Tighter cat bond pricing welcomed by sponsors: Aon Securities

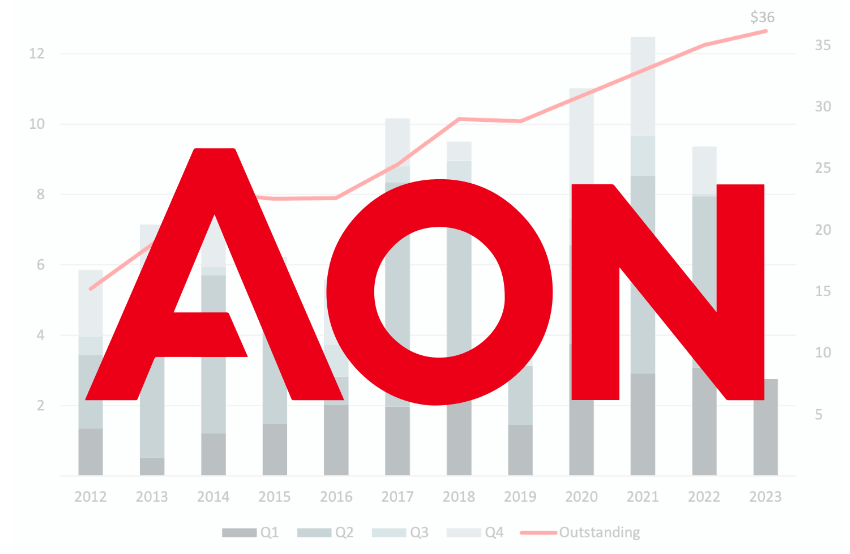

Catastrophe bond and insurance-linked securities (ILS) market conditions improved somewhat for sponsors during the first-quarter of 2023, with tightening of pricing welcomed by sponsoring re/insurers, Aon Securities has said.

In reporting on the Q1 2023 cat bond market activity, Aon Securities, the ILS and capital markets broker-dealer unit of the insurance and reinsurance broker, explained that the improved cat bond market conditions also helped to increase issuance sizes as well.

“After a difficult Q4 2022, the catastrophe bond market has reassumed its growth trajectory during the first quarter of 2023.

“Transaction sizes have increased markedly from the second half of 2022, with total deal sizes YTD 67% greater on average than those issued during H2 2022,” Aon Securities explained.

Pricing is still far higher than it was even a year ago, but a moderation in it has helped to attract sponsors and likely helped stimulate the larger deal sizes to be issued, it seems.

Aon Securities noted that, “Whilst pricing remains elevated from levels achieved in 2021, it has tightened during the first three months of 2023 from peak levels seen at year-end 2022, a development welcomed by insurers and reinsurers, alike, particularly at a time when pricing in the reinsurance and retrocession markets remain heightened relative to the prior decade.”

Adding that, “Capital markets investors have taken note of the relative value of the catastrophe bond market compared with other alternative asset classes, especially considering the persistent volatility that continues to pervade the broader financial markets.”

But not all segments of the ILS market are functioning as healthily as the catastrophe bond market in 2023, Aon Securities said.

“Elsewhere in the alternative capital markets, collateralised reinsurance remains somewhat constrained,” the broker-dealer unit said.

Continuing to explain that, “Whilst the sidecar market has not grown substantially, existing investors in the space are committing to existing transactions with meaningfully higher margins.”

It was positive net capital inflows into the catastrophe bond market in Q1 that aided in tightening pricing somewhat, making the costs of cat bond protection more reasonable, while also ensuring the capacity needed by sponsors was available.

Despite the tightening, Aon Securities said that “current margin levels have still proved very attractive to investors.”

While cat bond pricing has tightened, coming off the top of the hard market as we recently explained and our charts reflect, it remains at levels significantly higher than a few years ago, although with investors keen to hold onto higher margins, some are already citing concerns that pricing doesn’t drop too far, too soon.

After a busy first-quarter of 2023 for the catastrophe bond market, Artemis has so far recorded 26 new cat bonds that are together set to secure over $5.6 billion of protection for their sponsors in the second-quarter so far.