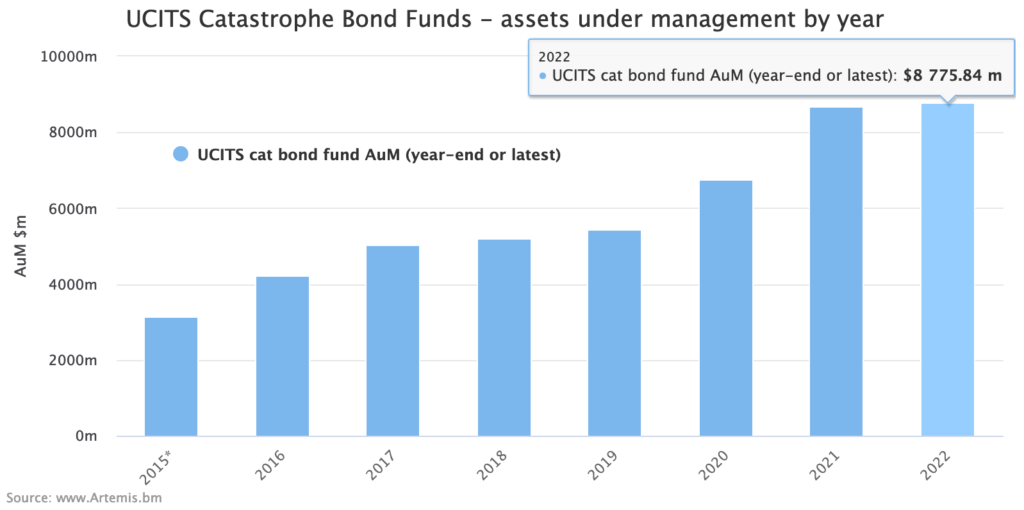

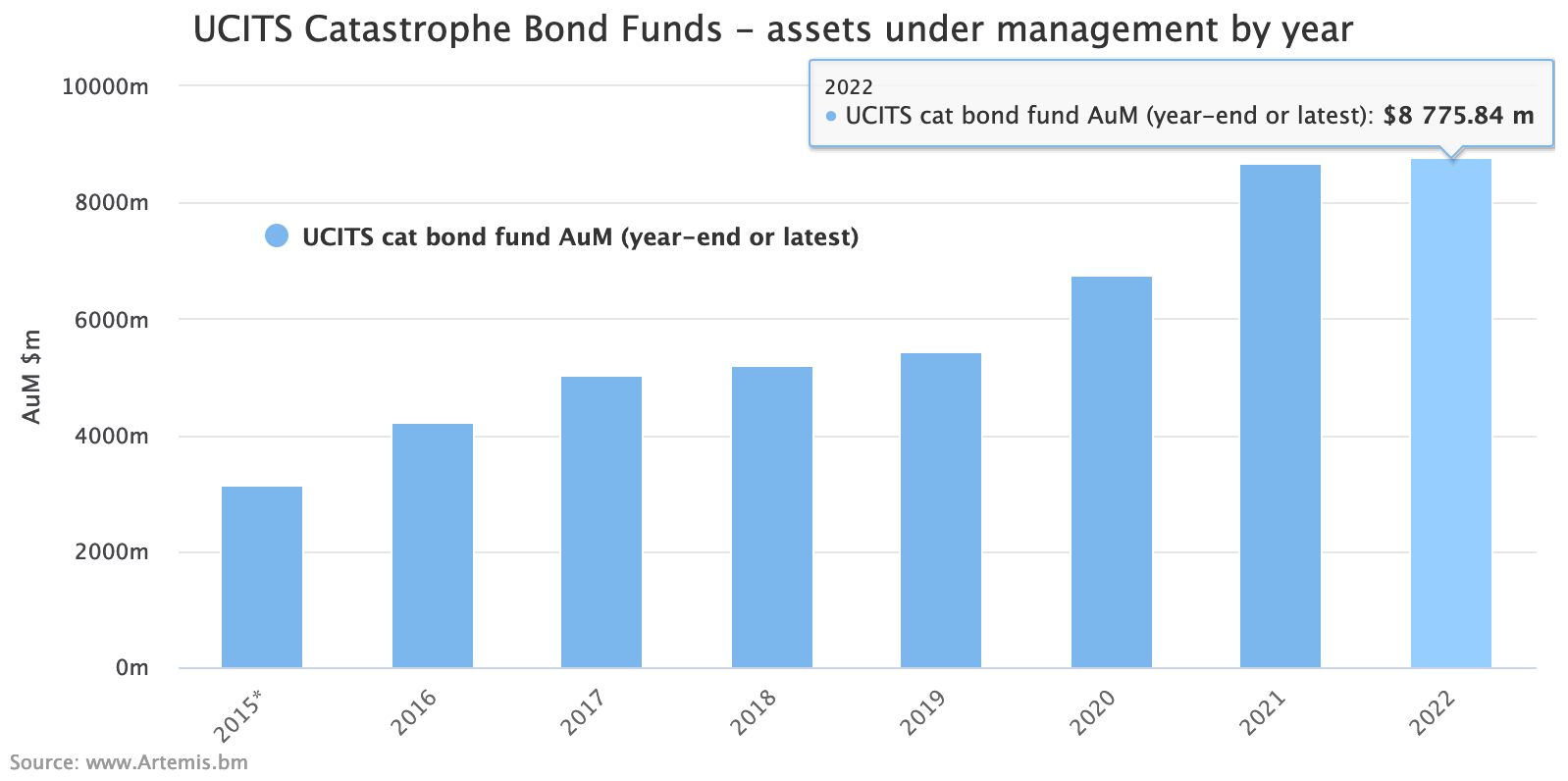

UCITS catastrophe bond fund assets climbed $700m in Q4 2022

The overall assets under management (AuM) of the main UCITS catastrophe bond funds as a group rose by almost $700 million during the fourth-quarter of 2022, as recovery of some cat bonds after hurricane Ian and fresh inflows helped the total increase 9% to reach $8.78 billion, a new year-end record high.

Over the course of the full-year 2022, these UCITS catastrophe bond funds only grew their assets under management (AuM) 1.2%, or $104 million, as the effects of hurricane Ian are clearly visible in fund data, both assets and performance (view UCITS cat bond fund performance here).

UCITS catastrophe bond funds had been a source of growth for their managers, who often also manage other more private insurance-linked securities (ILS), cat bond and collateralised reinsurance investment strategies.

The combined AuM of the leading UCITS cat bond funds had increased by an impressive 28% through 2021, as significant fund raising efforts by ILS managers helped to match a busy cat bond issuance pipeline.

Having begun 2022 with $8.67 billion of cat bond assets under management, these UCITS cat bond funds continued to grow and reached a new high of just over $8.8 billion at the end of May this year.

However, the effects of cat bond spread widening and price pressure, as well as some investor flows, reduced UCITS cat bond fund AuM as a group to $8.44 billion by the end of August 2022.

Then, along came hurricane Ian, which wiped out 4.3% of AuM, leaving the UCITS cat bond funds with $8.08 billion of AuM as a group at the end of September and the total fell further to just over $7.92 billion by the end of October this year, the lowest UCITS cat bond fund AuM figure since March 2021.

But the end of the year, with a resurgent pipeline of new catastrophe bonds, some value recovery on positions that are now deemed less exposed to hurricane Ian, and recovering investor confidence as it became clear Ian would not be the hit the catastrophe bond market had feared, helped to stimulate some new investor inflows.

As a result, the UCITS cat bond funds as a group ended 2022 with $8.78 billion of assets, almost back to the market high and representing a new year-end record.

Click the image below for an interactive version, where you can also see a month-by-month chart.

The impact of hurricane Ian on the catastrophe bond market is clearly visible in our chart that displays UCITS cat bond fund AuM by month, but so too is the rapid recovery and return to growth for this group of catastrophe bond fund strategies.

The nearly $700 million of AuM added in the fourth-quarter of 2022 is both related to valuation increases on certain positions and fund-raising efforts of managers.

We’re told some funds had good success at year-end, lifting their assets back towards previous highs with new inflows.

As before, the three largest UCITS cat bond funds, those managed by Fermat Capital Management, Schroders Capital and Twelve Capital, continue to make up the bulk of the market.

Between these three UCITS cat bond fund strategies, almost $6.97 billion of the assets reside and these three funds grew their AuM by 9.4% over the final quarter of the year and 7.3% across the full-year.

So the largest funds continue to outgrow the average across the entire cohort, which currently comprises 15 UCITS cat bond fund strategies.

Finally, it’s interesting to note that overall UCITS cat bond fund assets have increased by roughly 61% since the end of 2019, but over the same period the largest three UCITS cat bond funds expanded their combined AuM by an impressive 88%.

Investor confidence in the cat bond asset class returned quickly after hurricane Ian, as it became clear the market’s losses would be within expectations, perhaps lower than many would have thought likely to be seen.

As long as that remains the case, while the new higher spread environment promises far better and near-record cat bond returns, these UCITS cat bond funds are likely to be the beneficiaries of more investor inflows over the coming months and we could see these charts displaying stronger AuM growth across the group later in 2023.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.