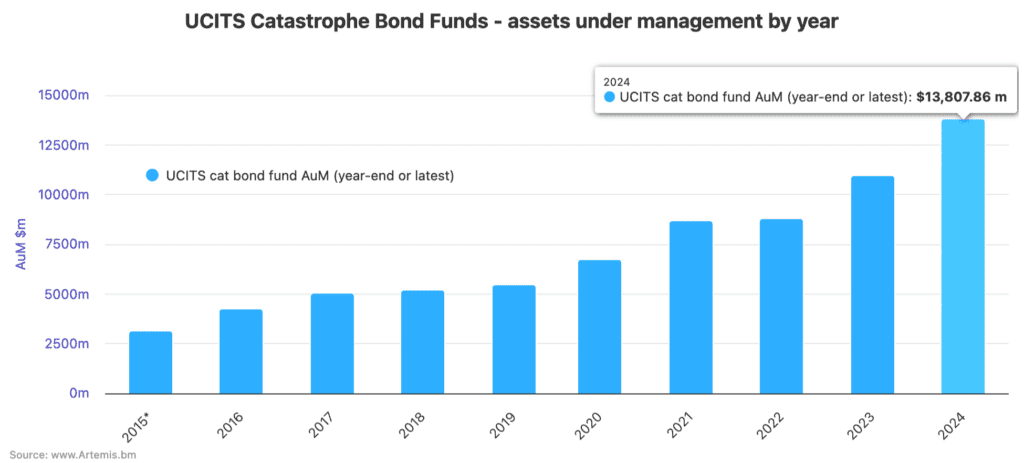

UCITS cat bond funds grow 26% in 2024, end year with $13.8bn under management

Catastrophe bond funds in the UCITS format continued their strong growth through the end of last year, reaching a new high of just over $13.8 billion in cat bond assets under management, which represents very impressive 26% growth through 2024.

In the final quarter of 2024, these UCITS structured catastrophe bond investment funds added almost $800 million to their combined assets under management (AUM).

Given the strong flow of maturities and also some investors taking profits, there was some fluctuation in the period, which you can see in the lower of our charts on this page tracking UCITS cat bond fund AUM by month.

But, a very strong December saw the total UCITS cat bond fund AUM rise by over $633 million in just one month, as cat bond fund managers welcomed new flows to meet the busy primary issuance pipeline.

Which helped the UCITS cat bond segment reach a new high, of just over $13.8 billion in combined AUM across the group of 16 funds by the end of 2024.

Analyse UCITS catastrophe bond fund assets under management using these charts (data kindly shared by our partner Plenum Investments AG, a specialist insurance-linked securities (ILS) fund manager).

Given the strong continued increase in AUM, these UCITS insurance-linked securities (ILS) investment fund strategies have increased their share of overall outstanding cat bond market risk capital once again.

Depending on your measure of current cat bond risk capital outstanding, the UCITS cat bond funds made up approximately 28% of outstanding cat bond market capital as of the end of 2024 (you can analyse Artemis’ measure of this here).

Which indicates continued growth of cat bond market share in UCITS funds, as when we last reported in early November these funds were 27% of the market.

The three largest UCITS cat bond funds continue to dominate assets under management in the sector.

At the end of the third-quarter of 2024, the three largest UCITS cat bond funds provide almost $9.26 billion of the total AUM, so around 71% of UCITS cat bond capital.

However, while the three largest UCITS cat bond funds grew further to $9.41 billion in combined AUM by the end of the year, the percentage share declined slightly to 68%.

At the end of 2024, the Schroder GAIA Cat Bond Fund strategy remained the largest with almost $3.49 billion in cat bond AUM and this fund grew 23% in the year.

The Twelve Cat Bond Fund is the next largest of the UCITS cat bond strategies, ending December 2024 at $3.35 billion for 15% growth in the year, followed by the GAM Star Cat Bond Fund at $2.57 billion which shrank 6%.

But, remember that Fermat Capital Management, the manager of the GAM Star Cat Bond Fund, also launched its own-branded UCITS strategy which grew from launch to $751 million by the end of the year.

There were other UCITS cat bond funds with very strong growth in the year, notably the Leadenhall UCITS ILS Fund added 79% to reach $1.01 billion, the first time this strategy has ever surpassed the billion dollar level.

Of the $100 million plus in size UCITS cat bond funds, other notable growers over the course of 2024, were the Plenum CAT Bond Dynamic Fund at 57%, Tenax ILS UCITS Fund at 47%, AXA IM WAVe Cat Bonds Fund at 35%, and Securis Catastrophe Bond Fund at 32%.

Of the smaller funds, the Credit Suisse (Lux) Cat Bond Fund added 188% in assets over 2024, while the HSZ Group Maneki cat bond fund added 70% and Solidum CAT Bond Fund 26%.

With catastrophe bond market issuance activity continuing apace in the first-quarter of 2025 (see the new deal pipeline here), and maturities set to accelerate (see the upcoming cat bond maturity schedule here), the catastrophe bond investment community looks set to have a busy start to the new year.

The issuance pipeline will need to be especially robust and those maturity flows will need recycling if these UCITS cat bond funds are to continue their growth surge through the first-half.

But with insurance and reinsurance company appetite for protection in securitized 144A catastrophe bond form remaining high, while deal execution and pricing are attractive for sponsors, and at the same time UCITS cat bond funds delivered investors another strong year of returns, there seems every chance these cat bond funds continue to expand as we move through 2025.

The catastrophe bond market pipeline already indicates a busy year ahead and the cat bond market yield remains at a historically high level, which should continue to attract investors and provide opportunities for cat bond fund managers to attract new inflows.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.