The Top Underwriting Agencies of Australia | Brokers on Underwriting Agencies

Jump to winners | Jump to methodology

Setting the gold standard

The 2024 winners of IB’s Brokers on Underwriting Agencies have been selected for their ability to proactively interact with brokers, listen to their insight and then act on their feedback.

That has seen these top underwriting agencies offer support to insureds before and after events occur, embrace technology to leverage data and analytics and also secure additional capacity.

While brokers’ expectations may shift year to year, the top underwriting agencies consistently strive to excel in the areas brokers value most.

Data from IB’s Brokers on Underwriting Agencies survey reveals key trends in broker priorities for 2024, which the winning agencies have responded to, highlighting opportunities and challenges in areas such as niche and emerging risks, technology and responsiveness.

Among the findings compared to 2023’s survey are:

the ability to place niche and emerging risks rose in priority, reflecting brokers’ growing reliance on agencies for tailored and innovative solutions

technology and automation remain areas of significant potential, with brokers calling for streamlined quoting, binding and claims management processes

responsiveness and pricing, while still important, saw a slight dip in satisfaction

marketing support and broker compensation schemes continue to rank lowest, suggesting a need for agencies to more effectively address these long-standing concerns

Categories such as technical expertise, responsiveness and pricing saw a slight drop in broker satisfaction, underscoring areas where top underwriting agencies can gain ground and strengthen broker trust in an increasingly competitive marketplace.

Brokers’ ratings of underwriting agencies’ ability to place niche or emerging risks experienced a modest decline, pointing to a growing opportunity for these partners to better serve this market.

Similarly, a small decrease in broker satisfaction with technology and automation highlights the importance of leveraging advanced digital tools to improve efficiency and attract more broker business.

Declines across most categories show that competition is getting tougher, and brokers expect more than just the basics. Australia’s top underwriting agencies stand out by focusing on core areas such as technical expertise and product knowledge while bolstering their reputation and support for brokers.

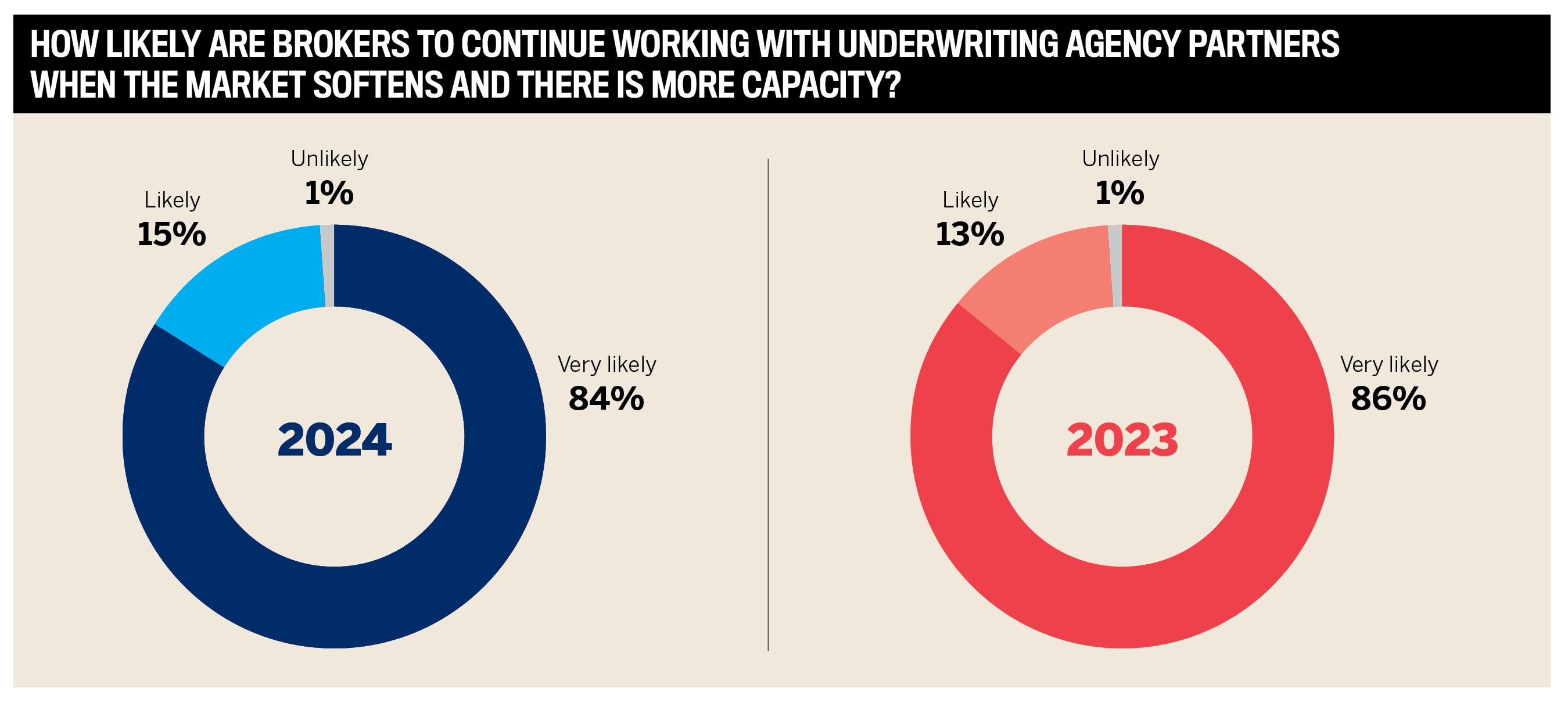

While a majority of brokers remain enthusiastic about working with their underwriting agency partners in 2024, the slight reduction in the “very likely” category and rise in the “likely” categories compared to 2023 could indicate a shift towards more cautious optimism, as brokers may be exploring other options and greater flexibility in serving their clients.

How underwriting agencies can improve and grow business with brokers

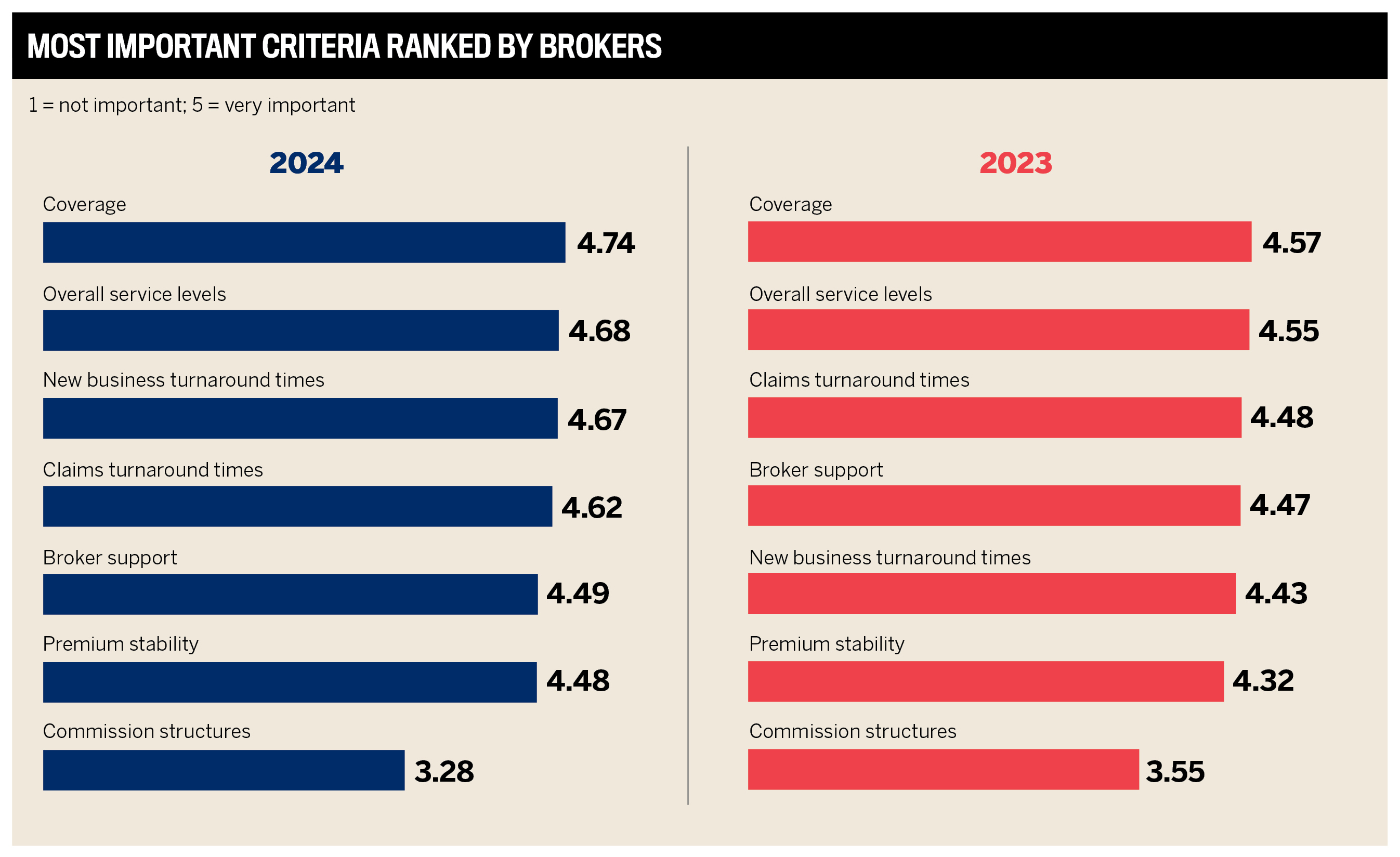

In 2024, brokers placed more importance on coverage, overall service and turnaround times for new business, showing they value underwriting agencies that offer a smooth process and high-quality service.

Those sentiments were evident in brokers’ top three picks for insurance products provided by an underwriting agency in the past 12 months:

AFA – Personal accident: “Great product, concise offering, competitive price, self-serve online portal and prompt responses from the underwriting team”

DUAL Australia – Professional indemnity: “Easy to transact and get a quote in minutes on their portal”

High Street Underwriting Agency – Public and products liability: “Easy-to-use system, a good broad appetite, knowledgeable underwriters and quick turnaround time”

Broker support slipped from fourth to fifth place despite a slight 0.60% rise in importance. Premium stability maintained its sixth-place position, but its increasing weight suggests brokers prioritise predictable pricing to build client trust.

Commission structures kept their last-place rank, with a notable 7.58% drop in importance, indicating brokers may be less focused on financial incentives and more attuned to factors that directly benefit their clients.

According to IB’s data, brokers’ top seven suggestions to underwriting agencies in Australia for retaining and growing their business include:

improve response times: “Faster turnaround on quotes, renewals and endorsements; aim to respond within 24 to 48 hours to ensure brokers remain competitive in securing business”

expand risk appetite: “Broaden appetite for niche, unique or hard-to-place risks and expand capacity in Northern Australia; improve clarity and updates on risk appetites and new product offerings”

enhance communication: “Increase direct communication via regular check-ins, visits and training sessions; ensure underwriters are available to discuss risks and respond to inquiries promptly”

invest in technology: “Improve online platforms for quoting, binding and policy documentation; create efficient digital systems, ensuring ease of use and minimal delays”

build strong relationships: “Maintain a human touch with personal outreach, direct support and relationship-building efforts; ensure knowledgeable underwriters are accessible for guidance and decision-making”

offer competitive pricing and coverage: “Focus on price stability and competitive premiums; provide broader coverage and fewer exclusions for complex risks”

optimise claims management: “Bring claims handling in-house to improve efficiency and customer satisfaction; offer proactive claims updates to brokers and clients”

The top-performing underwriting agencies strike a balance between agility and exceptional service, helping brokers serve their clients. This year’s winners are in the best position to retain and grow their share of broker business, as the following IB data suggests:

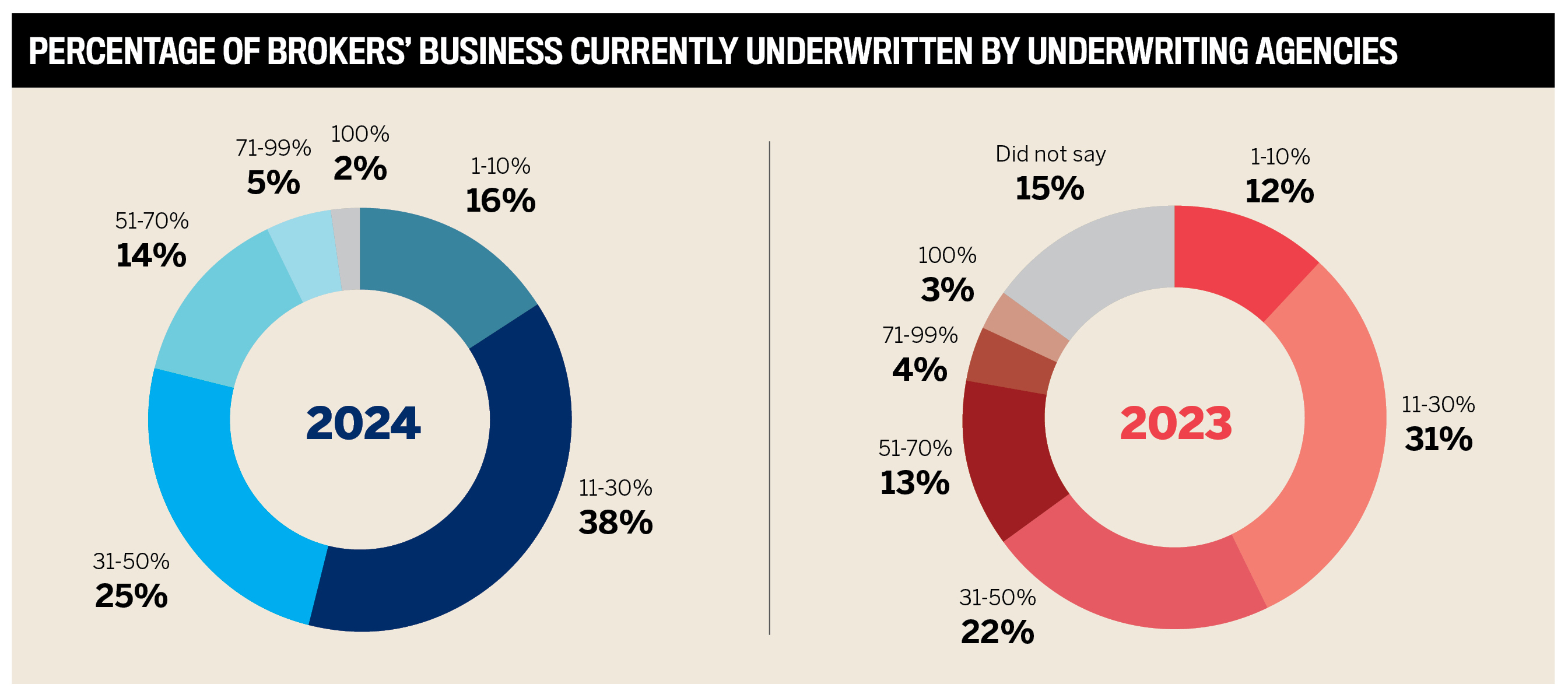

6.57% increase in the number of brokers who write 11-30% of their business with agencies, reflecting the largest growth segment in 2024 vs 2023

brokers relying heavily on agencies for 71-99% of their business has also increased, showcasing the top performers as trusted partners for high-volume business

slight decline in brokers giving 100% of their business to agencies underscores opportunities for the top performers to stand out and strengthen loyalty

brokers increasing placement of moderate business in the 31-50% category indicates the top agencies are excelling in areas such as coverage, service and turnaround times, factors brokers rated highly in 2024

In its search for the best underwriting agencies in Australia, Insurance Business surveyed 660 brokers, who ranked their top three agencies across 17 insurance types.

Brokers also commented on turnaround times, product ranges, pricing and the importance of key service aspects, such as commission structure, service levels and claims handling.

Based on this input, IB awarded gold, silver and bronze medals to the top three agencies in each category, as well as a Brokers’ Pick medal to the top three insurance products.

What’s driving Australia’s top underwriting agencies’ wins with brokers?

Over more than two decades, husband-and-wife duo Alan and Jan Whittle observed that the insurance industry, supposed to focus on caring for people, often lacked a personal touch. Determined to make a difference, they founded HSUA to bring that human touch back.

HSUA has expanded to a 40-plus-strong team, including their son, Blair Whittle, acting as CEO. With a dedicated in-house tech team, innovations and automation are implemented at lightning speed, allowing HSUA to stay at the forefront of changing trends and to free up brokers’ precious time.

“It’s essential our products are market-leading, especially with new entrants. We innovate and adapt our offerings to meet the highest client standards and expectations”

Blair WhittleHigh Street Underwriting Agency

“Our in-house tech team streamlines our ability to adapt to the constantly changing market,” acting CEO Whittle says. “We’ve also been fortunate to have been doing this for over 23 years, and our brokers know that we’ll be around for decades to come.”

HSUA continues to grow, and its reputation for exceptional customer service and innovation remains at the heart of everything it does.

Founded in 2003 by spouses Glenn and Peta Ross, the couple took a leap of faith in launching the business after discovering a need for a niche player in Australia’s construction sector.

One of the cornerstones of its success is the support and training it provides brokers to serve construction clients. What truly sets MECON apart from its competitors is its staff, who bring its thriving culture to life.

“Peter Drucker said culture eats strategy for breakfast, and while MECON has strategies, these are underpinned by our consistent and deep-seated culture that ensures engagement in goals and strategies are transparently shared across the company,” says executive general manager and co-founder Glenn Ross.

“That also ensures that our service ethic endures. If I had to sum up in a word the reason we won gold and enjoy broker praise and loyalty, that word would be culture.”

“MECON’s staff won this gold award because they make working here a pleasure. To a large extent, this radiates outwardly to our brokers, and that’s a big thing for us”

Glenn RossMECON Insurance

MECON has implemented several strategies to address the unique risks and challenges in Australia’s construction sector:

focusing on underwriting results to ensure the ongoing support of its carrier and longevity for its broad product coverage and continued product development

responding quickly to market changes with meaningful cover adjustments to meet client challenges, such as solutions for insuring vacated building works when construction companies have liquidated

extending the cover of its unique Cover Advantage endorsement and partnering with German-based insurance company ARAG to bring a construction-focused legal expenses insurance offering to clients

securing additional capacity to raise its in-house underwriting authority to $50 million in response to broker demand

“Collaboration with our brokers is our strongest suit; we rely on each other,” Ross adds. “We survey brokers yearly and donate to a charity based on response numbers, and broker feedback is vital in driving our focus for the year ahead.”

Ross notes that brokers’ views are carefully considered and can lead to bespoke training depending on the need and region.

“We can take a team and divide the brokerage into senior and junior levels, and we love doing that because we often come away with new ideas and understanding of the issues that brokers raise that we can actually work on,” he says.

Changes in the threat landscape haven’t solely driven the evolution of Emergence’s coverage.

It continues to provide comprehensive coverage for events such as ransom demands, cyberattacks, hacking and malware. However, over the last few years, the company’s focus has shifted towards addressing these events’ impact on their clients.

“This isn’t just about responding to cyber events, but ensuring insureds have comprehensive support before, during, and after an event,” chief operating officer Colin Pausey explains.

“Our strength lies in having the right people in place to provide person-to-person support, backed by advanced technology. It’s this balance that enables us to offer tailored, meaningful solutions to brokers and their clients”

Colin PauseyEmergence Insurance

Emergence’s approach includes:

in-house incident response team that operates under the mantra “every second counts”

direct, personal support during critical incidents, reducing clients’ stress and enabling quicker resolutions

Emergence has also expanded its award-winning cyber event protection policy to cover personal risks, such as those faced by directors or officers, through optional D&O covers, highlighting how it tailors coverage to meet clients’ current and emerging needs.

The cyber-focused company leverages sophisticated tools and analytics, but its approach is rooted in personal, human interaction.

“The combination is somewhat contradictory, but that’s precisely what makes our service effective,” says Pausey. “Our team is informed by cutting-edge tools but focused on holding the client’s hand during critical incidents.”

Inside Australian brokers’ picks of the leading underwriting agencies

HSUA’s 2024 medal achievements

Gold: Product liability and public liability

Silver: Directors and officers (D&O) and Hospitality

Bronze: Financial lines

Brokers’ Pick: Public and products liability

“Our motto is ‘Shockingly Human Service,’ so everything we do is with that in mind,” says Whittle. “We believe that even as a tech-led company, we’ve never shied away from picking up the phone and chatting with our brokers to get the full story and ensure our brokers get the absolute best coverage for themselves and their clients.”

Brokers noted that HSUA continues to go from strength to strength and praised its standout qualities:

“Great turnaround, and I can always speak with the underwriters”

“Plenty of experience and easy-to-use platform”

“Willing to cover difficult-to-place risks”

Whittle has spotted several trends in the current market, including rates that are holding steady and, in some cases, reducing.

“Our extensive experience and detailed data collection over the past 20-plus years enable us to accurately determine price adequacy for each risk, allowing us to adjust pricing strategically,” he remarks.

Staying ahead of the technological curve is also essential for Whittle.

The leading underwriting agency achieves this by leveraging advanced technology to enhance their processing efficiencies and reporting capabilities, ensuring it remains competitive and responsive to market demands.

MECON Insurance’s ninth consecutive medal

Gold: Construction

With a laser focus on the construction industry, the company keeps close tabs on developments, legislation and related initiatives. It shares that knowledge with brokers through an information-rich portal on its website, MECONpedia.

As a member of the Independent Construction Industry Rating Tool (iCRT), which assesses the trustworthiness and reliability of building and construction professionals, Ross keeps across the factors impacting contractors, including labour and material costs, supply chain issues and changing risks.

“We’re listening carefully to our brokers,” he says. “And we translate that into our market sector and the coverage initiatives that we come up with, including broker training, to keep our products and services competitive and relevant.”

Brokers praised MECON’s staff for their expertise and accessibility:

“Always knowledgeable and helpful with their coverage; willing to talk about deals and work with the broker to help place it, where possible. They also do some interesting risks that others won’t do”

“They pay claims in a fast and fair manner and know the industry well; their underwriters are approachable”

Emergence’s 2024 medal achievement

Gold: Cyber and information technology

The award-winning cyber insurance agency has earned recognition as a top brokers’ choice partner for their cyber business for many years.

That’s because, in addition to handling claims as they arise, Emergence also provides real-time, 24/7 risk management services as part of its smarter cyber solutions, as well as:

broker education and training, including anonymised, real-life claims stories

expert advice, tips and actionable insights so clients can improve their cybersecurity and prevent incidents

“Some of our competitors offer similar services, but we distinguish ourselves with comprehensive support that identifies issues early and helps clients take immediate action,” says Pausey.

“This approach combines an insurance offering with a service offering, which reflects where the more sophisticated players in the market are heading.”

Brokers lauded Emergence for its expertise and service, noting:

“They are best in class”

“The underwriter took the time to review and recommend the best product for the client. They offered informative training to our office”

“They stand out for coverage and additional, complimentary services for policyholders”

Accident and health

AFA

Gold

AHI Insurance

Silver

DUAL Australia

Bronze

Commercial motor

NTI

Gold

GT Insurance

Silver

360 Underwriting Solutions

Bronze

Construction

SURA Construction

Silver

ATC Insurance Solutions

Bronze

Construction (mobile plant and machinery)

Cyber and information technology

DUAL Australia

Silver

360 Underwriting Solutions

Bronze

Directors and officers

Professional Risk Underwriting

Bronze

Financial lines

Hospitality

Management liability

Marine

NTI

Gold

Allianz Marine & Transit

Silver

NM Insurance

Bronze

Not-for-profit

Community Underwriting Agency

Gold

DUAL Australia

Silver

ASR Underwriting Agencies

Bronze

Product liability

ASR Underwriting Agencies

Silver

Pen Underwriting

Bronze

Professional indemnity

Property

The Barn Underwriting Agency

Silver

GOAT Insurance

Bronze

Public liability

DUAL Australia

Silver

ASR Underwriting Agencies

Bronze

Strata cover

Strata Community Insurance

Silver

Travel

AFA

Gold

AHI Insurance

Silver

Brokers’ Pick

AFA

Personal accident

DUAL Australia

Professional indemnity