The Best Insurance Professionals Under 40 in the USA | Rising Stars

Jump to winners | Jump to methodology

Seizing their chance

The best young insurance professionals are on the precipice of opportunity as they navigate an industry facing a series of challenges such as a shortage of skilled workers, an aging workforce, rapid technological advancement, regulatory changes, and shifting customer preferences.

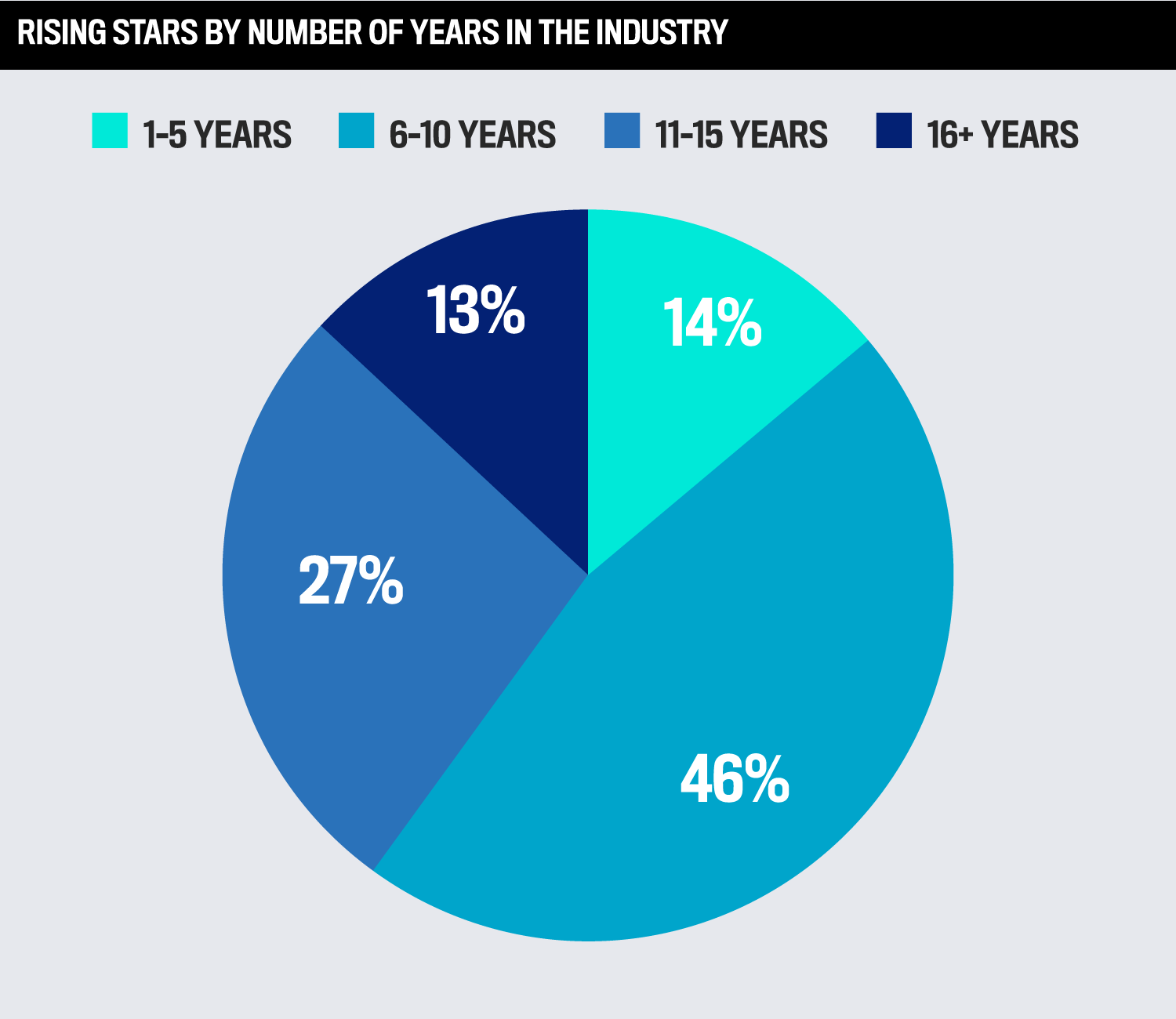

Data from the US Bureau of Labor Statistics shows that around 400,000 people will leave the workforce through attrition by 2026 and that it will be challenging to fill these gaps, as less than 25 percent of the industry are under 35. In addition, the industry is expected to lose 50 percent of its workforce to retirement by 2028.

This will open doors for the leaders of tomorrow to step up and cement their place in the industry, with Insurance Business America’s Rising Stars of 2024 at the forefront of this advancement.

Gail Audibert, industry expert and president of Audibert Associates, underlines the potential rewards.

“The insurance industry has an aging population, but it’s very dynamic. The number of people going to leave is massive, and there’s not that many people who’ve entered the industry. So, anybody who’s new or early in a career, there’s going to be such a groundswell of position people moving up, there’s going to be an incredible opportunity.”

And she adds, “Insurance touches every city, state, town, community in the world, and you have to have insurance. In most cases, prices go up and down in soft and hard markets but it’s a very stable industry and dates back to the Code of Hammurabi, 1750 BC.”

But only those professionals who can go beyond insurance and appreciate the human connection will succeed. That’s the verdict of IBA’s independent judging panel of industry experts for 2024’s Rising Stars:

Kim Gore of HUB International

Victoria Learned-Fenty of Big I (Independent Insurance Agents & Brokers of America)

Pamela Wheeler of NFP

Denise Campbell of Marsh

Aaisha Hamid of Alliant Insurance Services

Randi Kasongo of Travelers and the National African American Insurance Association – Los Angeles

“The winners really elevated in that they had a curiosity to learn. Many of them talked about how they continue their career development, their interest in things, not only just insurance, but things that are ancillary and really make a difference to the industry,” explains Gore. “It was great to see that they wanted to continue to learn. They were really invested in the industry and all things that touched it, and they understood that people are the most important thing we deal with, and those relationships have to be built.”

Nominees had to be 40 or under (as of October 1, 2024) and committed to a career in insurance with a clear passion. Their current role, key achievements, career goals, and contributions towards shaping the industry were analyzed, with recommendations from managers and senior industry professionals considered.

For Campbell, the key for the Rising Stars is to capitalize on chances to prove themselves, regardless of whether they are in reinsurance, claims management, or acting as brokers or providers.

“Each one of these roles will have unique perspectives and challenges that may or may not be greater than yesterday. Challenges are nothing but opportunities when met with the right attitude,” she says.

Going to the top

Kasongo, another member of the judging panel, feels the time is perfect for IBA’s Rising Stars to become major players.

“More leaders are recognizing that young professionals bring fresh ideas and new perspectives to established industries, making room for meaningful contributions at the table. This should inspire young professionals to continue striving to be their best selves.”

This drive is why Brown & Riding’s Grayson Lamb keeps aspiring higher.

“I still don’t feel like I’m where I need to be long-term, but becoming a shareholder in the company at the end of 2023 was a major milestone for me,” he says. “I try to pitch and sell against the gray-haired broker, especially with the market turn in 2022 and 2023 when they could sell a deal to an MGA with one policy for $50–$70 million capacity, whereas I’ve cut my teeth on shared layering accounts with up to five to seven carriers.”

Focusing on real estate has enabled Lamb to excel.

“I know that when a potential deal comes in, I have best-in-class market knowledge and expertise to get it over the line.”

Similarly showcasing a powerful desire to reach the top is Katelijne van Drongelen of Arch Insurance Group. Over the past 12 months, she helped launch an automated submission intake platform, with 75 percent of business projected to run it by the end of 2024.

“The standardization and digitization of data is incredibly important in the commercial space, because we’re getting requests for quotes and requests in 500 different formats with varying layers,” she comments.

“We’ve built a platform that automates the process from a data extraction perspective and provides a cue to the operations team to address anything that falls out of the automated submission intake process. It’s had a huge impact on our business.”

While for Brooke Leadbetter at Amwins, the challenge was carving out a place as a young woman in a male-dominated industry.

“I was in my early 20s going into rooms where I’d be the only woman with 20–30 men, to pitch ideas. At first, I was intimidated, but then I used it as my superpower and leaned into it.”

From there, the sky has been the limit as she has tripled her book of business due to her drive and determination.

“It was a lot of getting out and meeting new retailers, and not necessarily cold calling, but warm calling. However, cross-selling is a big reason. Someone may have a relationship in Salt Lake City or Seattle and I had to figure out how we can get into those shops and grow the Amwins brand.”

A smart move is to align with those already established and learn from them, which is something Natalie Yuen of the Arch Insurance Group did to build her reputation.

“It’s about knowing the opportunities that are available to you and proving yourself that you can progress. Whether it’s the business or operational side, you need strong supporters, and a big hurdle can be finding these people.”

In the first five years of her career, Yuen learned the trade before opportunities began to present themselves.

“You start getting brought into meetings and people seek you out for advice. Then, it clicks that you are doing things right. I wanted to be a property broker, and then I went into casualty, and switched from more client-facing to market-facing,” she reveals.

Yuen believes there can be biases against young professionals, particularly early in their career.

“We’re still at a stage where gray hair is valued. However, the moment you can articulate your value proposition to someone, it doesn’t matter what age, gender, or ethnicity you are. I want to continue to evolve and be part of the future of insurance.”

How the Best Insurance Professionals Under 40 made their mark

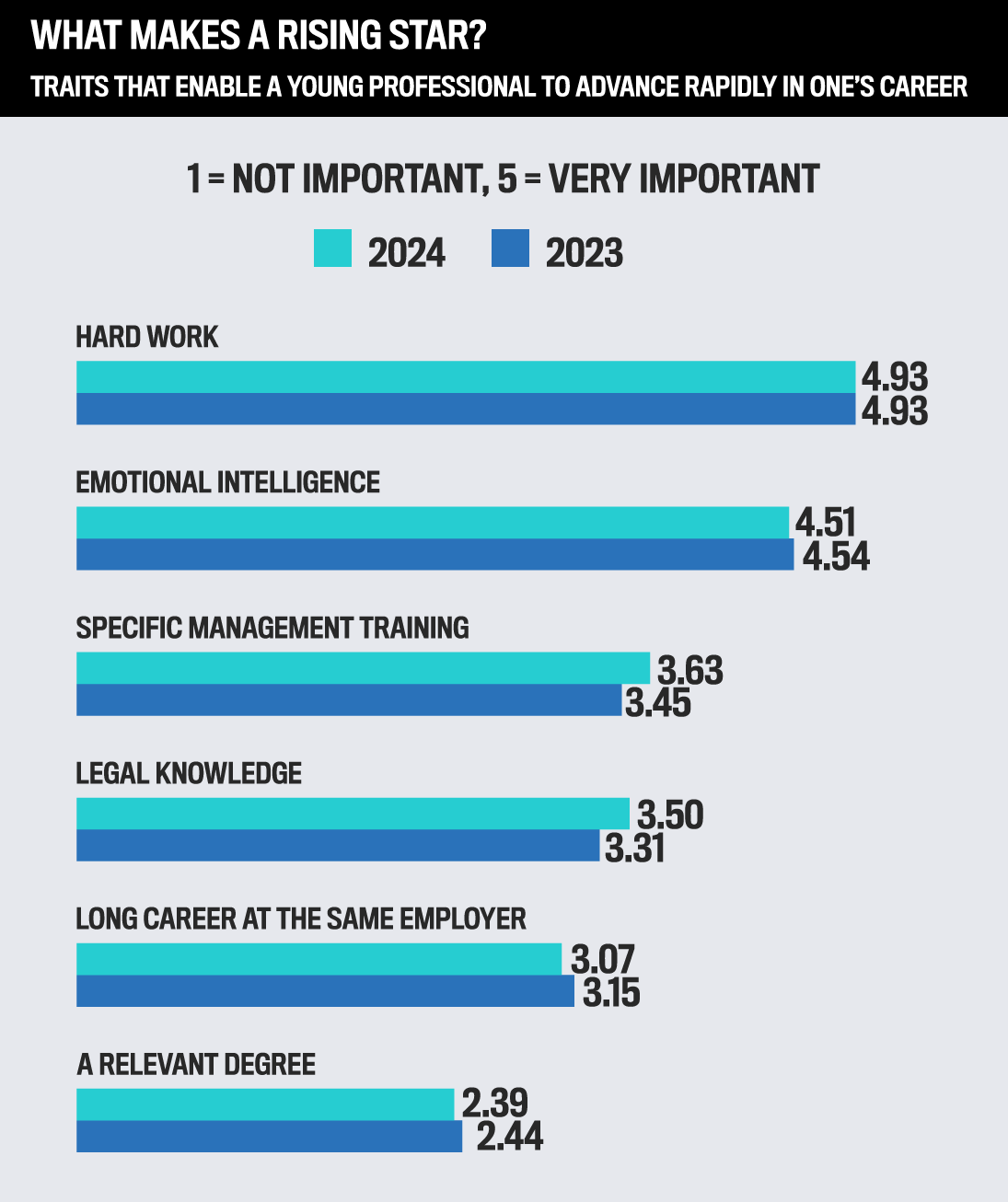

Nominees were asked to outline the most important facets that generate career rapid advancement. Compared to 2023, the same top three skills were hard work, emotional intelligence, and specific management training with a relevant degree being last.

This underlines that the Rising Stars are succeeding due to their ability to think laterally and connect with their clients.

Matt Domitrovich – Amwins

Location: Chicago, IL

Age: 39

Successfully leading a production team that surpassed $5 million in revenue in 2024 has marked him out.

“Most of the people have worked with me for the last 5-10 years and to go from 0 to over $5 million with 100 percent organic growth is a significant achievement. Taking the easy way out is never a key to success. We have the best team in the industry,” says Domitrovich.

“I don’t know if there’s ever been a better time to be a young person in the industry. If you’re an underwriter, employers only care about your ability to write profitable business. If you can prove that, you’re going to be a rockstar.”

David Lê – Aspen Insurance Group

Location: New York, NY

Age: 26

Assistant vice president of US distribution and marketing, co-chair of the Gender and Inclusion Network and member of the DE&I committee, Lê is also an executive national board member at the Asian American Insurance Network (AAIN).

“I like talking, so I wanted to balance that with my creativity, and that’s how I went into marketing,” he says.

Growing up in the Bronx in an immigrant family, Lê prides himself on a hardworking mentality. He supports strategic engagement backed by data with key insurance trading partners, while also driving initiatives aimed at elevating Aspen’s brand presence via advertising and graphic design, curated events, and e-marketing.

Grayson Lamb – Brown & Riding

Location: Dallas, TX

Age: 31

Working his way from production assistant to principal and senior vice president, Lamb values collaboration.

He says, “I recently went to Cincinnati and Columbus to meet potential new clients and some that we have on our books already. When I came back, I ensured our team was up to speed with our clients’ needs.”

A hardworking mindset is at the forefront of Lamb’s ethos.

“What we’re doing in the wholesale space is entrepreneurial. You’ve got to go out and grab it. There is no one pushing you, but it’s about having that drive to grow your book of business.”

Katelijne van Drongelen – Arch Insurance Group

Location: Raleigh, NC

Age: 39

As vice president of software engineering in the property domain, she leads two teams of 80 engineers to develop property intake clearance, underwriting and claim solutions.

She initially found it tough in a traditionally male dominated sector.

“Some of it was overcoming my own insecurities about being in a place where I didn’t really see a lot of people that look like me, especially in leadership positions. I developed confidence over time, entering in a room when you know you’re able to deliver projects successfully builds considerable confidence,” she says.

Van Drongelen’s ability to build relationships and innovate are key.

“What I bring to the table is transformation and that gets people’s attention. No insurance company wants to hear about how they’re going to catch up to the competition. They want what will make them different, because if you’re trying to catch up, you’re going in the wrong direction.”

Taylor Forst – Alliant Insurance Services

Location: San Francisco, CA

Age: 31

Specializing in liability insurance for the real estate industry, her primary responsibility is serving clients who own or manage apartment buildings and other habitational properties.

“I love building that rapport, and meeting people face to face. I try to be there when they need me and pay attention to detail,” he says.

Forst’s role involves assisting in procuring insurance coverage tailored to the specific needs and risks, via thorough assessments of their properties and analyzing potential liabilities.

“I like getting into the nitty-gritty of forms and coverage.”

Lorenzo Marini – ARI Financial Group

Location: Miami, FL

Age: 28

A qualified electrical engineer turned insurance professional, he designs tailored life insurance policies and builds strong relationships with high-net-worth individuals. Marini started when ARI used a third-party IT company and was supervising as a data analyst.

“I start suggesting changes to processes and the financial side of things. A year after joining, I was offered a job with an engineering firm, but I decided to stay with ARI because I was enjoying my work here,” reveals Marini.

From there, he’s become an expert at tailoring and designing policies, and is now a director.

“I care about my clients, I’m not transactional, and I bring a level of sophistication,” he says.

Brooke Leadbetter – Amwins

Location: Scottsdale, AZ

Age: 30

An expert in the builder’s risk subcategory of property and insurance, the senior vice president manages a production team and has seen her book of business grow from $25 million to $73 million in premium over the past four years.

“I got the opportunity to take over a small book of business in Portland, and I moved there for a brief period of time, and it’s continued to grow. When I started, there were two people on the team and now we have seven.”

She continues, “It’s about being young and hungry, because if you lose that enthusiasm, you can get complacent. People recognize that and want to work with people who are eager to help them win.”

Shadi Jalali – Alliant Insurance Services

Location: San Francisco, CA

Age: 34

A licensed property and casualty insurance producer working with entities such as the Port of Seattle, California State University, University of California, and the City of San Jose.

“My biggest achievement has been becoming a commissioned producer with my own book of business,” she says.

Adopting a strategic mindset has been crucial.

“It’s a people-based job. It’s incredibly important to partner with the right carriers and clients. With over a decade in the industry, I have those relationships in place, and it makes my job much easier and a lot more fun.”

Patrick Goodwin – Arch Insurance Group

Location: New York, NY

Age: 36

A vice president and segment leader, he has regional management responsibilities in the northeast and southeast regions for the excess and surplus (E&S) casualty underwriting team. In the first six months of 2024, the E&S casualty team enjoyed a 20 percent increase in written premium, with half coming from regions that Goodwin directly manages.

He says, “I have a good understanding of where the company wants to take E&S casualty and where the market is moving. I’m tuned into our competitors – the business that they’re writing and watching their performance. That all plays into how I decide on strategy by noticing trends.”

Tyler Jensen – InsuraRisk University

Location: Ogden, UT

Age: 29

As founder and president of InsuraRisk University, he provides agents with the tools they need, such as motivational insights and personal development.

“I saw too many agents leave the industry within their first five years. I studied top producers across the US to understand what it takes to be a top performer,” he says. “I put together my own frameworks and a roadmap that agents can follow to run a successful business within the insurance space, where clients want to stay because of the culture they’ve built.”

Jamie Behymer – Independent Insurance Agents & Brokers of America

Location: Alexandria, VA

Age: 27

Only joining the industry in 2022, she has experienced a meteoric rise. As program manager, Behymer oversees multiple facets and including agent development, crafting, and implementing strategies to enhance agent performance and growth.

“I have the gift of the gab, but I also love to listen and learn more about others. That’s very important in my role as I’m not customer-facing. If something goes wrong, I’m able to think on my feet and come up with a plan B immediately,” she says.

Natalie Yuen – Arch Insurance Group

Location: San Francisco, CA

Age: 40

Leading business development for the company’s west region, she is responsible for driving each business unit’s growth strategy across 13 states.

“A lot of my role is merging that data with the people aspect of the business, because that’s still what heavily drives insurance,” Yuen says.

She listens and engages with colleagues.

“It’s about staying curious, no matter what point of your career you are at. If you lose that, you become complacent.”

Katelynn Fellows – Risk Placement Services

Location: Woodstock, GA

Age: 29

As area assistant vice president, Fellows controls the placement of various commercial properties, including layered and shared programs, builder’s risk ground-up construction, and renovation projects.

She says, “Picking up the phone has helped me be successful. I find a lot of people in our industry don’t make calls and would rather send emails. It’s easier to build a relationship over the phone rather than hiding behind an email.”

In 2015, the year she joined, the team’s premium was $61 million. It has grown to $300 million by 2023.

“We deal with large excess-and-surplus lines, property accounts, for builders, risk construction, renovations, single payroll, earthquake and flood deals, all across the US. I aim to streamline our processes to help us become more efficient as a team,” Fellows says.

Albert Huang, RPLU

AVP, Underwriter

At-Bay

Alex Kahn

Assistant Vice President, Surety Claims

Skyward Specialty Insurance Group

Allyson Lundsford

AVP, Head of Partner Management

Nautilus Insurance Group

Amber Johnson

Associate Client Advisory, AVP

Marsh USA

Amy LaFond

Account Executive

The Buckner Company

Andrew McNeil

Senior Benefits Advisor

Arrow Benefits Group

Ashley Arikawa

Director of Marketing & Communications

Ori-gen

Ashley Engl

Business Development Manager

Jencap Specialty Insurance Services

Barb Habel

Vice President & Head of Excess Liability

Atain Insurance Companies

Brian Harmer

Vice President, Underwriting

Tangram Insurance Services

Brian Stone

Commercial Insurance Advisor

Leavitt United Insurance Services (Leavitt Group)

Brittany Sotomayor

Middle Market Broking Leader

Willis Towers Watson

Feada Kakish

Associate Broker

Aon

Camdon Turley

Licensed Sales Producer

Allstate: Katie Woods Insurance Agency

Catherine White

Director, Member Advocates

PURE Insurance

Cecil Varghese

Property Broker

Aon

Connor Bowen

Assistant Vice President

Mosaic Insurance

Courtney Maugé

Cyber Practice Leader

NFP, An Aon Company

Crystal Cathcart

Product Sales Executive

Verisk

Dalton DeFendis

Vice President

DiBuduo & DeFendis Insurance Brokers

Dylan Campbell

Casualty Broker

CRC Group

Elliot Bassett

President

Ellerbrock-Norris

Emma Woerner

Assistant Vice President, Cyber/E&O Broker

Willis Towers Watson

Emmanuel Delgado

Agency Owner and Commercial Insurance Agent

Delgado Insurance

Erica Weill

Sales Executive

Imperial PFS

Erich Schutz

Vice President, National Practice Leader Cannabis

Jencap Group

Erik Davis

Assistant Vice President

Kevin Davis Insurance Services

Erin Mitton

Production UW Supervisor

Great American Insurance, Environmental

Erin Rose Hainey

Underwriting Manager

Intact Insurance Group

Georgia Schelberger

Business Development Manager

Berkley Mid-Atlantic Insurance Group

Gregory Lyons

Partner

Elite Specialty & Wholesale Insurance Services

Hadassah Masudi Minga

Director of Business Performance Analytics

Travelers Insurance

Jatin Sharma

Founder, Managing Partner

Nardac, an Amwins Company

Jenna Silva

Systems Integration and Process Leader

C3 Risk & Insurance

Jennifer Kessel

Vice President of Operations

USG Insurance Services

Jesse Jorgensen

Client Executive

Marsh McLennan Agency

Jessica Waite

Client Advisor

C3 Risk & Insurance

Jonathan Wheat

Senior Vice President and Principal

EPIC Insurance Brokers & Consultants

Jordan Muckway

Commercial Lines Manager

Burns & Wilcox

Julianna Parvani

Account Executive

Fred C. Church, Assured Partners

Justin Jacobs

Executive Vice President, Marketing

IMA Financial Group

Kai Zwiebel

Marketing Manager

Cothrom Risk & Insurance Services

Karthikeyan Vaidyalingam

Global Head, Cloud and AI Security

MetLife Group

Kelley Carter

Vice President of Personal Lines

Choice Insurance Agency

Kelly Cervantes

Assistant Vice President, Western Region

Resilience

Kelly J. Winning

SVP, Underwriting Center Lead

Chubb

Kevin Fukuyama

President

Ori-gen

Khanh Le

Senior Underwriter

Professional Program Insurance Brokerage

Kristin Brown

Assistant Vice President of WC/P&C TPA

Davies

Kristin Hanson

AVP Account Executive

Aon

Kristina Marcigliano

Vice President

Risk Strategies

Lauren Loef

Lead Associate Broker, FINEX Cyber/E&O

Willis Towers Watson

Leanna Peppercorn

Senior Casualty Advisor

Marsh USA

Lilianne Padron

Senior Account Manager

Brown & Brown

Lindsay Cunney

Vice President, Global Client Executive

Chubb

Lindsay Nietfeld

Account Manager

Assured Partners of Oregon LLC

Logan Cheadle

National Practice Leader, Enrollment Strategy & Voluntary Benefits

IMA Financial Group

Lyndsey Jarvis

Director of Commercial Claims

Davies

Mariah Shields

Senior Benefits Consultant/Part Owner

Arrow Benefits Group

Maribel Barranco

Manufacturing Specialist, Commercial Underwriter, P&C Middle Market

Chubb

Marife Molina

EVP, Strategic Revenue

C3 Risk & Insurance

Marina Seddik-Rastetter

Service Representative

Amalgamated Life Insurance Company

Matthew C. Daley

Agent and Owner

The Daley Agency/American National Insurance Company

Maxwell Lin

Claims Advocate

C3 Risk & Insurance

Megan Easley

Senior Vice President, Contingent Risk

CAC Specialty

Michael Pistone

Program Manager

Ryan Specialty Transportation Underwriting Managers (RSTUM)

Michele Fredrikson

Senior Vice President, Casualty Broker

Brown & Brown

Mike Kinoshita

Executive Vice President

Aihara & Associates Insurance Services

Nadine Kuznetsova

Senior Account Manager

Worthy Insurance

Nina Rodriquez

Senior Property Underwriter, Western Region

Berkshire Hathaway Specialty Insurance

Paul Glover

Vice President

Woodruff Sawyer

Scott Tardif

Senior Production Underwriter

Great American Insurance Group, Environmental Division

Shaina Miller

Managing Director

Higginbotham

Shana Stodolski

Vice President, Cyber and Technology

Ambridge

Shantelle Cabir

Senior Vice President, Business Insurance Consultant

Newfront

Stephanie Ritz

Analytics Manager

Key Risk

Stephen Wallace

Vice President, Underwriting, Commercial Casualty

QBE North America

Tolga Tezel

Founder and CEO

Canopy Connect

Traci Hastings

Underwriting Manager

Markel Specialty

Walker McKenzie

Casualty Broker and AVP

CRC Group

Will Tschetter

Senior Vice President

INSUREtrust

William Curto

Underwriting Operations Supervisor

Tokio Marine HCC