TransRe boosts focus on AI

TransRe boosts focus on AI | Insurance Business New Zealand

Reinsurance

TransRe boosts focus on AI

Promoted duo will report to the company’s COO

Reinsurance

By

Kenneth Araullo

TransRe has restructured its data science team to support the development and adoption of artificial intelligence (AI), machine learning, and large language models.

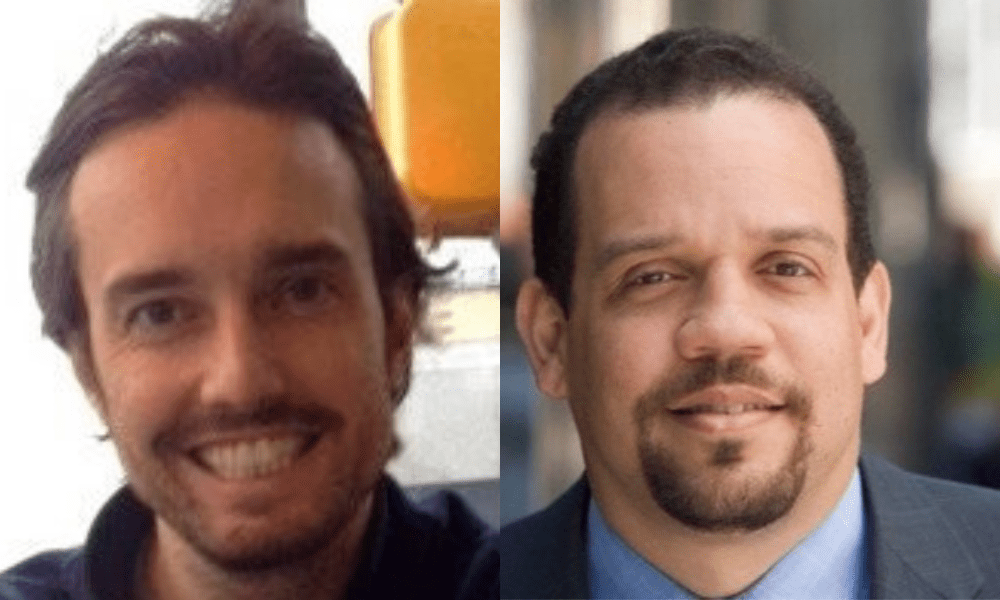

Otakar Hubschmann (pictured above, left) has been promoted to the newly created role of chief artificial intelligence officer, where he will lead the TransRe Artificial Intelligence Team (TRAIT). Socrates Pichardo (pictured above, right), TransRe’s chief technology officer, will also join TRAIT.

Otakar joined TransRe in 2016 from a quantitative trading background to establish a data science group. Since then, the team has undertaken several projects, including automating data extraction and ingestion from submissions and contracts.

Socrates has been with TransRe since 1993 and has led numerous IT projects, such as the development of TransRe’s property underwriting platform and the company’s migration to cloud-based systems. He was appointed group CTO in 2017.

TRAIT will focus on integrating AI’s rapidly developing capabilities with TransRe’s existing expertise, aiming to deliver additional insights for both colleagues and clients.

To help embed these capabilities within the operating units, TRAIT will report to TransRe’s chief operating officer, Matt Mahoney.

Back in July, the Berkshire Hathaway-owned reinsurer also announced the appointments of Tina Kališnik to global portfolio leader, cyber, and Diana Liu to US cyber underwriting leader.

Kališnik, who joined TransRe in 2016, was praised by the company as integral in building the company’s European professional liability business and client base, with a particular focus on cyber exposures.

Meanwhile, Liu, who joined TransRe’s actuarial department in 2019 and later the US professional liability underwriting team in 2022, will take on the role of US cyber underwriting leader. Liu has focused on cyber underwriting and marketing and has integrated new cyber analytics and modeling capabilities into the underwriting process.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!