The first $4bn+ cat bond month ever. Issuance running 38% ahead of record year

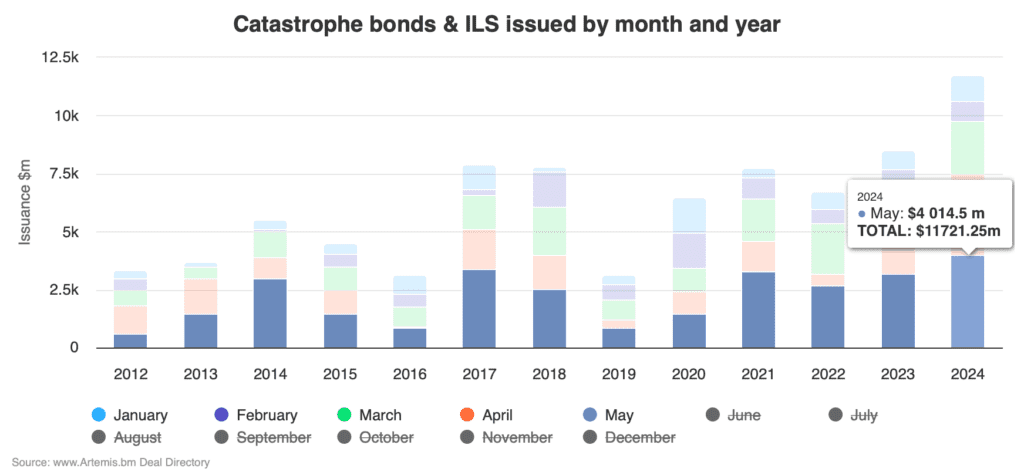

Today, Artemis’ data and charts on the catastrophe bond and related insurance-linked securities (ILS) market have been updated to accommodate the latest new Marlon deal and we’ve now cleared the $4 billion milestone for May 2024, while year-to-date issuance is tracking 38% ahead of the previous record for the first five months.

At $4.014 billion of catastrophe bonds issued and tracked by Artemis in May, it has become the biggest single month of issuance we’ve ever recorded and the first time any single month has surpassed $4 billion.

That’s notable on its own, but when you look at issuance for the first five months of 2024, it really drives home the record setting pace of activity we’ve been reporting on in the catastrophe bond market.

The chart below (available here in interactive form), shows catastrophe bond issuance by month and year and can be filtered to exclude, or include months:

The previous biggest month of new catastrophe bonds we’d ever recorded was December 2023, with almost $3.6 billion of issuance, before that was May 2017 with $3.4 billion.

May 2024 saw 14 new catastrophe bonds listed and settled in the Artemis Deal Directory, just one of which was private, a $25 million Eclipse Re (Dec 2023 saw a $100m Eclipse Re deal issued). That’s a record number of deals for any May we’ve tracked.

Meaning that, May 2024 is also the record single month of 144A catastrophe bond issuance as well, at nearly $3.99 billion.

Large deals did skew the months total issuance recorded in our Deal Directory somewhat, with two cat bond issues of over $1 billion, from Florida Citizens and State Farm.

There was a good deal of diversification on offer for investors in May 2024, with a mix of cat bond triggers, two parametric deals, three index-trigger deals, and the rest indemnity that we have trigger details on, while on perils we saw US nationwide multi-peril deals, Florida focused cat bonds, other regional US deals, one cyber cat bond, one Caribbean, and one featuring Mexican Pacific coast wind risk.

Perhaps more impressive than May’s total alone, is the new record level of cat bond issuance for the first five months of this year.

Artemis has now recorded just over $11.7 billion of newly settled cat bonds and private cat bonds in 2024 so far.

The previous record for the first five months was just over $8.5 billion, set last year, and before that almost $7.9 billion in 2017.

As a result, 2024 catastrophe bond issuance recorded by Artemis is now running 38% ahead of the prior year record by the end of May, which is a really impressive increase and bodes well for the full-year total also setting a new record.

With just over $430 million of new cat bonds still being marketed for a June settlement at this time, the half-year total is on course for a very strong record showing at above $12.1 billion so far, a figure that could rise by the time we get through the next month.

The previous first-half record, for Artemis’ cat bond Deal Directory was approximately $10.34 billion, set last year.

Which means, with over $11.7 billion issued and settled by the end of May, the catastrophe bond market has already broken the first-half record by 14% and with June’s currently marketed deals included, it indicates a new first-half record by more than 17% at this point in time.

All of which is helping to drive outstanding catastrophe bond market growth and even after a glut of recent maturities, our measure of the outstanding market remains above $49 billion today ($49.1bn), which is more than 9% up on the end of 2023 figure.

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.