Top Workers’ Compensation Insurance Companies in the USA 2023

Jump to winners | Jump to methodology

Partners in supporting workers

In the United States workers’ compensation (WC) market, accident frequency has been steady or slightly downward, but the severity of claims has been increasing and costs have been driven up dramatically.

Influencing this trend are:

Medical and technology costs associated with accident survivability for injured workers who are surviving what used to be fatal injuries

Catastrophically injured individuals living longer

Advanced medical science with injuries such as severe burns or quadriplegia; a quadriplegic in their 20s or 30s could live 30 to 40 more years, requiring round-the-clock attendant care

Large cost drivers associated with catastrophic injury claims are often not covered by fee schedules, such as extended ICU hospitalizations

Legislative expansion of benefits through various measures such as cancer presumption laws in the public entity market

“Our customers number in the thousands, and we custom-design programs based on their needs. That differentiates us from other insurance providers”

Tom Grove, Safety National

Loretta L. Worters, vice president, media relations at the Insurance Information Institute, lays out what a market-leading WC provider should be.

“Financial stability, do they have a good credit rating? While every workers’ comp company must follow state statutes on coverage terms, limits of liability and benefits, there are other things that you want to look for,” she explains. “What’s their reputation for paying claims in a timely manner? The provider should be accessible when you have questions or concerns. They should be a partner to help prevent workplace safety issues.”

All the IBA 5-Star Workers’ Comp winners display these qualities and are dedicated to delivering.

“Claims are the opportunity to deliver on the promise that the policy represents, [and] we treat this opportunity seriously”

Matthew Zender, AmTrust Financial Services

Matthew Zender, AmTrust Financial Services

What do brokers want from workers’ compensation

insurance companies?

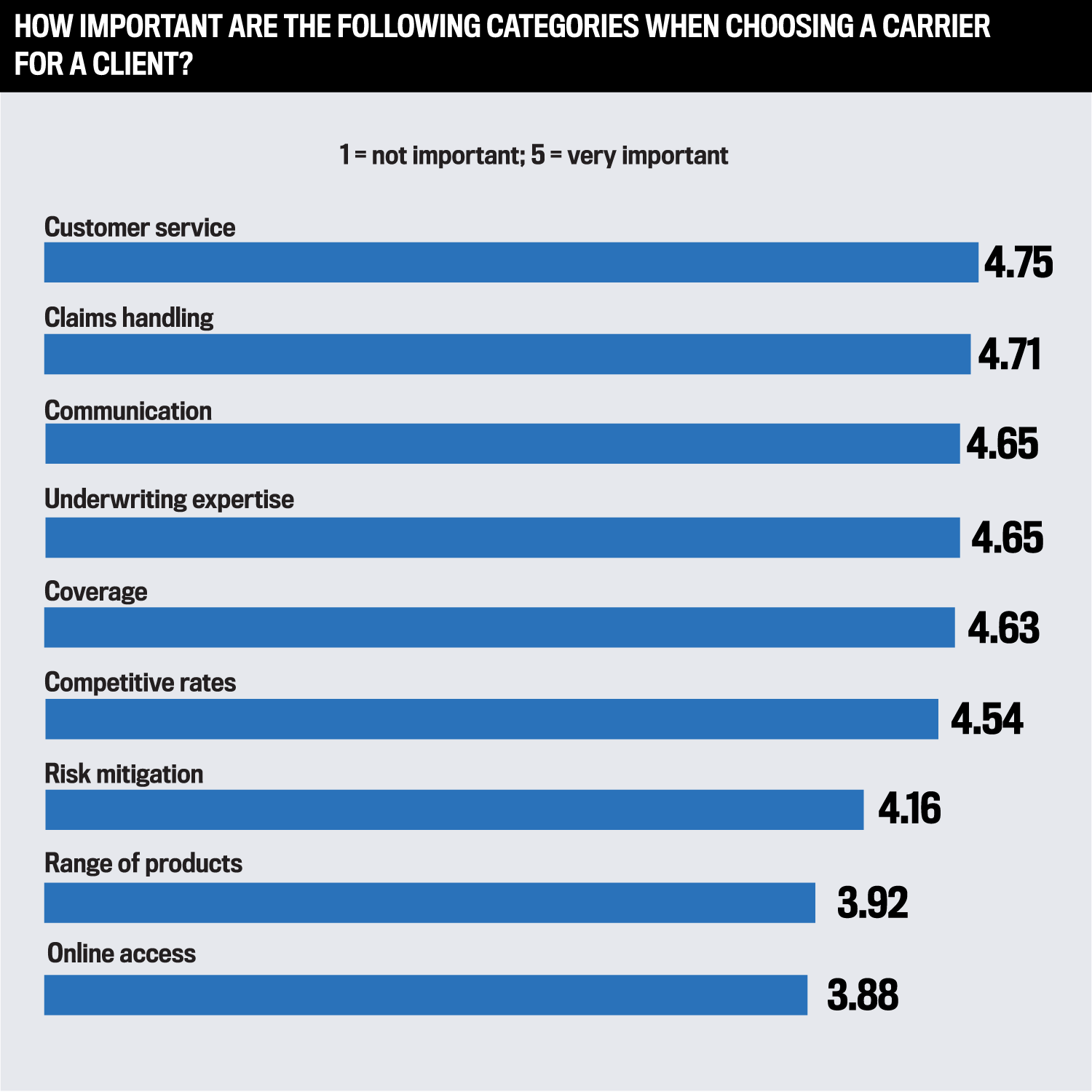

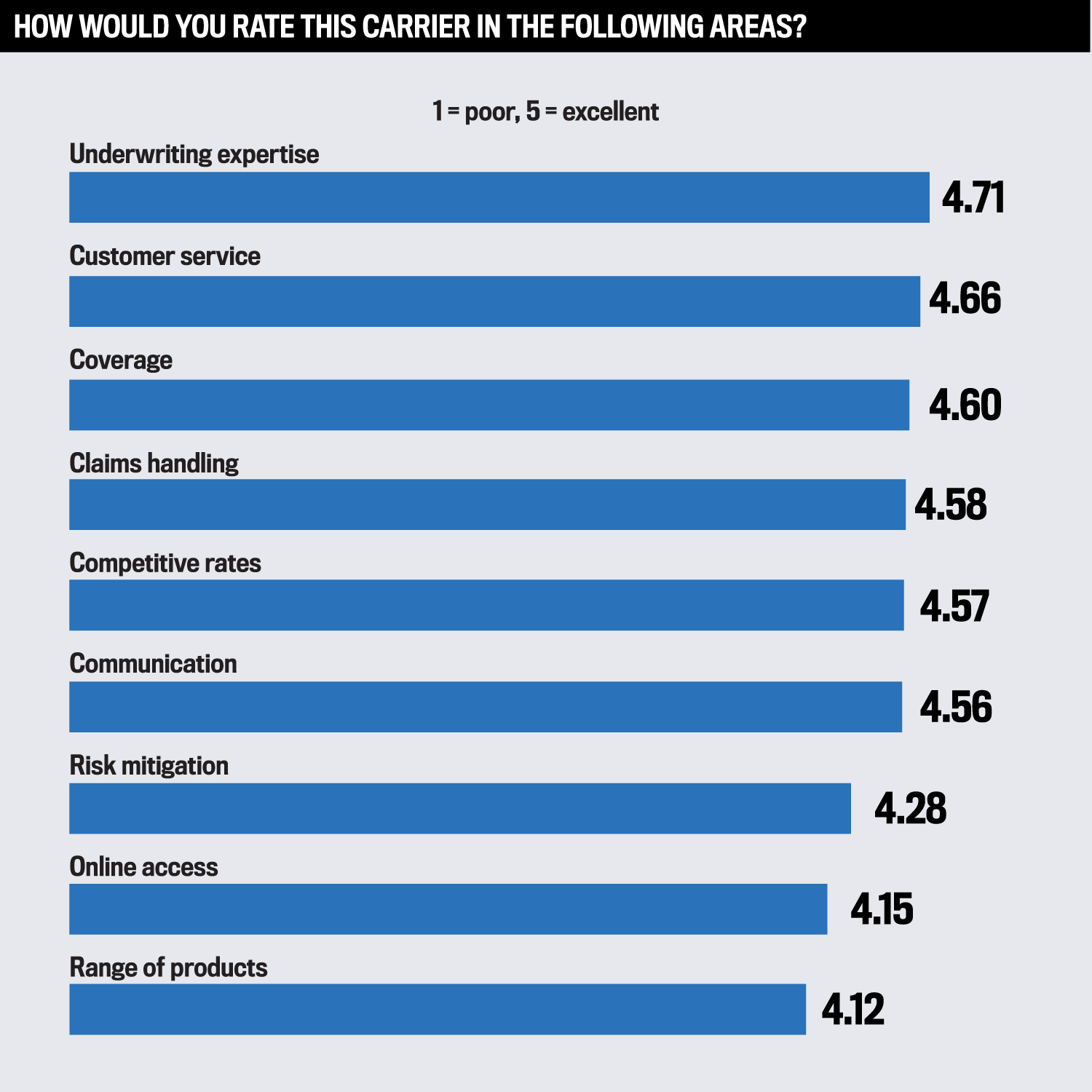

IBA surveyed hundreds of brokers to get their take on what’s most important in the top workers’ compensation insurance companies’ offerings.

Some of their suggestions on what they want to see in the industry include:

“Offer faster service and more streamlined communication”

“Make the underwriting process and binding process easier”

“Open up appetite to include more class codes”

“More flexible billing options”

A group of 5-Star winners explained to IBA how they’ve met expectations:

Tom Grove, chief client officer, Safety National

Mary Beth Pittinger, executive vice president, workers’ compensation, Chubb Commercial Insurance

Matthew Zender, senior vice president of WC strategy, AmTrust Financial Services

Customer service

AmTrust Financial Services

“From a workers’ compensation perspective, we understand the need to provide service as efficiently as possible. We have worked to achieve the right balance between self-service and support, all in order to set our agents up for success.”

Safety National

“Customer service is not an approach. It’s who we are. It’s our DNA. That’s what separates us from other insurance companies. Because of our flat organization and customized approach, our buyers will get to form relationships with us that we believe create a superior high-touch experience with us than they will get with any other carrier.”

Chubb Commercial Insurance

“Advancements in service technologies continue to raise customers’ expectations of service. While technology is important, workers’ compensation is a service-driven product line and it’s important that underwriters, risk engineers, claim handlers, premium auditors, and policy servicing teams are working together to deliver personal touchpoints during various steps of the workers’ compensation life cycle.”

Claims handling

AmTrust Financial Services

“Claims are the opportunity to deliver on the promise that the policy represents. We treat this opportunity seriously and we take pride in our claims organization and their success.”

Safety National

Managing high-exposure, catastrophic claims for more than 80 years has given Safety National unique expertise. “A claims adjuster’s worst catastrophic claim is a claim we see on a regular basis”.

Chubb Commercial Insurance

“Deep expertise and experience in handling WC claims and providing quality care to a customer’s most valuable asset — their employees — is table stakes for being a premier workers’ compensation carrier. The average tenure of our claims adjusters is 10+ years.”

Communication

AmTrust Financial Services

“We listen, act and respond. We communicate relevant details timely and are there when needed.”

Safety National

“Everyone can make promises, but we pride ourselves on the follow-through and execution. The bureaucracy is minimal. We are easily accessible and nimble, with the ability to make a decision and reply with an answer quickly. We treat each client as a true partner. We are flexible and communicative through every step of the process.”

Chubb Commercial Insurance

“Collaboration with customers throughout the entire workers’ compensation cycle is critical to achieving the best outcomes. That includes helping insureds to identify hazards and prevent accidents, and handling claims promptly and fairly while offering support for injured employees.”

“Collaboration with customers throughout the entire workers’ compensation cycle is critical to achieving the best outcomes”

Mary Beth Pittinger, Chubb Commercial Insurance

Mary Beth Pittinger, Chubb Commercial Insurance

Underwriting expertise

AmTrust Financial Services

“Understanding the business that we insure is paramount. We look to recognize fit in class and use this expertise to provide a competitive quote based on the unique characteristics of each risk.”

Safety National

“Many carriers write tens of thousands or hundreds of thousands of customers, and they are treated the same because there is just a sheer mass of accounts. Our customers number in the thousands, and we custom-design programs based on their needs. That differentiates us from other insurance providers.”

Chubb Commercial Insurance

“A few key segments we offer underwriting specialists include professional services, life sciences, technology, energy, manufacturing, retail/wholesale trade, and financial services, to name a few. We understand the unique workers’ compensation exposures generated from each of these individual segments, and tailor our underwriting and service offerings to provide the most comprehensive program.”

Coverage

AmTrust Financial Services

“We ensure that our coverage options are as robust as any found in the marketplace.”

Safety National

“Our underwriting approach is to determine what a customer seeks in their relationship with an insurance carrier. What are their service needs or where do they need help in terms of controlling losses or claim management? We come up with a competitive price and, from there, we deliver on our service commitments.”

Chubb Commercial Insurance

“While workers’ compensation coverage is statutory, it’s important to understand how the different state jurisdictions impact an insured’s experience. Staff in Chubb’s 48 US branches understand the intricacies of each state’s jurisdiction to provide customers with workers’ compensation policies that meet the criteria of their jurisdiction.”

The numbers speak for themselves

These top workers’ compensation insurance companies stand out with their quantified achievements.

As of year-end 2022, Safety National reported:

$3.4 billion in statutory surplus

$13.8 billion in assets

$2.4 billion in gross written premium

Other accolades include:

Being a wholly owned subsidiary of Tokio Marine Holdings, ranked among the top 10 insurance companies in the world with a presence across more than 40 countries

Earning the highest ratings from AM Best (A++, FSC XV), thus lauding the company’s financial stability and lasting power

Ranking as a Best Place to Work in Insurance honoree for multiple years

Zender of AmTrust says, “With over 360,000 policies in force, and as the third largest writer of workers’ comp in the country, we bring our capabilities to bear daily to support the needs of our policyholders.”

And according to the most recent 2021 AM Best data, Chubb ranks as the fifth largest direct written premium carrier with over $2.2 billion of direct WC premium.

Applied Underwriters

Chubb Commercial Insurance

Employers

Encova

FFVA Mutual Company

ICW

Lion Insurance

Markel

Midwest Employers Casualty

Midwestern Insurance Alliance

Omaha National

Pie Insurance

State Fund

SteadPoint/Benchmark

The Hartford

XSWC – Safety National

Claims Handling

Applied Underwriters

Chubb Commercial Insurance

Encova

FFVA Mutual Company

ICW

Lion Insurance

Markel

Midwest Employers Casualty

Midwestern Insurance Alliance

Omaha National

Pie Insurance

State Fund

Steadpoint/Benchmark

The Hartford

XSWC – Safety National

Communication

Applied Underwriters

Chubb Commercial Insurance

Employers

Encova

FFVA Mutual Company

ICW

Lion Insurance

Markel

Midwest Employers Casualty

Midwestern Insurance Alliance

Omaha National

Pie Insurance

State Fund

SteadPoint/Benchmark

The Hartford

XSWC – Safety National

Competitive Rates

Applied Underwriters

Chubb Commercial Insurance

Employers

Encova

FFVA Mutual Company

ICW

Lion Insurance

Markel

Midwest Employers Casualty

Midwestern Insurance Alliance

Omaha National

Pie Insurance

State Fund

SteadPoint/Benchmark

The Hartford

XSWC – Safety National

Coverage

Applied Underwriters

Chubb Commercial Insurance

Employers

Encova

FFVA Mutual Company

ICW

Lion Insurance

Markel

Midwest Employers Casualty

Omaha National

Pie Insurance

State Fund

SteadPoint/Benchmark

The Hartford

XSWC – Safety National

Customer Service

Applied Underwriters

Chubb Commercial Insurance

Employers

Encova

FFVA Mutual Company

ICW

Lion Insurance

Markel

Midwest Employers Casualty

Midwestern Insurance Alliance

Omaha National

Pie Insurance

State Fund

SteadPoint/Benchmark

The Hartford

XSWC – Safety National

Online Access

Applied Underwriters

Chubb Commercial Insurance

Encova

FFVA Mutual Company

Lion Insurance

Markel

Midwest Employers Casualty

Omaha National

Pie Insurance

SteadPoint/Benchmark

The Hartford

Range of Products

Applied Underwriters

Employers

FFVA Mutual Company

Lion Insurance

Markel

Midwestern Insurance Alliance

Omaha National

Pie Insurance

State Fund

SteadPoint/Benchmark

XSWC – Safety National

Risk Mitigation

Applied Underwriters

Chubb Commercial Insurance

FFVA Mutual Company

Lion Insurance

Markel

Midwest Employers Casualty

Omaha National

Pie Insurance

State Fund

SteadPoint/Benchmark

The Hartford

XSWC – Safety National

Underwriting Expertise

Applied Underwriters

Chubb Commercial Insurance

Employers

Encova

FFVA Mutual Company

ICW

Lion Insurance

Markel

Midwest Employers Casualty

Midwestern Insurance Alliance

Omaha National

Pie Insurance

State Fund

SteadPoint/Benchmark

The Hartford

XSWC – Safety National

Specialized Workers’ Compensation

Amerisafe

Hard-to-place risk

Applied Underwriters

Construction

BerkleyNet

High hazards

Clear Spring

Long-haul transportation

ICW

Tree operations

Omaha National

Contracting

State Fund

Hard-to-place risk

High-Risk Workers’ Compensation

Applied Underwriters

Heavy construction

Berkley Industrial

High hazard risk

Clear Spring

Contractors and transportation

ICW

Contracting

Omaha National

Artisan contractors

PEO

Cell tower climbers

Pie Insurance

Roofing

State Fund

Trucking

To select the best workers’ compensation insurers for 2023, Insurance Business America enlisted some of the industry’s top experts. During a 15-week process, IBA’s research team conducted one-on-one interviews with specialist brokers and surveyed thousands more within its network to gain a keen understanding of what insurance professionals think of current market offerings. Brokers were first quizzed on what features they thought were most important in WC insurance policies, and then asked to nominate WC carriers and policies across key areas including claims processing capabilities, customer service, competitive premiums, flexibility, communication, and more.

At the end of the research period, the insurance providers that offered the best overall service to brokers were named 5-Star award winners.