The Top Claims Insurers in Canada | 5-Star Claims

Jump to winners | Jump to methodology

Claims champions

Insurance Business Canada’s 5-Star claims insurers of 2024 have demonstrated remarkable resilience in the face of increasing natural disasters, talent shortages, supply chain disruptions, and rising claims costs.

The six top claims insurers have earned recognition as industry leaders by devising innovative solutions to swiftly navigate this ever-changing environment, raising the bar for excellence in the insurance sector.

IBC’s survey data was the result of collecting the views of hundreds of brokers on insurers they have worked with over the past 12 months.

The top five criteria brokers consider most important in the claims process are illustrated below:

Over 400 insurance professionals rated 19 notable nominees across various metrics, elevating the highest ranked to the 5-star podium.

The Insurance Bureau of Canada’s (IBC) Fact Book 2023 offered an informative look at the industry, with data revealing:

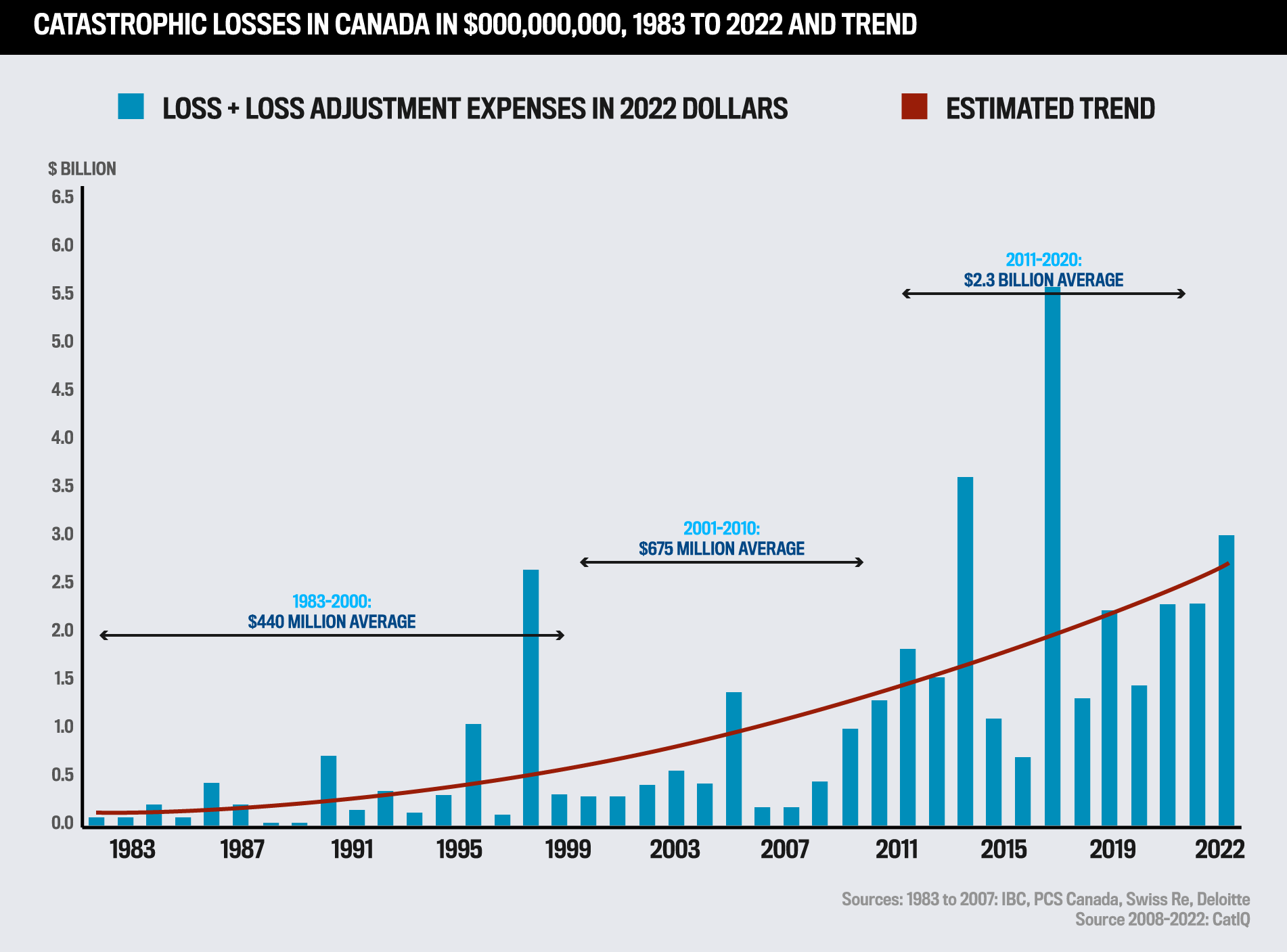

$3.1 billion in insured damages in 2023 – making it the fourth worst year for insured losses in Canadian history

196 – private P&C insurers actively compete in Canada

140,500 – number of Canadians employed by the P&C insurance industry in 2022

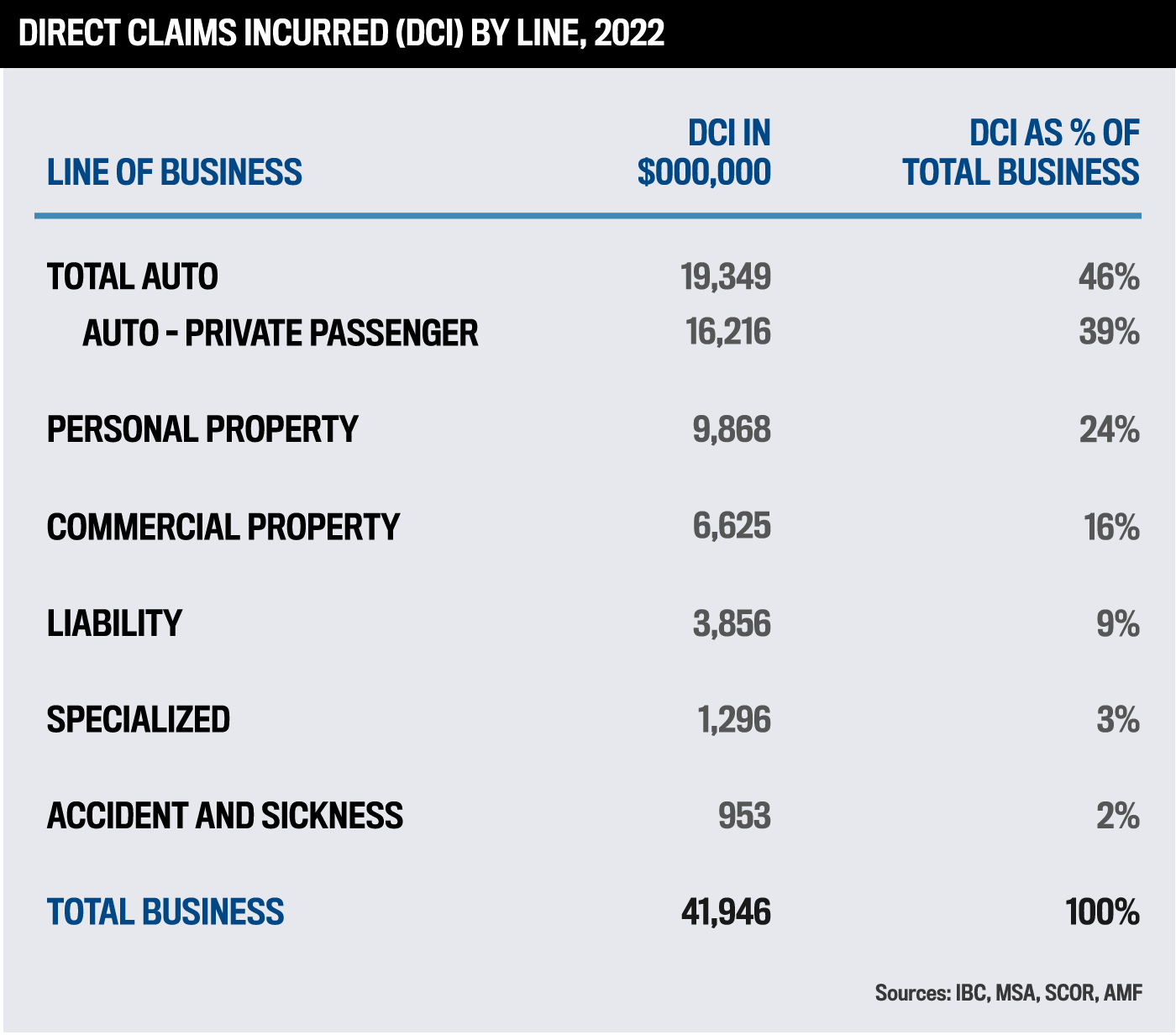

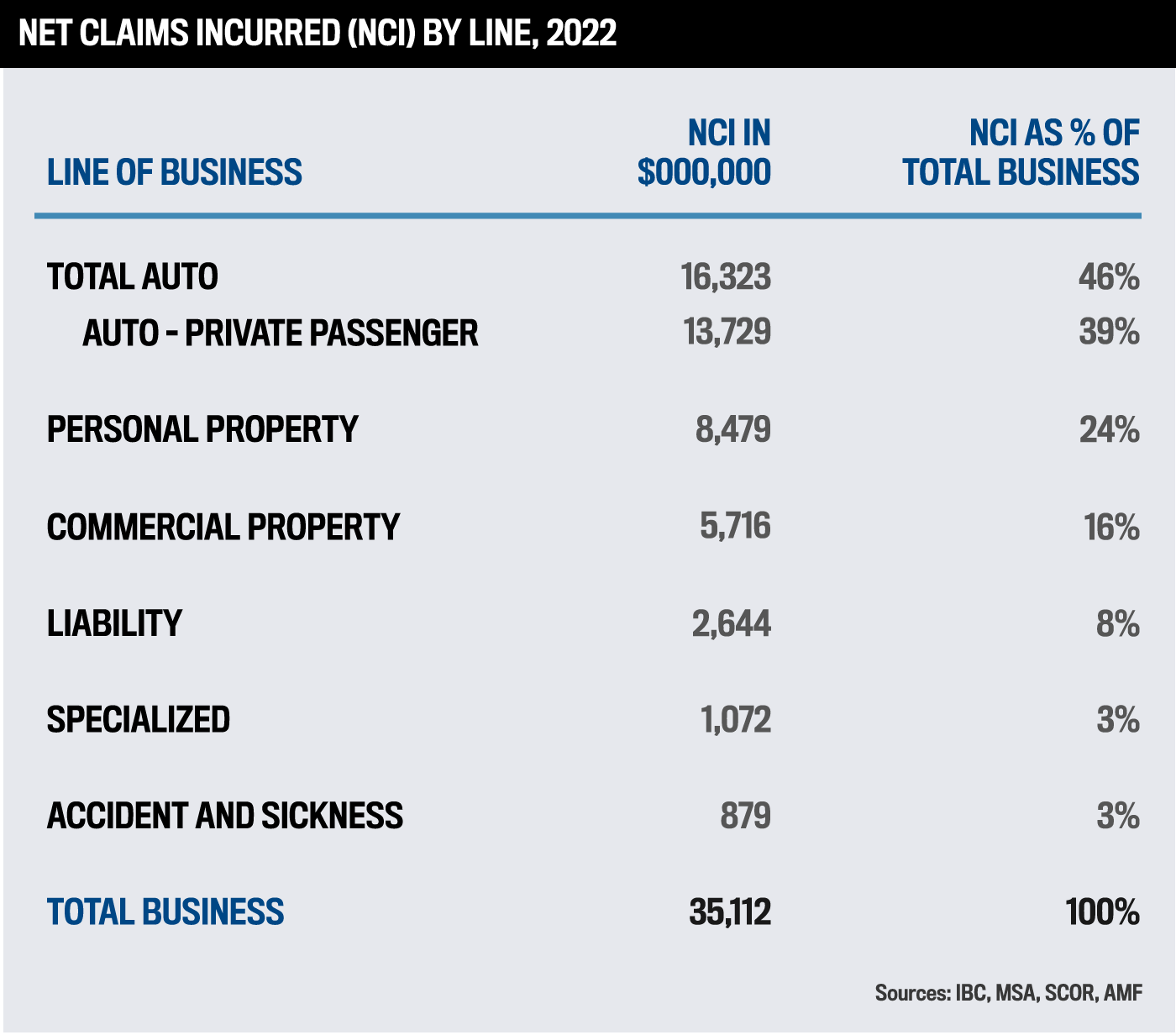

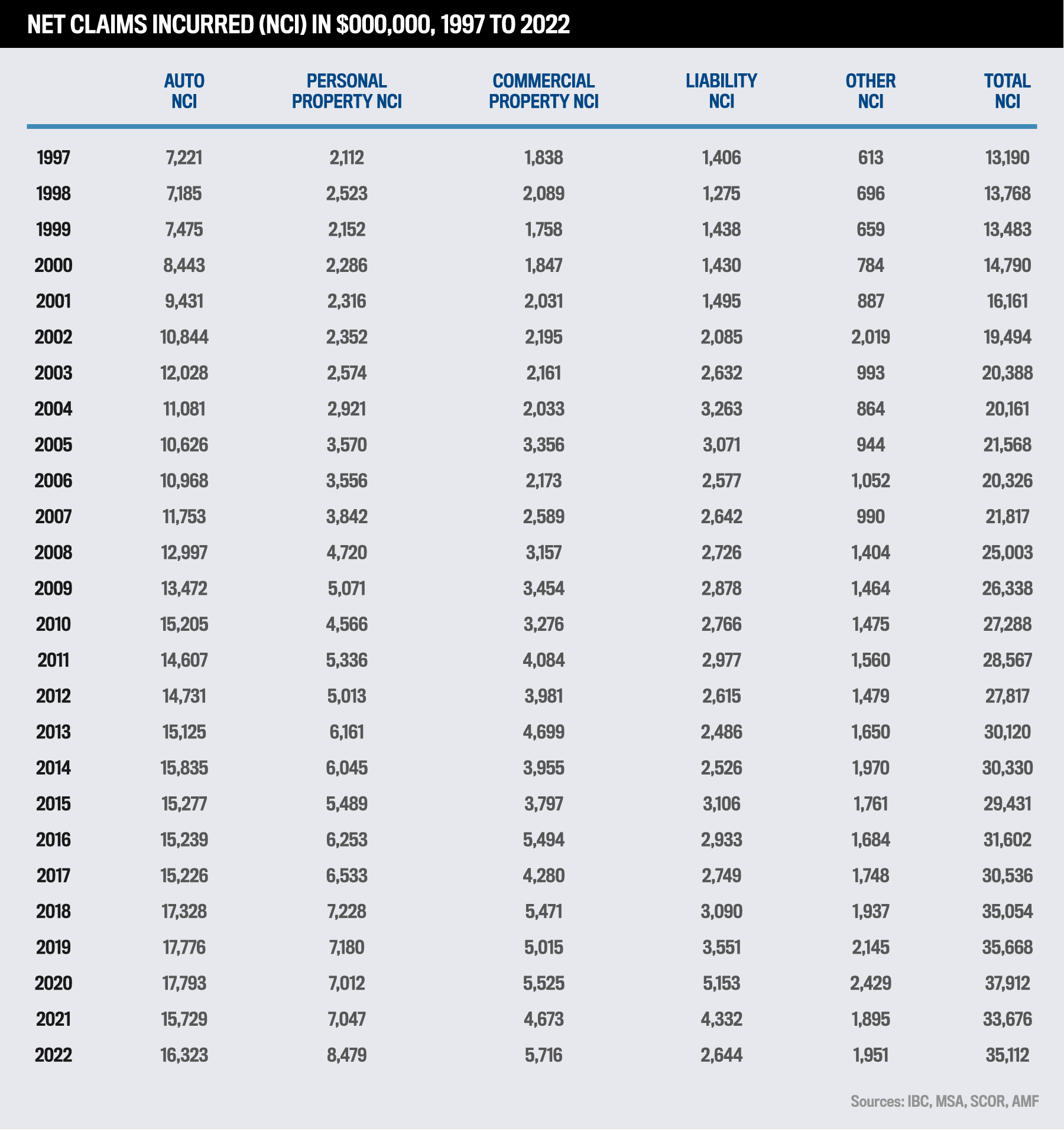

IBC’s data also showed the breakdown of claims (direct and net) across lines of business.

Claims leaders from two of the 5-Star award-winning insurance companies exemplify the highest standards of work quality, specialist expertise, and client service. These essential qualities significantly impact customers’ overall satisfaction and experience during the claims process.

Top claims insurers triumph over a year marked by challenges

The domestic claims environment continues to face a myriad of challenges. In the competition for talent, Arch has distinguished itself by implementing effective talent management and recruitment strategies.

These tactics include:

partnering with colleges and universities that offer insurance programs

seeking candidates outside the industry with transferable customer service skills and backgrounds

creating and nurturing a supportive, growth-oriented culture in which employees can thrive

“We have to be true promoters of the industry and all the exceptional career opportunities it offers,” says Elizabeth Bull, senior vice president for claims. “The landscape of who we are recruiting into the industry has changed, and we’ve had to adapt and be more innovative and concerted in our effort to attract the right talent.”

“We pride ourselves on treating all clients with their unique needs in mind, and we have adapted our claims service delivery model to support this approach”

Elizabeth BullArch Insurance Canada

Arch garnered its industry-leading status through the engagement and dedication of its people. The company has established an inclusive culture where employees’ input and opinions, technical acumen, and customer-centric claims handling approach are valued and highlighted as a competitive advantage.

“I believe we are known to be best-in-class by our broker partners and clients and for being solutions-oriented, customer-focused, and delivering on our promises,” Bull says.

Its reputation as a “small but mighty” organization continues to flourish, even as its entrepreneurial spirit has driven sustained growth. The company’s focus on prioritizing client and broker relationships well before a claim arises positions it to personalize the claims experience.

Severe weather events like wildfires and floods are occurring with heightened frequency across the country, and the top claims insurer’s readiness to act quickly sets them apart.

“We’re fortunate to be supported by our regional claims teams across Canada, and together with our national claims field team, we can mobilize and act within a moment’s notice to be on the scene when one of these events takes place,” says Jon Medel, vice president of claims experience and quality.

He recalls a specific instance during wildfires in Western Canada when Northbridge’s field team was waiting at the perimeter of the catastrophe zone for the authorities to let them in to assist customers.

Driven by its purpose to help Canadian businesses have a safer and brighter future, Northbridge shines in its commitment by being there for its customers when unforeseen events happen.

“It’s all about delivering on the expectations customers have when they buy their insurance,” says Medel. “Our approach to claims is strategic, and the two key things we focus on are providing exceptional customer service and industry expertise.”

“Our Northbridge claims brand has an established reputation, and while we work with select external partners in resolving claims, we do not outsource our claims or customer relationships”

Jon MedelNorthbridge Insurance

Northbridge emphasizes the importance of hiring and developing a best-in-class team of in-house claims professionals who deliver optimal claims service through solid customer relationships, as well as:

fostering a culture of continuous improvement anchored by customer feedback, claims analysis, and staff input

executing an annual needs assessment to guide new and solutions-oriented strategies

Medel says, “Our philosophy is that we want to be the first in and first out, and our ability to execute sets us apart.”

5-Star claims winners redefine competitiveness in the insurance industry

The top claims insurers share an unwavering commitment to exceptional service, underpinned by a dynamic culture that encourages employees to reach their full potential.

Bull notes three principles that guide Arch’s outstanding service delivery:

Customer-oriented approach: “We believe in building responsive, trusting, and collaborative relationships, especially with our broker partners and their clients. We aspire to understand clients’ businesses and unique needs and are committed to listening to the ‘voice of the customer’ to improve our claims service delivery.”

Claims expertise: “Our team’s technical acumen is best in class. We encourage and support all industry accreditation programs and continuing education available. We utilize our partners to develop and deliver a timely continuing educational series.”

Responsive and timely communication: “We view speed across every phase of the claim’s lifecycle, from FNOL to claim settlement, as essential to meeting broker and customer needs. We pride ourselves on listening to customers to meet their unique needs and drive our continuous improvement ethos.”

Medel emphasizes that Northbridge’s unique value proposition is grounded in its collaborative culture and dedication to creating meaningful employee experiences. Maintaining a family atmosphere with a claims team that has grown to over 300 within the company’s 1,800 employees nationwide is a testament to its top-tier status.

“We’re a people-first company, and because of that, I think our culture shines through during our customer interactions and claims process,” he says.

These elements also strengthen its overall approach to claims:

Commitment to lifelong learning: “There’s always something new coming along, and teaching the technical aspect of claims handling is relatively easy. It isn’t easy to teach someone without a customer-focused outlook, but we’re fortunate that our claims team represents the best of our unique blend of customer service and technical skills. It’s a winning combination.”

Northbridge Centre for Claims Excellence: “We ensure we select the right candidates with the right cultural fit and provide them with the support they need to succeed. We now have over 50 courses in our education program, and we pride ourselves on the ongoing education and training we have developed.”

Technology boosts the claims process and client satisfaction

The dedicated claims business delivery and innovation team at Northbridge ensures a continuously improved claims user experience, focusing mainly on adjusters and others involved in delivering service to customers.

“By enabling our frontline claims professionals with the best tools possible to do their jobs easier, better, and faster, we know it will pay dividends in improved customer outcomes,” says Medel.

Northbridge achieves this by:

identifying and improving its core claims system and seeking opportunities for integrations with carefully selected vendor partners

leveraging cutting-edge technology to accurately scope damage to things such as a flooded basement full of contents

actively developing AI solutions to streamline the claims process

Arch is currently undergoing a claims transformation driven by new and emerging technologies. It expects to roll out its new claims system in 2025 for its US operations, with Canada to follow in later phases.

In preparation, the company has conducted an in-depth review of current processes and procedures, updating them where required.

“We have also become much more focused on data analytics and predictive analytics, allowing us to better understand our claim outcomes, loss costs, and service deliverables,” says Bull.

Allianz

Unica

Chubb

Economical