TWIA to drawdown most if not all CRTF funds on hurricane Beryl & storm losses

The Texas Windstorm Insurance Association (TWIA) has said that with it estimating losses of $400 million from hurricane Beryl making landfall in the state, it now believes most if not all of its Catastrophe Reserve Trust Fund (CRTF) may be eroded, something that will have implications for its funding and maybe for its reinsurance buying.

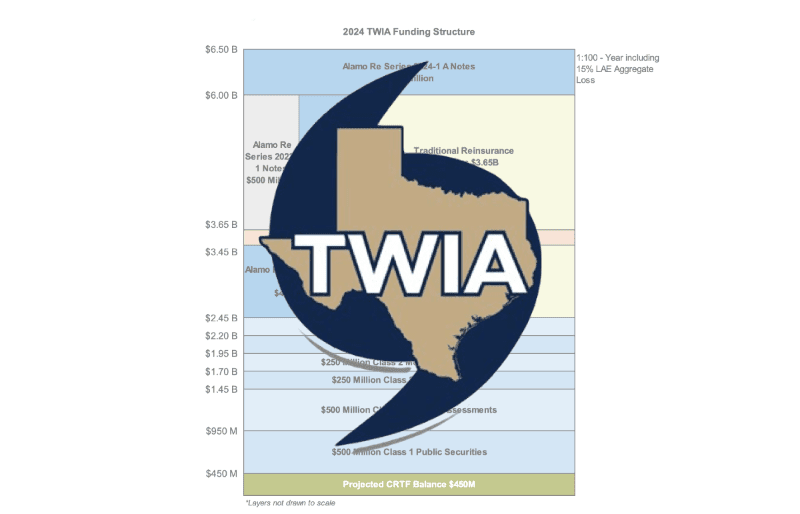

As a reminder, the Catastrophe Reserve Trust Fund (CRTF) is the bottom-layer of TWIA’s funding tower for 2024 that also features its private market reinsurance and catastrophe bonds.

It’s made up of contributions the insurer of last resort pays into the CRTF from its net gains, acting like a kind of savings account, and for the 2024 hurricane season it amounted to a $451 million capital buffer at the bottom of the funding tower.

But now, with that set to be at least majority eroded by claims from hurricane Beryl as well as other severe weather, TWIA may have to turn to mechanisms to top-up and replenish that layer.

By August 5th, TWIA had received more than 27,000 claims from hurricane Beryl and had made payment on more than 10,000 of those, for a total claims payment of around $120 million.

But, TWIA’s actuarial team said that a preliminary estimate of losses from Hurricane Beryl claims is $400 million, including adjusting costs.

The insurer explained that, “This estimate is subject to significant change as claims from this storm continue to be received and adjusted.

“TWIA staff expects that combined with heavy spring storms, claims from Hurricane Beryl will require the Association to draw down a substantial portion, if not all, of TWIA’s Catastrophe Reserve Trust Fund, which stands at $451 million as of the end of the second quarter of this year.”

Before TWIA taps into the CRTF it would usually pay claims out of premiums and other revenue, but it seems that amount is minimal this year given the projection to significantly erode the CRTF.

Above the CRTF, should hurricane Beryl losses exhaust it completely, TWIA would move into using its borrowing layers above, of public securities, while the private market reinsurance and cat bonds do not kick-in until a loss of $2.45 billion or greater is suffered.

With the CRTF depleted, it means TWIA could have to look to more borrowed sources of funding to fill that lower layer, it seems. Or continue through the hurricane season with no lower-layer coverage in place.

Which takes us back to 2016, when TWIA explored the purchase of reinsurance that could fill in the CRTF layer if it was eroded.

Back then, the CRTF was larger at $700 million and TWIA was concerned that should it be eroded it would significantly affect its funding position and then if not able to be replenished it could harm its ability to secure funding for the following year as well.

As a result, TWIA’s reinsurance broker, Guy Carpenter, said in 2016 that it would explore the possibility to buy an additional layer of reinsurance that would be inured to the CRTF balance.

If the CRTF balance was severely eroded, this reinsurance could provide a drop-down layer to backfill it to a degree.

In the end, back in 2016, this additional CRTF gap coverage reinsurance layer was not purchased, we believe, with TWIA finding the cost too expensive.

Fast-forward back to 2024 and given where the reinsurance market’s pricing sits, it seems unlikely that TWIA would look to fill the CRTF with reinsurance, although not impossible.

However, would the reinsurance and insurance-linked securities (ILS) markets have the appetite to fill that lower layer? That’s also not impossible, but the price exacted for it would likely be significant and could make it uneconomic to do so.

As a result, it seems more likely TWIA will explore other types of funding first, while also seeing whether it has any other resources that can replenish the CRTF to a degree. Failing that, it may have to go bare lower-down, or drop public securities into its place, but that could have coupon payment implications and we don’t believe the reinsurance above would drop down as well, so this could still leave a gap in the funding tower anyway.

The other implication for TWIA with an eroded CRTF, is how this affects its purchasing of funding for next year. It could cause the non-profit insurer to look for a lower reinsurance attachment point, or to need to insert an additional layer of public securities, to bolster its resources.

With exposure still growing, meaning more funding is generally required, this will have implications and make for interesting board discussions next year.

Separately, TWIA is planing to file a rate increase of 10% for residential and commercial policies, with these new rates likely to go into effect in January 2025.

Also read: TWIA reinsurance rate-on-line hits 9.6% as it seeks to control risk transfer expense.