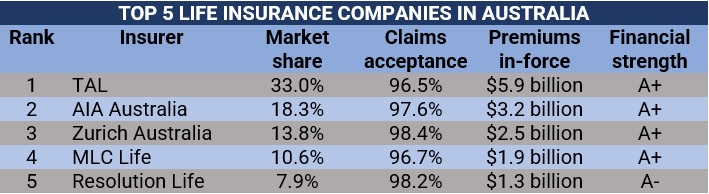

The top 5 life insurance companies in Australia

1. TAL Life Limited

Market share: 33%

Claims acceptance rate: 96.5%

Premiums in-force: $5.9 billion

Financial strength rating: A+

Head office location: Sydney, NSW

TAL is a subsidiary of the Japanese insurance giant Dai-ichi Life, which completed the acquisition of the company in 2011. It was formerly known as Tower Australia. The insurer provides life insurance policies through the following brands:

TAL: The company’s flagship brand offering life insurance policies to more than 4.5 million Australians.

Asteron Life: A brand it acquired from Suncorp in 2019. TAL subsequently discontinued new sales under the brand while maintaining existing policies.

BT Life: TAL completed the acquisition of the brand from Westpac in August 2022, upping its client base to 4.8 million. It then closed BT Life to new business, while continuing the management of existing plans.

One of TAL’s most popular life insurance plans is called Accelerated Protection, which has the following key features:

Death benefit: Pays out the sum insured after the policyholder dies

Terminal illness benefit: Early payment of benefit if the policyholder becomes terminally ill

Advanced payment benefit: Advanced payment of benefit capped at $25,000 as soon as proof of the policyholder’s death (medical or death certificate) is received

Repatriation benefit: Advanced payment of benefit capped at $35,000 if the policyholder dies while travelling abroad

2. AIA Australia Limited

Market share: 18.3%

Claims acceptance rate: 97.6%

Premiums in-force: $3.2 billion

Financial strength rating: A+

Head office location: Sydney, NSW

AIA Australia is a subsidiary of Hong Kong-based AIA Group – the largest pan-Asian life insurance group and among the largest insurance companies in the world. AIA began its Australian operations in 1972.

AIA Australia is also the company behind the CommInsure brand, which it acquired in 2019. It has since ceased issuance of new policies under the brand but continues to service existing life insurance plans.

Among AIA’s life insurance offerings in the country is the Priority Protection Life Cover, which has the following features and benefits:

Death benefit: Pays out a lump sum equal to the sum insured once the policyholder dies

Terminal illness: Pays out the sum insured if the policyholder is diagnosed with a terminal illness

Final expenses: Pays out 10% of the sum insured capped at $25,000 while AIA assesses the death claim

Complimentary family final expenses: Pays for the lower of $20,000 or 10% of the sum insured if a child of the policyholder aged two to 17 dies or is diagnosed with a terminal illness

Guaranteed future insurability: Allows the policyholder to raise the sum insured for important personal or business events before the age of 55, without providing further proof of health or insurability

Benefit indexation: Automatically raises the sum insured at the policy anniversary by whichever is higher of the Consumer Price Index increase and 5%, and adjusts premiums accordingly

Premium freeze: Allows the policyholder to keep their premiums the same for the succeeding year by decreasing the sum insured amount

Premium and cover pause benefit: Allows the policyholder to pause premium payments and cover for a period of three, six, or 12 months in certain situations

Financial planning reimbursement: Pays up to $3,000 to reimburse financial planning advice obtained within 12 months of a claim payment

Complimentary interim accidental death cover: Pays out a lump sum in case of accidental death while the application is being evaluated, up to 90 days from the date of the signed application

Accommodation benefit: Reimburses the accommodation costs incurred by immediate family members while the policyholder is confined more than 100km from their home, capped at $250 per day for up to 30 days

Counselling benefit: Covers $200 for each session of grief counselling for the policyholder or immediate family member capped at $1,200 per life insured

Apart from life insurance, AIA offers health insurance plans, as well as a health and wellbeing program that rewards healthy lifestyle called AIA Vitality.

3. Zurich Australia Limited

Market share: 13.8%

Claims acceptance rate: 98.4%

Premiums in-force: $2.5 billion

Financial strength rating: A+

Head office location: North Sydney, NSW

Zurich is the Australian subsidiary of Swiss industry giant Zurich Group. It entered the country’s insurance market through the acquisition of the Commonwealth General Assurance Corporation in 1961. In 2016, Zurich announced the purchase of Macquarie Life and subsequently rebranded Macquarie plans as Zurich life insurance policies. A year later a deal to acquire ANZ Bank’s life insurance arm OnePath was announced. The transaction was completed in 2019 and Zurich has since continued to sell life insurance policies under the OnePath brand.

The Wealth Protection Death Cover, Zurich’s flagship life insurance policy has the following features:

Death & terminal illness benefit: Pays out a lump sum upon the policyholder’s death or diagnosis of a terminal illness

Advancement for funeral expenses: Gives an advanced payment of $15,000 for funeral expenses

Accidental injury benefit: Gives an early payment of a portion or the entire death benefit if the policyholder suffers certain accidental injury

Future insurability business benefit: Allows policyholders to increase cover without underwriting if certain business events occur

Inflation protection: Increases cover every year even without health assessment, unless the policyholder declines

Future insurability: Increases cover without underwriting after certain life events

Accommodation expenses: Reimburses some travel and accommodation expenses for an immediate family member who travels more than 100km from home to care for the policyholder if they are bed-ridden and require full-time assistance

Financial planning advice: Reimburses the cost of advice following a claim payment, capped at $3,000, with the benefit increasing to $6,000 if death cover has been in place for at least five years

Interim cover: Puts some accident cover in place as soon as cover is applied for

Zurich is just one of two among the top five life insurance companies in Australia to register a claims acceptance rate above the national average of 97.7%.

4. MLC Limited

Market share: 10.6%

Claims acceptance rate: 96.7%

Premiums in-force: $1.9 billion

Financial strength rating: A+

Head office location: North Sydney, NSW

MLC is jointly owned by Japanese insurance giant Nippon Life – which has an 80% stake – and the National Australia Bank (NAB) – which owns the rest.

Customers can access the MLC Insurance Life Cover that includes these features:

Best doctors service: Provides access to leading medical practitioners across the globe

Accidental injury benefit: Pays out a lump sum if the policyholder is injured due to an accident and this leads to total and permanent loss of hands, feet, and eyes within six months

Advanced death benefit: Pays out a $20,000 benefit from the life cover lump sum to help loved ones pay for the policyholder’s funeral expenses

Financial planning benefit: Reimburses a portion of the costs charged by a qualified financial adviser, if the lump sum benefit paid is $100,000 or more

5. Resolution Life Australasia

Market share: 7.9%

Claims acceptance rate: 98.2%

Premiums in-force: $1.3 billion

Financial strength rating: A-

Head office location: Sydney, NSW

Resolution Life, a UK-based specialist manager of in-force legacy insurance businesses, acquired the life insurance unit of ASX-listed AMP Life in 2018. However, Resolution has ceased the issuance of new AMP policies at the end of January 2019, although existing AMP policyholders are still able to manage and add to their policies.

In 2022, Resolution Life completed a significant separation milestone from AMP by acquiring the remaining 19.13% of its equity interest in Resolution Life Australasia. The deal was first announced in November 2021.

Still, Resolution Life controls almost 8% of the market and has the second-highest claims acceptance rates among the top five life insurance companies in Australia.

Methodology for ranking the top Australian life insurance companies

Our latest rankings of the top five insurance companies in Australia are based on the latest market share data from APRA and premiums in-force figures from Plan for Life, Actuaries & Researchers (PFL Research).

Claims statistics, meanwhile, are for death cover purchased with the help of insurance brokers and financial advisers calculated using an online tool from the Australian Securities & Investments Commission’s (ASIC) consumer channel MoneySmart. Lastly, financial strength ratings were taken from Standard & Poor’s (S&P).

Here’s a summary of the top five life insurance companies in Australia.

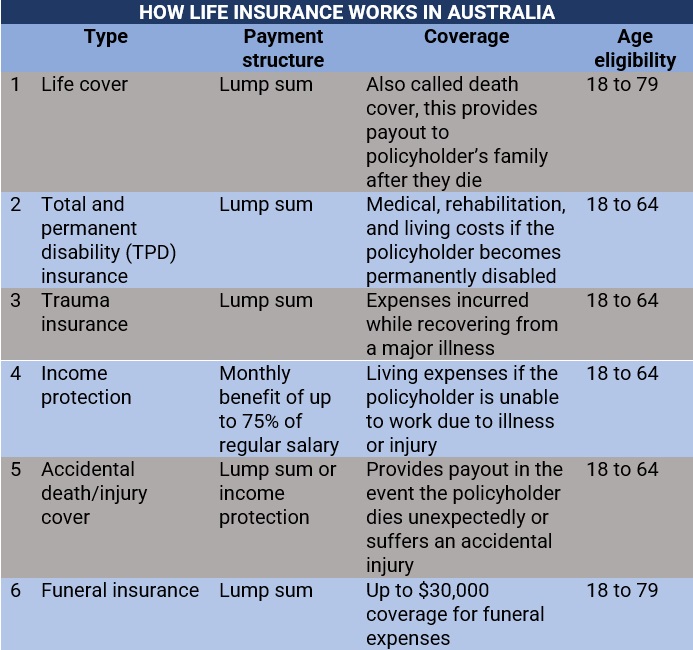

Life insurance is designed to provide a financial safety net should the policyholder die, get seriously ill, or become disabled. It pays out a lump sum payment that families can use to pay off loans and debts, as well as provide them with the financial means to meet daily living expenses.

In Australia, life insurance plans are classified into six categories, with each offering different levels of protection from varying situations. How these types of policies work is summed up in the table below:

Each person comes with a different set of circumstances, so it is difficult to provide a one-size-fits-all average of the cost of life insurance policies in Australia. Typically, life insurance premiums depend on a range of factors that determine how likely a person will make a claim. These include:

A person’s age

Medical history

Smoking status

General health condition

Level of cover

Policy features

Premium structure

To work out how much coverage you require, experts recommend that you carefully assess your lifestyle and financial responsibilities. Among the factors you need to consider are your:

Income

Outstanding debts

Living expenses

Total assets

Number of dependents

Coverage period

Premiums are also calculated differently depending on the type of policy. If you want to learn more about how this insurance component works, our comprehensive guide on insurance premiums can help.

How can you find the top life insurance companies in Australia?

If you want to find the top life insurance companies in Australia that offer policies that best matches your need, an experienced insurance agent or broker can help get the job done. You can also check out our Best Insurance Australia page, where you can link up with dependable and trusted insurance specialists across the country.

On this page, we feature only the insurance companies that are nominated by their peers and vetted by our panel of industry experts as respectable market leaders. These insurers can provide you and your loved one with the best coverage during the times you need it the most.

Have you taken out a policy from the top five life insurance companies in Australia? How was your experience? Share your story in the comment box below.