Turkey earthquakes loss estimate raised 32% to ~$4.6bn by PERILS

PERILS AG has hiked its insurance and reinsurance market industry loss estimate for the recent Kahramanmaras Earthquake Sequence that struck Turkey and Syria in February 2023 by a significant 32%, with the estimate now at almost US $4.5 billion.

But this still falls well short of an estimate made by Swiss Re in its results disclosure yesterday of US $5.3 billion, suggesting there could be a further increase to come from PERILS in future.

PERILS first reported in March that the series of earthquakes, which caused widespread devastation across parts of the Republic of Türkiye and the Syrian Arab Republic on February 6th 2023, were estimated to have caused TRY 65.4 billion of property insurance market losses, equating to around US $3.44 billion as of the time of that report, but US $3.5 billion on the date of the quakes.

Now, the estimate has been lifted by a significant 32% to TRY 86.4 billion, which at today’s rate would be around US $4.45 billion, but on the day of the earthquakes US $4.6 billion.

As we reported yesterday, global reinsurance firm Swiss Re has set its own reserves for the Turkey earthquakes based on an industry loss of US $5.3 billion.

Of course, it’s difficult to know how to compare the two, but the fact Swiss Re’s estimate remains so much higher, could suggest there is more room for PERILS industry loss estimate to rise at later updates as well.

As a reminder, catastrophe risk modeller Moody’s RMS previously said the losses would likely be above US $5 billion.

But global reinsurer Hannover Re had estimated the quakes were a EUR 3.5 to 4 billion industry loss event.

So, there’s still some uncertainty around exactly where the loss estimate from these quakes will settle, but it’s clear it was the largest insured loss of the first-quarter and that finalising the total will take time.

One comparison between estimates, is that PERILS only includes insured losses in Turkey and not in Syria, although that would not be expected to be a significant differentiator in the quantum, given insurance penetration in Syria is extremely low.

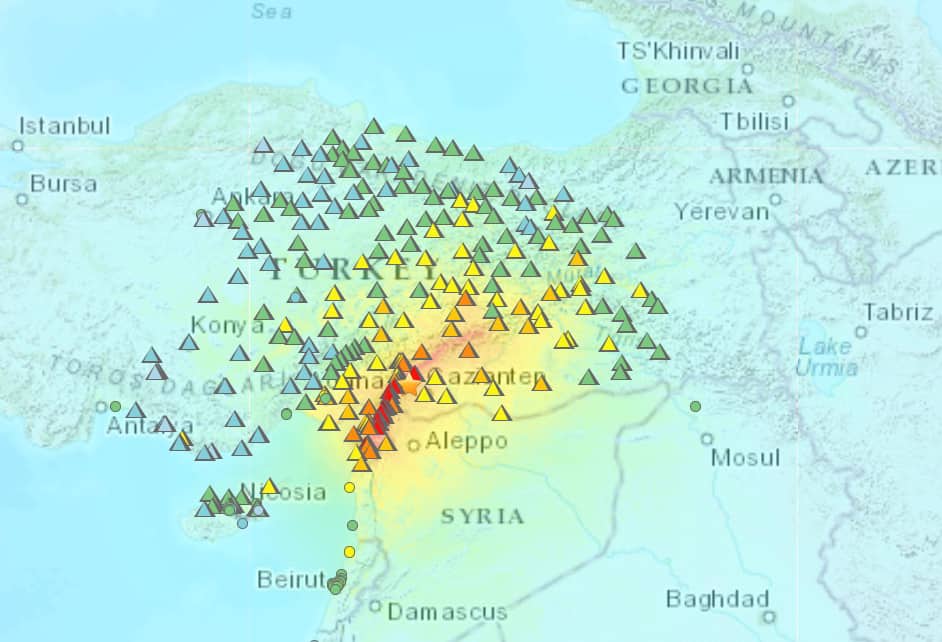

PERILS said that the Kahramanmaras Earthquake Sequence consisted of three major earthquakes measuring Mw 7.8, Mw 6.7 and Mw 7.5 on the moment magnitude scale, that occurred along the south-western end of the East Anatolian fault system and caused extreme ground shaking in south-central Turkey and north-western Syria.

Official figures put the loss of life at 50,783 in Turkey and 8,476 in Syria, with 107,204 people estimated injured in Turkey and over 14,800 in Syria.

In insured loss terms, the quake sequence is the most costly catastrophe event in Turkey’s history, PERILS notes.

Luzi Hitz, CEO of PERILS, commented, “Our second loss report gives some indication of the immense scale of the Kahramanmaras Earthquake Sequence, with highly populated areas with large value concentrations severely impacted by the event. Recovering from a loss of this magnitude is a huge undertaking, but some initial shoots of recovery are evident with the reopening of schools in affected provinces in Turkey on 24 April.

“Insurance and reinsurance can play a central role in restoration efforts after an earthquake event. However, to ensure sustainable capacity, it is critical that the risk is properly understood and can be assessed accurately and effectively. By providing our industry loss and exposure data for Turkey and many other territories, we hope to contribute to this heightened risk understanding and by so doing, support the increased availability of insurance and reinsurance for natural catastrophe risk.”