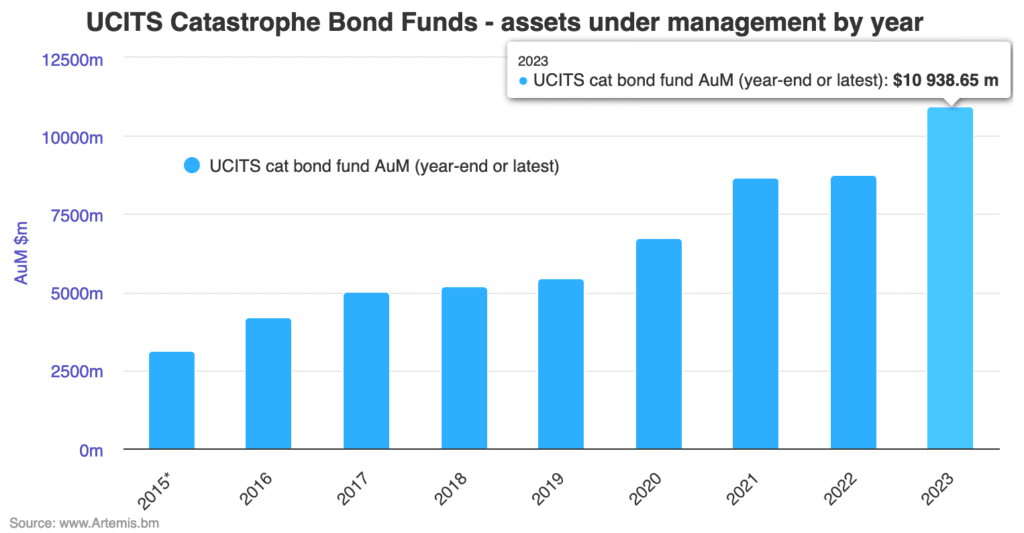

UCITS cat bond fund assets soar 25% to record near $11bn high in 2023

Catastrophe bond funds in the UCITS format experienced significant growth in assets under management in the final quarter of 2023, growing by 10.5% that period, to end the year with almost $11 billion of assets across this group of cat bond funds.

The combined assets under management (AUM) of the main UCITS catastrophe bond funds increased by almost $1.04 billion during the fourth-quarter of 2023, as fund managers looked to absorb the record levels of new catastrophe bond issuance in the period.

As the cat bond market reached new heights in 2023, as detailed in our latest report, the cat bond fund management community maximised their opportunity to bring onboard new investors and raise new assets to meet the busy pipeline of deals head on.

It meant the combined AUM of these cat bond funds ended the year at a record-high of $10.94 billion, so just shy of the $11 billion landmark figure.

That represents a very impressive 25% growth in assets across the full-year 2023 for the UCITS cat bond fund sector, or just over $2.16 billion growth in dollar terms.

UCITS cat bond funds as a group now command more than double the amount of assets they had under their management as recently as the mid-year of 2020.

While the growth in 2023 has been impressive, this would only have absorbed only between 10% and 15% of the new issuance that came to market in the record year 2023.

At almost $11 billion, the popular and growing UCITS cat bond fund sector still only holds around one-quarter of the outstanding stock of cat bonds, showing the importance of the private fund space and also direct investors in the cat bond market.

At the end of 2023, the three largest UCITS cat bond funds now contribute 78%, or almost $8.5 billion of the total assets under management across the group, with Twelve Capital ending the year with the largest UCITS cat bond fund, at just over $2.9 billion.

Interestingly, the three largest UCITS cat bond funds as a group have actually grown a little slower than the overall group across the course of 2023, with their combined AUM growing 22% over the period, compared to the whole cohort of UCITS cat bond funds growing their AUM by 25%.

Of the three major UCITS cat bond funds, the Twelve Cat Bond Fund grew by 36% in 2023, adding almost $772 million in assets across the year.

Next, was the Schroder GAIA Cat Bond Fund, managed by the Schroder Capital ILS team, which grew 23%, adding $528 million to reach $2.83 billion at year-end, while the GAM Star Cat Bond Fund managed by Fermat Capital Management grew 9% and added $218 million to reach $2.74 billion at year-end 2023.

However, in percentage terms, the fastest growing UCITS cat bond fund of 2023 was the Plenum CAT Bond Dynamic Fund, managed by Plenum Investments, which added 191% to reach almost $142 million in assets.

The Solidum CAT Bond Fund also saw a strong year, growing 87% to reach $72.5 million.

While, the Leadenhall Capital Management operated Leadenhall UCITS ILS Fund grew by 82%, adding $275 million, to reach $608 million at year-end.

We are currently in an interesting phase of the market annual cycle for cat bond fund managers, as we’ve had very strong issuance through the end of the year, driving new capital raising, then a glut of maturities, and now while the market has started the year looking quite busy, it is far slower than just a few weeks back.

As a result, it will be fascinating to watch the assets under management of these UCITS catastrophe bond funds through the first-quarter of 2024, to see whether the pace of growth continues and importantly whether these UCITS cat bond fund managers can recycle their capital from maturing deals back into new investments.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.