UCITS cat bond funds gain 0.4%, recover to -4.2% since hurricane Ian

Catastrophe bond funds, as measured by the Plenum CAT Bond UCITS Fund Indices, continued to recover more of the ground lost since hurricane Ian, gaining 0.40% in the last week.

Reduced loss expectations have helped catastrophe bond funds recover some of the initial mark-to-market loss after hurricane Ian, as certain sponsors of exposed cat bonds have said their losses fall below the levels required to trigger the cat bond deals.

The Plenum calculated UCITS catastrophe bond fund indices had declined -6.58%, on average, immediately after major hurricane Ian impacted Florida.

Now, with another 0.40% gained in the week to November 18th 2022, the UCITS cat bond fund index has recovered so that the decline since hurricane Ian is now an improved -4.2%.

The recovery is slowing though, which appears to suggest more of a consensus on catastrophe bond market losses from hurricane Ian is emerging.

At the same time, the additional mark-to-market pressure on many cat bonds that are not exposed to Ian, but have seen their prices depressed due to the forward-return expectations of investors, remain marked down.

Meaning that, while these UCITS cat bond fund indices are down -4.2% on average, a proportion of that is from spread widening across the cat bond market as price expectations have adjusted markedly.

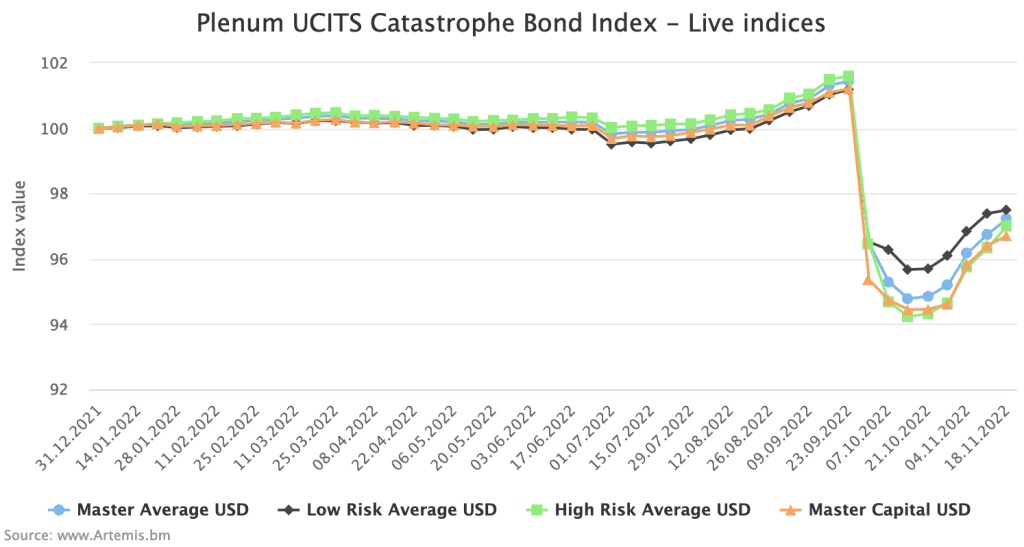

You can see the recovery of the UCITS cat bond funds tracked by these indices below (click the chart image to access the interactive version):

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

The average gain across these UCITS cat bond fund indices over the week to November 18th 2022 was 0.40%, with the low risk cat bond fund Index rising 0.11% and the high risk Index 0.66%.

Factoring in this latest week of returns, since hurricane Ian’s landfall, these UCITS cat bond fund indices are now -4.2% down on average, with the low risk Index now at -3.65% since Ian, while the high-risk cat bond fund Index is at -4.52% since the storm.

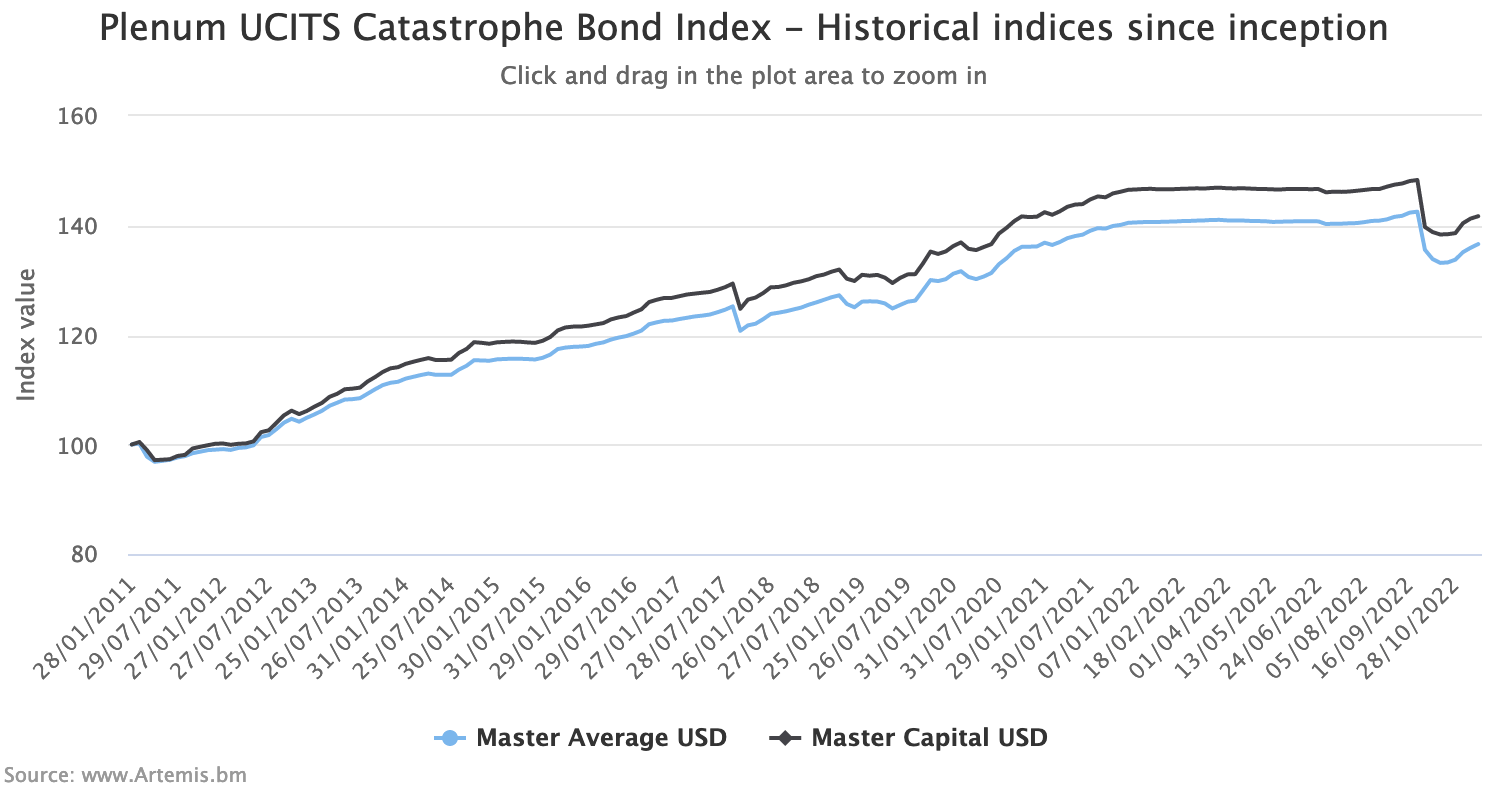

Below, you can see the UCITS cat bond fund index since its inception (click the image below for an interactive version):

The recovery since hurricane Ian will be expected to slow until further clarity emerges over the potentially loss-affected cat bonds and how significant any losses of principal could be.

At the same time, the spread widening effects on other cat bonds may prove prolonged, with individual names expected to recover as they reach maturity, hence it taking time for that effect to be unwound and recovered.

Positively though, with new catastrophe bond issuance likely to carry much higher risk-adjusted returns, the forward-performance potential of cat bond funds is also rising, so absent any losses or worsening of loss positions for Ian-exposed bonds, we could see a sustained period of better performance from the index helping them to recover back towards their previous highs.

Analyse the UCITS catastrophe bond fund index here.