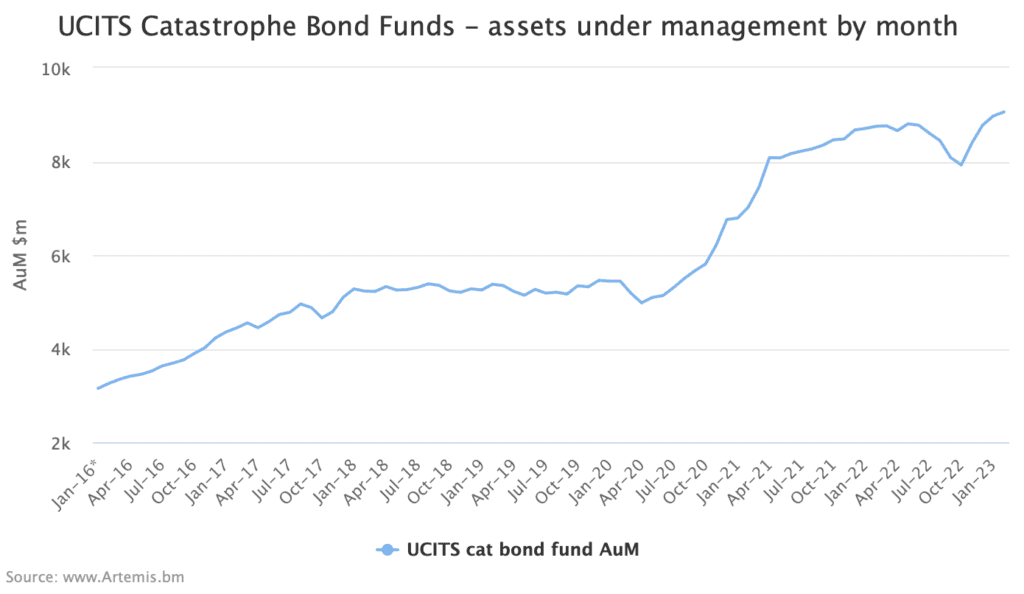

Catastrophe bond funds in the UCITS format have reached another key milestone, with the combined assets under management (AuM) of the group of main UCITS cat bond funds surpassing $9 billion for the first time ever.

The overall assets under management (AuM) of the main UCITS catastrophe bond funds has been rising steadily since a recent low point in October, after hurricane Ian wiped significant value off the outstanding cat bond market.

The drivers of growth in the UCITS cat bond fund sector have been evident for a number of years and now the combined AuM of the main cat bond funds in this format has doubled since 2017.

These cat bond funds had grown very strongly through 2020 up to Q2 2021, since when growth had been slower, but steady, right up until spread widening began to erode cat bond values earlier in 2022 and then hurricane Ian struck in September.

Since then, value has been recovered every month, while some inflows are being seen as well.

You can view our chart of UCITS cat bond fund AuM by month below, click the image for the interactive version.

Now, as of the end of February 2023, the combined assets under management across the 15 UCITS cat bond funds currently tracked has risen to almost $9.06 billion, a new all-time high and up 3.2% since the start of the year.

The first two months of 2023 have seen cat bond fund managers recovering asset values since Ian, as well as some of the spread widening being reversed, meaning some strategies are recovering to the near highs they had seen earlier in 2022.

The Fermat Capital managed GAM Star cat bond fund strategy is now back over $2.6 billion in assets, leading the pack, and closing on its previous high set last May.

The Schroders Capital ILS managed GAIA cat bond fund strategy is nearing $2.37 billion in second place, but had previously set its high, in terms of AuM, at over $2.4 billion in September 2021.

Third place goes to Twelve Capital, with its UCITS cat bond fund that has now grown to almost $2.27 billion.

That is an all-time high, in AuM terms, for Twelve Capital’s UCITS cat bond fund and this manager bucks the trend by having consistently grown over the last year and now closing the gap on the larger players in the UCITS cat bond fund space.

The three largest UCITS cat bond funds continue to make up a significant share of assets, with their over $7.24 billion of cat bond AuM now just slightly under 80% of the market we track.

It’s going to be interesting to see how the assets under management of these UCITS catastrophe bond funds changes over the coming months, with managers forecasting more significant inflows beginning from March, in order to match the growing primary cat bond market pipeline.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.