Three big Trends İnsurance With People United States in 2022

In this article, SCOR’s Hiroe Noonan examines key trends in the US life insurance market. Why should insurers make New Year’s resolutions?

Why should insurers make New Year’s resolutions?

Millions of people make New Year’s resolutions every year. The start of a new year traditionally marks a positive start or renewal for most of us. But it’s also an opportunity to set new goals or projects and break old negative habits. However, the stress and fatigue associated with the pandemic have also affected our outlook on life, relationships and maybe even our decisions.

The latest global consumer research from ReMark, a SCOR Group company, provides key insights into the changing attitudes of US consumers driven by the pandemic. Insurance companies and players in the insurance ecosystem want to incorporate valuable insights from this study into their marketing strategies. Below are the key trends identified by the study.

Americans want to learn more about personal insurance.

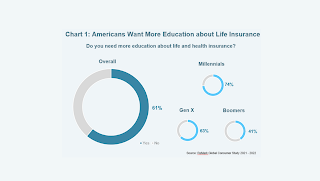

Don’t be surprised to see the word “life insurance” in many of the resolutions made this year. American interest in personal insurance has increased significantly in recent years, particularly due to the COVID-19 pandemic. 61% of US respondents surveyed said they needed more information about personal insurance. A large part of this percentage is related to Generation Y.

A third of respondents said that COVID-19 has changed their behavior towards risk and the value of insurance. This is even more important (70%) among people who know someone who has died of COVID-19. According to the insurance knowledge score calculated by ReMark, the United States ranks 11th out of 22 countries surveyed. Americans want to learn more about personal insurance, but their general knowledge lags behind other industrialized countries such as Canada, Sweden, the United Kingdom, and Singapore. This is an opportunity, but also a responsibility, for the personal insurance industry in the United States to improve the knowledge of American consumers in this area.

Many have removed or increased their personal insurance coverage. Status to follow?

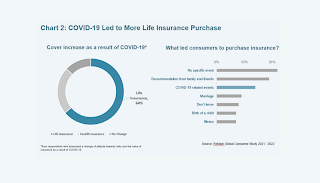

According to the Global Consumer Survey report, 64% of respondents said they increased their personal insurance coverage in 2021.

About half said they’ve recently launched a new product, including their whole life policy. When asked what encouraged them to sign up, 19% said it was recommended by family and friends, and 14% said it was due to COVID-19 related events. It is not yet clear whether more Americans will follow this trend in 2022.

But one thing is for sure, the COVID-19 crisis continues, so individuals need to make sure they have adequate insurance coverage. It is up to each insurer to capitalize on this positive trend and strengthen their potential customers’ willingness to purchase better insurance coverage.

Americans want to do physical activity and sleep better. This is also what insurance companies want people to do for them.

The study shows that 7 out of 10 participants have become more proactive about their health as a result of the pandemic. When asked what aspect of their health they would like to improve, “sleeping better” is the fastest growing problem, ranking second only to “being more physically active”.

Wearable health devices that track steps, calories and sleep cycles are gaining popularity. Owning wearables for health increased from 27% to 32% in two years. This is good news for life insurers as healthier policyholders will have better risk profiles and positive overall financial results.

Some insurers are already actively involved in integrating HealthTech into their value chains, from the customer insurance journey, product development, through underwriting and management empowerment. This trend is expected to continue as more players in the ecosystem, including startups, vendors, and traditional players, start working in this space.

Solution

Insurers’ New Year’s Resolutions: Empowering and Educating Consumers.

This year, we’re recommending personal insurance companies make their own New Year’s resolutions. As a result of the growing interest in personal insurance and increased sales of these products among American consumers, personal insurance companies will face enormous opportunities and challenges as insurance protection continues to be filled.

All insurance companies will have to take measures to empower consumers to improve their individual insurance knowledge. Companies with visionary and innovative consumer-oriented approaches will not only be able to gain competitive advantage in the coming years.Not only will they become a business leader, they will also have a position of industry leadership.