The number one insurance brand in America is…

The number one insurance brand in America is… | Insurance Business America

Insurance News

The number one insurance brand in America is…

Which insurance brands come to mind when Americans go shopping for a policy? Find out where the industry’s biggest names rank in this article

Insurance News

By

Mark Rosanes

Which insurance brands are Americans most likely to consider when taking out coverage? These are what global market research and data analytics company YouGov has revealed in its latest annual US insurance rankings.

In this article, Insurance Business lists the top industry names “most considered” by American consumers based on the London-based firm’s latest reports. The company used in-depth surveys and proprietary metrics to determine which insurance brands buyers prefer in two key segments – home & auto and health insurance.

To give you a more industry-wide perspective, we also compiled the rankings of the top insurers based on “fame” and “popularity,” according to YouGov’s data. Find out if your insurer made the list in this article.

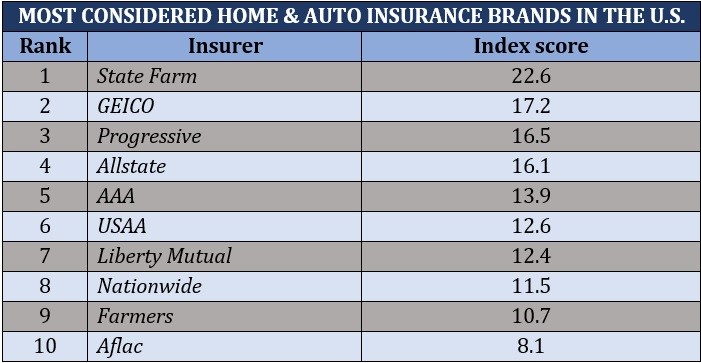

YouGov surveyed around 25,000 consumers and analyzed brand health and audience intelligence data to come up with an index score indicating insurance brand consideration among US consumers. These are the 10 biggest names on the annual report’s list.

1. State Farm

Index score: 22.6

Previous ranking: 1st

State Farm is the most considered home and auto insurance brand for the second year in a row. And why not? The mutual insurer is known for offering competitive rates and consistently scoring above the industry average when it comes to customer satisfaction. According to the survey, State Farm is the top brand Americans consider when actively shopping for a better deal.

2. GEICO

Index score: 17.2

Previous ranking: 2nd

Berkshire Hathaway-subsidiary GEICO retains the number two spot in the latest rankings. It is one of the most popular car insurance brands in the country, thanks to its robust offerings and above-industry-average customer satisfaction ratings. And, of course, who hasn’t heard of Gecko – the company’s adorable mascot, which continues to be the most recognizable aspect of the insurer’s commercials.

Mascots have played a huge role in helping insurance companies build brand recognition. Find out which ones American consumers can relate to the most in our list of the top 10 insurance mascots of all time.

3. Progressive

Index rating: 16.5

Previous ranking: 4th

Progressive climbed a notch from last year’s rankings. The company is among the top insurance brands homeowners are switching to, according to the survey. Home and auto policyholders benefit from the insurer’s nationwide accessibility, robust product offerings, and plenty of discount options.

4. Allstate

Index rating: 16.1

Previous ranking: 3rd

Edged out from third place by Progressive, Allstate remains one of the top brands that insurance buyers are considering. It boasts about 16 million policyholders and 175 million policies in-force across the country. These are mostly under the commercial, home, and auto insurance segments. Allstate distributes products through its network of 12,300 agents.

5. AAA

Index rating: 13.9

Previous ranking: 5th

American Automobile Association, also known as AAA, is a federation of motor clubs across North America. It operates as a non-profit group and provides insurance policies and other services exclusively to members. The myriad of perks and discounts the association offers make membership worthwhile.

6. USAA

Index rating: 12.6

Previous ranking: 6th

Another membership-only insurer, USAA offers a range of insurance policies to members of the armed forces, as well as veterans, reservists, and their families. Still, it is among the largest auto and home insurers in the country. USAA is known for its competitive rates and excellent customer service.

Liberty Mutual specializes in property and casualty risks. Customers are drawn to its flexible pricing, which is often customized to suit different profiles. Liberty Mutual insurance policies are available in around 900 locations across the country and distributed through its network of 2,200 exclusive agents.

8. Nationwide

Index rating: 11.5

Previous ranking: 9th

Nationwide rises one spot from the previous rankings. The insurance brand’s portfolio includes auto, motorcycle, homeowners, renters, farm, and commercial insurance. It also offers a range of financial services. A 25,000-strong workforce makes up the company’s operations.

9. Farmers

Index rating: 10.7

Previous ranking: 8th

Farmers serves more than 10 million policyholders and has around 19 million policies in-force in all 50 states and the District of Columbia. It also ranks in the top five insurance brands clients choose when switching home and auto insurance providers. Farmers’ products are distributed through its network of over 48,000 captive and independent agents.

10. Aflac

Index rating: 8.1

Previous ranking: 10th

Aflac is a supplemental health insurance provider that also offers home and auto policies. The Georgia-based insurer serves 40 million policyholders through its subsidiaries in the US and Japan. The company also consistently ranks in the top 10 insurance brands customers are considering when shopping for a better deal.

Methodology for identifying the top 10 most considered home and auto insurance brands

YouGov conducted the survey between January 1 and December 31, 2022 and compared the results with those from the previous year to identify trends. The firm then connected its findings with each insurer’s brand health data through BrandIndex, a proprietary technology that tracks 16 metrics, including customer satisfaction, ad awareness, and quality.

The company also analyzed audience intelligence data, which allowed it to measure consumers’ changing attitudes towards these insurance brands.

Here’s a summary of the top 10 home and auto insurance brands that American buyers consider when shopping for coverage.

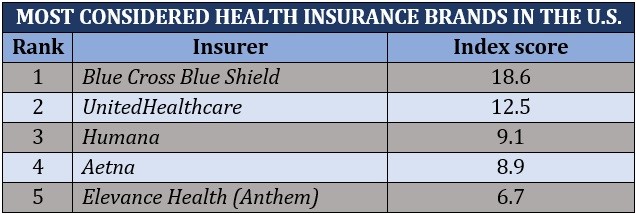

For this list, YouGov polled hundreds of thousands of respondents to identify the health insurance brands Americans aged 26 and older consider the most when shopping for coverage. Here are the top five insurers that made the annual list.

1. Blue Cross Blue Shield

Index rating: 18.6

Change in annual score: +0.2

Blue Cross Blue Shield Association is a federation of 34 independent companies that cater to more than 115 million policyholders worldwide. Its clients include around 17 million unionized workers, retirees, and their families. The association also has a federal employee program, which has around 5.6 million members. This figure accounts for more than half of all US federal employees, making BCBSA the world’s largest single health plan group.

2. United Healthcare

Index rating: 12.5

Change in annual score: +0.8

UnitedHealthcare not just ranks among the most considered health insurance brands in the US, it is also the largest insurance company in the world. It offers healthcare coverage and other benefits through the UnitedHealthcare brand and tech-enabled health services via Optum. The company boasts a network of more than 1.3 million healthcare professionals and 6,500 medical facilities.

3. Humana

Index rating: 9.1

Change in annual score: +0.7

Humana is a managed healthcare company that offers individuals, employer groups, and those looking for government-sponsored plans a range of affordable health insurance options. These include Medicaid and Medicare plans. The company also provides health and wellness products and services, as well as commercial medical plans and specialty healthcare benefits.

4. Aetna

Index rating: 8.9

Change in annual score: +0.6

Aetna is a managed healthcare company that offers a range of health insurance policies and related services to around 39 million clients in the US. It is a subsidiary of insurance giant CVS Health. Aetna boasts a network of more than 1.2 million healthcare professionals, 690,000 primary care doctors, and 5,700 hospitals.

5. Elevance Health

Index rating: 6.7

Change in annual score: +0.4

The company boasts a network of 1.7 million doctors and hospitals that serve more than 32 million clients. Elevance Health is the largest managed healthcare company in the Blue Cross Blue Shield Association.

Methodology for identifying the top five most considered health insurance brands

YouGov’s survey ran from December 1, 2021 to November 30, 2022, with the findings released just in time for the 2023 Open Enrolment. Just like the home and auto insurance brands list, the data analytics firm connected the poll results with health brand and audience intelligence data.

Here’s a summary of the top five health insurance brands most considered by Americans searching for coverage:

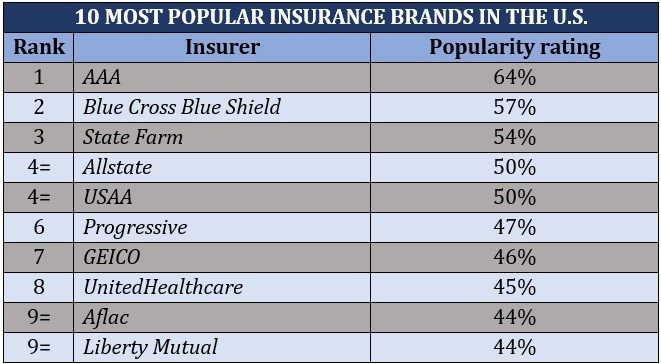

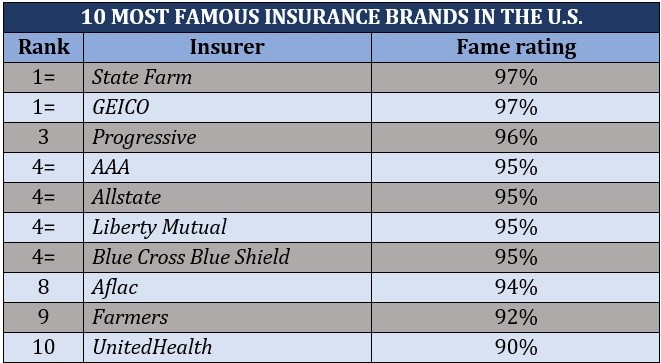

Apart from shopping consideration, YouGov measures brand awareness to track a company’s market performance. To do so, the data analytics firm uses two variables. These are:

Popularity: This is the percentage of buyers who have a positive opinion of an insurance brand.

Fame: This is the percentage of consumers who have heard of an insurance brand.

The tables below list the top 10 insurance brands based on popularity and fame, according to YouGov’s metrics.

Insurance companies often invest millions of dollars in producing TV commercials to boost brand recognition. If you want to find out which ads are among the best, you can check out our picks for the top insurance commercials of all time.

Utah-based experience management firm Qualtrics describes brand awareness as the “foundation to multiple brand equity models.” In layman’s terms, this means that a brand’s success relies heavily on the consumers’ attitudes towards it.

The company added that brand awareness brings several benefits that apply to all industries, including insurance:

It indicates growth: Brand awareness is the most common metric tracked by top-level executives because it often indicates a company’s progress. Generally, if awareness goes up, that is a sign that a business is achieving success and reaching its goals.

It keeps the brand on top of buyers’ minds: Brand awareness can evolve into brand consideration, which gets more people to buy a brand. Once this happens, a brand’s market share will likely increase as well.

It reflects the effectiveness of a company’s marketing campaigns: Improvements in brand awareness are a good indicator that a business’ marketing campaigns are resonating with their target audience. If there’s no improvement in brand awareness, it shows that a company’s marketing strategy needs to change.

If you want to get an idea of what an effective marketing campaign looks like, you can check out our choices for the best insurance ad campaigns.

What do you think about the top insurance brands on the list? Are there other brands that you feel should be included? Let us know in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!