The Best Insurance Companies for Construction in Canada | 5-Star Construction

Jump to winners | Jump to methodology

Building bridges

Insurance Business Canada’s 5-Star insurance companies for construction demonstrated exceptional adaptability in navigating the cyclical construction market.

In IB’s 2024 Brokers on Construction report, the research team surveyed hundreds of brokers nationwide to identify the crucial qualities they value in a construction insurer and asked them to rate the construction insurers they had worked with over the past 12 months.

Ziya Falcon, vice president at KASE Insurance, an award-winning specialty commercial brokerage in Toronto, shares his expert insight on what is expected of Canada’s best insurance construction companies in each of IBC’s 5-Star Construction criteria.

Coverage

“For contractors, it’s important to first and foremost satisfy all of their contractual insurance requirements. Beyond that, there are many aspects of insurance that contractors or their clients don’t typically consider, which can still impact them significantly. Depending on the contractor, they may benefit from having a pollution, Errors & Omissions or Directors & Officers policy.”

Claims payment/processing speed

“As cash flow is always vital to a contractor’s operations, a slow claim payout can put a strain on the relationship between all parties. This is why, when we recommend an insurer, we usually consider how timely the claim service has been.”

Underwriting experience

“If an underwriter doesn’t understand a risk, the usual inclination is to decline it. Underwriters with more experience in the construction field often work with our team to understand the risk better and uncover details that may make the risk more favourable to quote.”

Value for money

“Exclusions and warranties are often overlooked or misunderstood by inexperienced brokers. Limitations on coverage in the wording can be a very good indication of the value of an insurance policy. Since insurance is there to cover its policy holders for substantial losses that the insured wouldn’t otherwise be able to cover themselves, it’s very important that these factors are favourable to the insured during a claim.”

Access to risk mitigation partners

“Providing resources that help clients manage risk shows clients that they are working with experts that care about the insurance program and the overall safety of the insured’s operations. As contractors grow, having an insurer that actively assists in managing their risk profile can reduce the insured’s desire to market the policy with other insurers and develop longer relationships.”

Ability to create bespoke policies

“Not every insurance package meets the needs of our insureds, and we often need to customize our policies to maximize coverage and savings for the insured. It’s important that an insurer has the experience and capacity to build policies specific to a client’s operations.”

Service to brokers

“Timely responses, insight into policy coverages, and industry specializations help with the management of an insurance program. It’s important that we make the buying and servicing process as easy and painless as possible for the insured so that they can focus on what they do best.”

Online platform

“Broad appetite for operations, direct billing, and underwriting support are key features any broker looks for in an online portal. It’s also important to understand the underwriting flexibility the carrier has through their online products.”

The importance of IB’s best insurance companies for construction is set to grow with a ramp-up in demand, as shown by 74% of the respondent brokers expecting premiums to rise, which is 8% more than who answered the same in the 2023 survey.

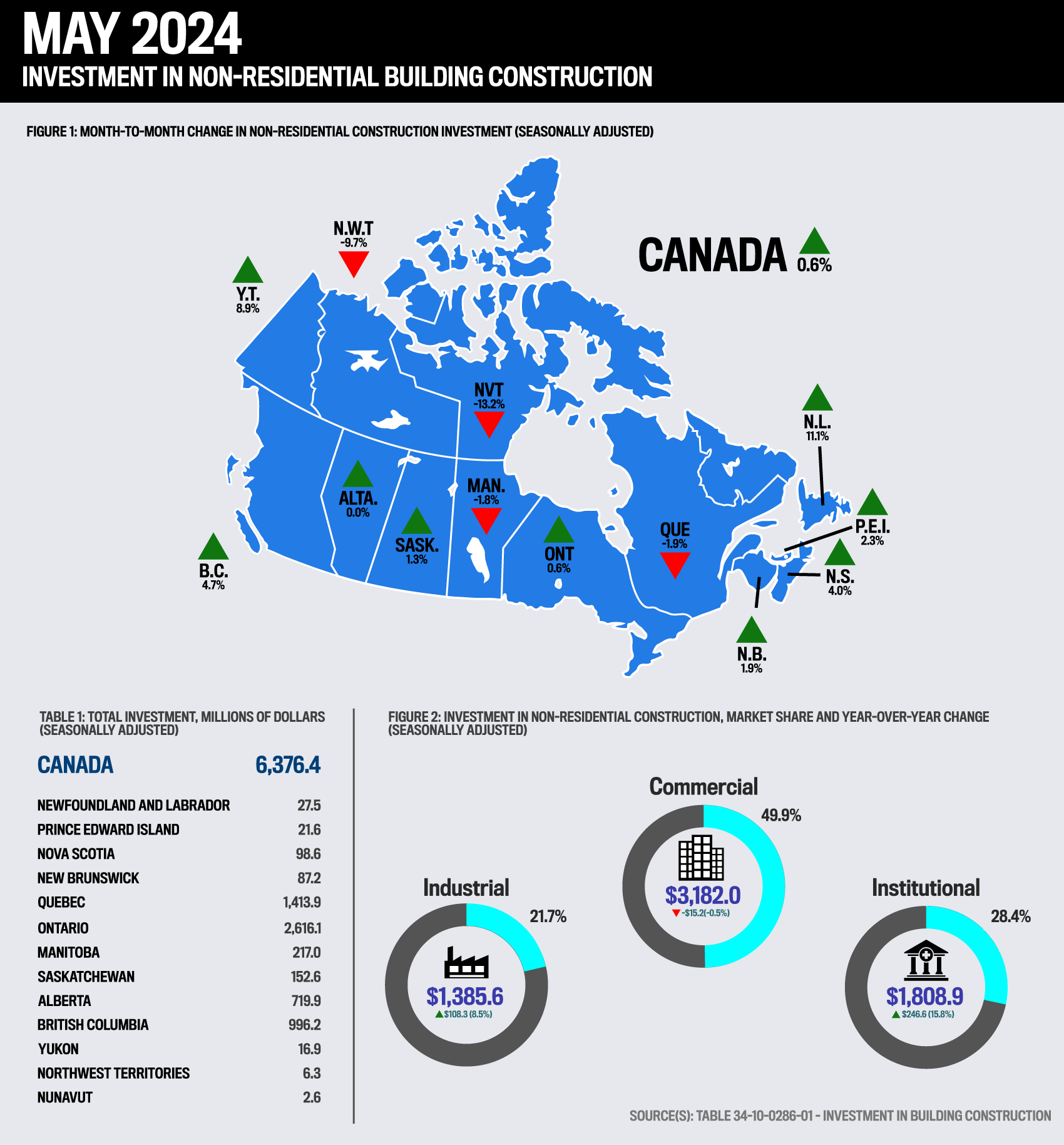

Industry data shows that for investment in non-residential building construction:

Industrial: Market share was 21.7%; total investment totaled $1,385.6 million, representing a year-over-year increase of 8.5% or $108.3 million.

Commercial: Market share was 49.9%; total investment totaled $3,182.0 million, representing a year-over-year decrease of 0.5% or $15.2 million.

Institutional: Market share was 28.4%; total investment totaled $1,808.9 million, representing a year-over-year increase of 15.8% or $246.6 million.

While for residential building construction across Canada:

Single homes: Market share was 32.1%; total investment totaled $1,974.1 million, representing a year-over-year decrease of 5.5% or $114.0 million.

Semi-detached homes: Market share was 3.3%; total investment totaled $205.5 million, representing a year-over-year increase of 20.7% or $35.3 million.

Row homes: Market share was 11.8%; total investment totaled $724.0 million, representing a year-over-year increase of 7.7% or $51.5 million.

Condos and rental apartments: Market share was 52.8%; total investment totaled $3,242.8 million, representing a year-over-year increase of 9.0% or $267.8 million.

Policies

In 2024, brokers place builder’s risk/course of construction, commercial general liability, and equipment insurance among their top priorities when placing insurance policies, which is consistent with IB’s data from last year.

However, environmental liability has risen to fourth place this year from sixth place, indicating a significant shift in broker recognition of environmental risks in construction insurance and a greater emphasis on the insurer’s ability to address and manage these risks.

Another similarity across both data sets was that workers’ compensation, auto liability, and cyber were the least prioritized by brokers.

Insurers

Coverage remained the most important consideration for brokers when selecting an insurance company. The next top reasons for service to brokers and underwriting experience swapped places between 2023 and 2024.

Similarly, the online platform remained the least important, with access to mitigation partners and ability to create bespoke policies rounding out the bottom three, but trading positions.

What’s driving broker satisfaction at the 5-Star Construction carriers?

Two of the top companies for construction insurance are delivering what brokers regard highly:

capacity

faster and more efficient service

competitive pricing

enhanced underwriting authority

clarity and consistency in policy language

product innovation

Cementing its status as a leading player by focusing on industry segmentation, the firm specifically dedicates teams at all levels to construction.

This organizational foundation ensures all departments, including underwriting, claims, and risk services, understand the industry’s needs, as well as those of customers and brokers.

The insurer’s commitment to ongoing education and industry knowledge gained through attending construction association events also keeps it at the forefront of developing essential solutions for its customers.

“Our approach enables us to provide high-quality products and services tailored to the needs of the industry,” says Adam Collier, underwriting director for Western Canada.

Brokers rated Northbridge’s performance high overall across eight time-tested metrics, reflecting a steady quality of work, specialist expertise, and client service.

Collier shares the factors underpinning brokers’ top scores in the top three categories, adding, “I’m thrilled to see the scores, in general, but particularly in these areas. We’re constantly looking at ways to ensure our products are broad and comprehensive.”

“Insurance is a promise; when the worst happens, we’ll be there to help. This is our biggest opportunity to truly demonstrate our commitment to our customers”

Adam CollierNorthbridge Insurance

Coverage

recent policy enhancements include improvements in cyber and pollution coverage

products are regularly updated to ensure protection against a wide range of potential threats

dedicated to coverage recognized as industry leading

Underwriting experience

Claims payment/processing speed

emphasize the importance of being there for customers during claims, especially in fast-moving construction scenarios

achieved speed due to streamlined processes and a commitment to quick and efficient service

24/7 dedicated claims team

“Insurance is a promise that we’re going to show up during the claim when the worst is happening to the customer, and we’re going to be there to help them,” Collier says. “We know how fast construction moves and that we need to move quickly, too.”

The strength of the dedicated construction team of underwriters and customer support, combined with strong in-house capacity on the delegated underwriting authority’s (DUA) side, has fueled Buildersure by Cansure’s rise to IB’s list of the best insurance companies in Canada for construction.

“Our 27-person team allows us to be quite service-oriented,” says Chris Pauli, senior vice president of construction for Buildersure, a construction underwriting team backed by i3 Underwriting and Cansure construction expertise. “We value repeat contractors and prioritize consistency with the carriers and brokers we deal with.”

Based on eight established metrics, brokers rated Cansure’s performance high overall, highlighting their consistent work quality, specialized expertise, and customer service.

While Pauli notes that it’s difficult to stand out with construction wording because of industry standardization, Cansure emphasizes a broad approach to meet customers’ unique needs.

“Especially in this ever-evolving market, we’re not hindered by a one-size-fits-all approach. If necessary, we can adjust and make changes as long as they’re reasonable,” he says.

“Developing and maintaining strong, ongoing relationships with key brokers is important to us, as their major concerns are the quality of our product and how quickly we can deliver it”

Chris PauliCansure

Coverage

high sub-limits on select items with flexibility in certain wordings

in-house policies for up to 36 months and up to $100 million TIV, with access to exclusive capacity

Underwriting experience

Broker service

responds quickly, particularly for cases that fit within its appetite under their DUA, allowing them to provide same-day services with ease

expert underwriters readily available to provide expertise on bespoke projects

5-Star construction carriers respond to ongoing challenges

The construction industry continues to battle many challenges, including supply chain disruptions, economic uncertainty, permitting and legislative changes, and a softening market that can be unsustainable.

Collier has heard repeatedly from his construction customers about the difficulty in attracting and retaining employees, particularly as industry veterans retire and the need for new skilled trade workers mounts.

“There’s been a lot of challenges, but we’re getting out there. Supporting boots on the ground and interacting with brokers and customers helps us understand what these needs are,” he says.

In 2024, Northbridge launched a construction bursary program in partnership with Nova Scotia Community College to support the development of new skilled professionals. Key elements of the program include ten $5,000 bursaries earmarked for Atlantic Canada.

Cansure’s Pauli adds that customers want enhanced coverage, and brokers are more aware of increased competition.

“There’s more capacity in the market, and we need to be able to pivot and make changes when necessary. We need to realize that it’s a cycle, and we’re in one of those downward cycles at the moment,” he explains. “This is where our access to exclusive capacity for construction provides us with our competitive edge and ability to deliver bespoke solutions.”

Rising to the ESG challenge

Both 5-Star Construction insurers acknowledge that environmental, social, and governance (ESG) is evolving. It’s an emerging issue highlighted by 65% of brokers in this year’s report, versus 66% in 2023.

As a Canadian-owned and operated company, Northbridge prioritizes the needs and beliefs of its customers by:

working to minimize climate impact in its operations

actively supporting customers in adapting to climate change risks

partnering with various organizations to help build resilient communities, including disaster relief

supporting the communities in which it operates to improve the overall quality of life through donations and volunteering

“About natural disasters, responding to these events gives us a unique opportunity to see the needs on the ground and provide financial or logistical support to help these communities operate again and help our customers minimize their downtime and disruption,” says Collier.

Buildersure by Cansure adopts a multi-pronged approach to ESG strategies that include:

commitment to becoming net zero by 2035

partnering with EcoClaim to roll out its Trax 2.0 software on claims, which tracks the amount of diverted waste from property claims

being the first MGA to partner with The Nature Force, an organization focused on building resilience in Canadian communities from the impacts of climate change

the construction team is diverse in representation across the board in terms of tenure, age, visible minorities, experience, and gender identification. Employees fully support each other directly and through its corporate employee resource group programs

Advancing construction insurance with tech and enhanced solutions

Northbridge leverages technology updates to deliver faster, better, and more tailored solutions, addressing clients’ unique business challenges.

The company also engages with customers and attends trade shows to stay informed about emerging technologies. This helps it support adopting and integrating technologies such as IoT water technology connectivity, ensuring safer and more efficient operations for customers.

Cansure has embarked on a major project to develop a new broker management system that will significantly enhance its efficiency at the back end. For example, brokers will benefit from the increased speed of policy issuance and quoting.

The top construction insurer has also enhanced its offerings on smaller risks for construction of $10 million or under via its digital product offering on the Buildersure by Cansure portal. Brokers can quote and bind ground-up course of construction policies 24/7 for up to $6 million in fire-resistive projects and up to $4 million in frame projects, while enjoying their most competitive rates and increased commission for brokers.

CNA

Intact

Premier Group

Starr

Totten

Zurich