Turkey earthquakes insured loss estimate raised 7% to US $4.9bn

The insurance and reinsurance market industry loss estimate for the Kahramanmaras Earthquake Sequence that struck Turkey in February 2023 has been raised a further 7% by PERILS, to reach TRY 92.8 billion, which would have been US $4.9 billion at exchange rates when the disaster struck.

The industry loss estimate continues to fall short of some made by industry players, including the US $5.3 billion estimate made by reinsurance firm Swiss Re.

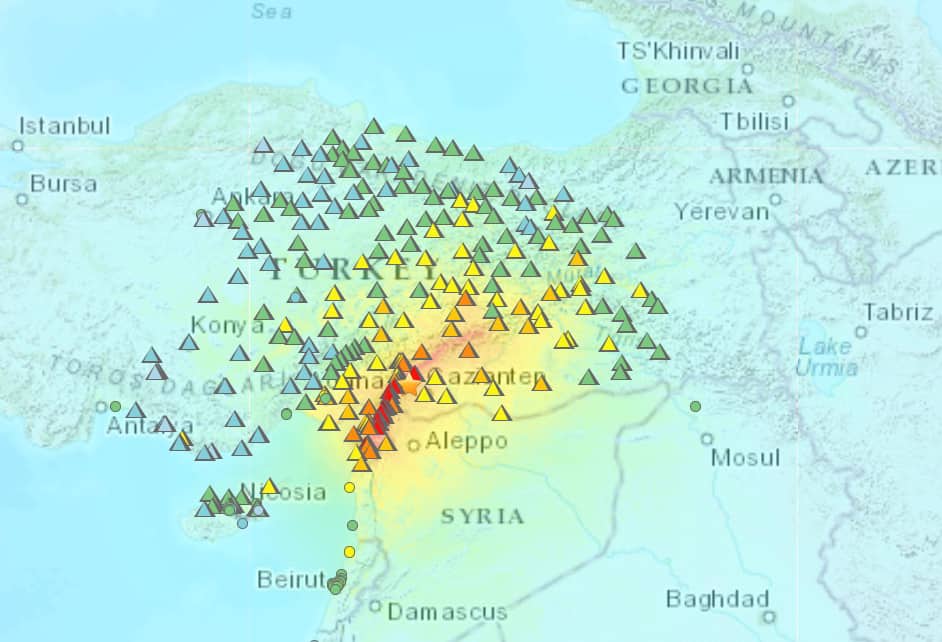

PERILS initially reported in March that the series of earthquakes, which caused widespread devastation across parts of the Republic of Türkiye and the Syrian Arab Republic on February 6th 2023, were estimated to have caused TRY 65.4 billion of property insurance market losses, equating to US $3.5 billion on the date of the quakes.

Then, the estimate was lifted by a significant 32% to TRY 86.4 billion, which on the day of the earthquakes US $4.6 billion.

Global reinsurance firm Swiss Re had set its own reserves for the Turkey earthquakes based on an industry loss of US $5.3 billion.

Catastrophe risk modeller Moody’s RMS previously said the losses would likely be above US $5 billion.

But global reinsurer Hannover Re had estimated the quakes were a EUR 3.5 to 4 billion industry loss event.

Now, at a constant currency rates US $4.9 billion, PERILS estimate of insurance and reinsurance market losses from the earthquakes is approaching the rest of the industry.

Industry loss estimates often converge, but sometimes take time to do so.

The updated loss estimate is solely based on the property line of insurance, business, while losses from other lines of business as well as losses from Syria are not included.

uzi Hitz, CEO of PERILS, said, “At current exchange rates, TRY 92.8bn translates to approximately USD 3.4bn or EUR 3.1bn. However, in February 2023 when the earthquakes struck, TRY 92.8bn equated to approximately USD 4.9bn or EUR 4.6bn. Currency fluctuation is one example of the many challenges facing the Turkish insurance market as it continues to successfully process an unprecedent number of insurance claims from this event.”