Tackling the ever-challenging excess casualty market

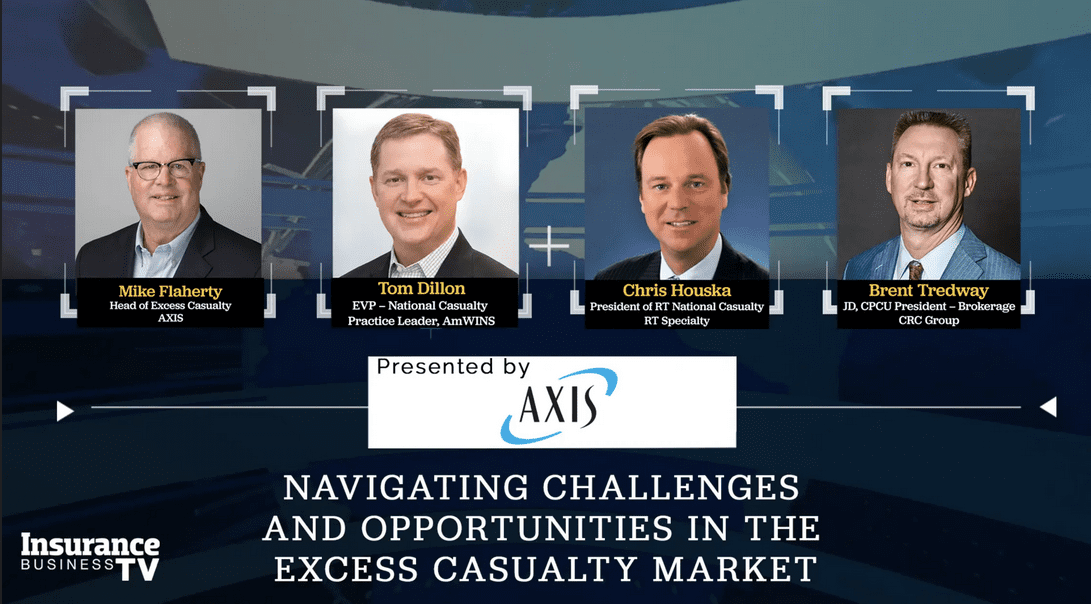

Bethan: [00:00:32] Hi everyone and welcome to Insurance Business TV. I’m Bethan Moorcraft, senior editor at Insurance Business, and this episode will focus on the excess casualty market. Now, this market is attracting new entrants and capacity is in high demand. But by its nature, the excess casualty market deals with specialized, often complex and hard to place risks. In recent years, the market has gone from firming to hard, and then it stabilized. In recent months. And as today’s panelists will explain, there are always ways for carriers and brokers to get solutions for their clients, even if it’s challenging. With that, I’m delighted to welcome today’s esteemed panel. We have Mike Flaherty, president and head of Excess Casualty at Axis.

Mike: [00:01:18] Thanks, Bethany. And thank you to our broker guest for joining us today.

Bethan: [00:01:23] Yes. We also have Tom Dillon, executive vice president and national cultural practice leader at AmWINS.

Tom: [00:01:30] Thank you, Bethan. Great to be here.

Bethan: [00:01:33] We’ve got Chris Houska, managing director of RT specialty and president of Casualty.

Chris: [00:01:39] Hello Bethan, Looking forward to talking about some insurance.

Bethan: [00:01:42] And we also have Brent Tredway, president of the brokerage division at CRC Group.

Brent: [00:01:48] Thank you, Bethan, and glad to be here.

Bethan: [00:01:51] Great. Well, it’s a pleasure to have you all on the show. Going to start with a big question. It’s one we always like to ask. So, Chris, I’m going to come to you first. How would you describe the current state ecxess casualty market?

Chris: [00:02:03] Quickest word is stable. We’ve talked about this for a while and in 2021, there is a lot of capacity that entered the market. But as we said, everybody was wondering where the capacity was going to be deployed. They’re now able to deploy it in late 21 and 22. That is through the getting the proper experience underwriters management in place. And with that deployment, I think in Q3, Q4, you’ll see a little more of those markets entering, but yet there’s so much more need for that capacity. The word stable comes to mind and healthy.

Bethan: [00:02:45] Thanks, Chris. Tom, do you agree with that sort of analysis of stability?

Tom: [00:02:50] Yes, I agree that the new capacity in the marketplace has made a difference. But but I also believe that the traditional capacity that’s been around for quite some time made some major changes in 2019 to the capacity in which they were willing to deploy and individual deals to the attachment point in which they in which they place the business or which they wish they sat. And that rate has stabilized over the past 3 to 6 months. And I continue to see that moving forward.

Bethan: [00:03:25] Excellent. Thanks, Tom. And Brent, what’s your assessment of the current marketplace?

Brent: [00:03:29] I think the new entrants have helped definitely fill some voids in capacity. But I also think that the incumbent markets, the markets that have been around for a long time, have gone through a period of re underwriting their books, reducing capacity, as Tom and Chris mentioned, getting rates. And so what I hear often from a lot of carriers is that they like their books of business and they don’t want to lose the book that they currently have. So I think that they’re I think it’s a healthy marketplace, and I do think it’s a stable marketplace for the most part.

Bethan: [00:04:00] That’s great. Mike, from the carrier side, what are you seeing?

Mike: [00:04:03] Well, I would agree with our panelists that we’re in a healthy market and we are in a market that’s definitely showing stability. As we’ve worked through 2017, 18 and 19, we’ve seen firming firm to even hard market conditions, whereas now as new capacity has deployed, we’re seeing more stability. Yet still a very, very healthy market for excess casualty. Business limits or moderated pricing is strong and times are good. It’s a good time to write business. I would caution everyone to to beware that behind all of this, lurking lurking behind the scenes as we re-emerge from COVID is the courts are reopening. Severity loss continues to drive through the market. Nuclear verdicts continue to affect the market and certainly claims escalation and inflation, all those things are still there. So I’m not quite sure that we’re at the plateau and now it’s a downward spiral into a soft market. It might not look that way going forward, I think. There’s more questions to be answered yet.

Tom: [00:05:24] Mike. I agree with that 100%. I think what this past market shift has proven to us is that you and Axis and our other carrier partners have the ability to really make quick decisions and then turn on a dime. And when they see markets heading in a certain direction, I think the correction in 2019 was pretty swift and needed. And now that things have settled down a little bit, I think you all have proven that you have the ability to make similar decisions in the future. So should things go in the direction to which you referred? That’s always a good possibility.

Bethan: [00:06:03] Interesting. And Mike, picking on something that you just said, so you describe the market as firming. There were some hard conditions, etc.. All of these terms kind of used when sort of discussing market cycles. So I’m curious, is this a cyclical market? And if so, have we been here before?

Mike: [00:06:23] Well, I’d say we continue to be part of a cyclical marketplace, but not all cycles are the same, and not all drivers of cycles are the same. And as we look back at that history and what drove some of the more recent hard markets in 1985 was driven by a deterioration of loss ratios and a lack of capacity. In 2001 2002, we saw a reaction to the tragic events of September 11th, and that moved the market. Again, more recent years, it’s been a phenomenon of severity, loss, nuclear verdict and social inflation that have really moved the market. So, you know, a common thread there, I guess is deterioration of loss ratio, but different drivers to different markets. And, you know, with this market coming out of COVID and the course reopening and severity continuing to drive through the product line, you know, the future is a bit uncertain as to where we’re going to end up and how long this market will last.

Bethan: [00:07:34] That’s interesting. Thank you. And Brent, do you have anything to add on kind of what’s driving this current market cycle?

Brent: [00:07:40] Well, I think that the true economic inflation is playing a big part right now, and I think that’s going to be a driver for the next couple of years. Mike mentioned social inflation, nuclear verdicts. Those continue to be there as drivers as well. The other thing I would add is that I think that that data analytics information is so much greater than it has been in the past. And in my opinion, that stabilizes and flattens the market changes quite a bit because I think carriers are better informed about their books and the historical performance of those books. So so I think those are big drivers going forward as well.

Bethan: [00:08:17] And Tom, what are your thoughts? Have we been in a market like this before?

Tom: [00:08:22] Yes, I would say it is cyclical. I think the ultimate result is the same to our insureds and our retail partners. I think while in the three major hard markets over the past 30 years and granted, I was not in the industry in 86, 87. But from what I understand, the issue then was there just wasn’t it was it was loss driven and there wasn’t availability of capital within the marketplace in 2001, to which Mike referred after the tragic events of 911. There was capacity. It was more about pricing and rate. And carriers were still putting up large chunks of limit. And in this marketplace in 2019, while capacity was available and capital was available, it was just the carriers willingness to deploy that capital on individual deals. So while each market was a little bit different, the end results to our insurers were the same. So cyclical is probably a great term to utilize.

Bethan: [00:09:26] Thank you. And finally, Chris, would you describe this as a typical market cycle?

Chris: [00:09:32] I would not. But then I think that the answer is is no. As everybody commented there, there was events that caused past market cycles in the past. The surplus lines portion of the of the market was 3%. So I believe it was more of a happening where the surplus lines markets would come in for a short period of time, fill the gap standards, would come back and take it over. And it was that was the typical, quote unquote, hard market. Now, with the surplus lines carriers. At least 12 or 13% at Marketplace. And as Mike and the others mentioned, you have funded litigation, social inflation, environmental issues, social issues. This is going to be a constant, in my view, for for some time. So you’ll need that big chunk of the surplus lines market be able to react quickly, differently, different forms, etc.. So I think that it’s not going to just be a typical jump in, fill some gaps and get out cycle. It’s going to be a more permanent position for our carriers.

Bethan: [00:10:38] Interesting. Thank you. Now, this marketplace has been challenging in recent years. Which segments of the excess casualty market in particular are seeing increased risk and worsened loss activity? Michael I’m coming to you first from the underwriting scene.

Mike: [00:10:55] Yeah. From an excess casualty standpoint where we’ve seen the most challenge recently is a low attaching severity and severity exposed business is certainly most affected. But conversely, we also see the phenomenon of the phenomenons of wildfire and nuclear verdicts where. There’s no limit to the loss amount that could occur. And those losses are very large and extremely vertical in nature. So it’s two different types of severity, driving through the business, low attaching and then that very, very large loss of. In terms of specific classes of business that are most challenging. I’d say the low attaching heavy auto exposures classes such as New York construction and even classes as simple as habitation business in places like New York and Florida have been extremely challenging at low attachment.

Bethan: [00:11:57] And Brent, what would you describe as some of the more sort of challenging areas of the marketplace?

Brent: [00:12:02] I think Mike. Mike hit on several of those. And I think there’s two issues, right? The carriers that are writing the leads, the first layer is directly access to primary that they’ve got attachment point issues. Right. And and if you think about the market that in 19, in the 1980s, excess carriers increased their attachment point from half 1000000 to 1000000. If you look at standard consumer price index effect on that, that number today is probably closer to 3 million. So I think if you’re writing leads, it is still important to try to select the best attachment point and the proper attachment point. Then I think Mike also brings up a great point, that excess of the lead attachment point may not necessarily be able to fix the problems that are out there because of the things that he talked about with wildfire, heavy auto losses, you know, crime at apartment locations that those the numbers coming back and verdicts and judgments are are significantly higher than we’ve seen in the past. So I think it’s kind of two problems. One issue for the excess carriers and what issue for the carriers that are writing in the lead attachment.

Bethan: [00:13:12] So, Tom, which segments of the excess casualty market are seeing increased risk and worsening loss severity?

Tom: [00:13:18] You know, both Brent and Mike, you know, hit on most of the major areas, difficult areas, the low attaching auto. And, you know, the one difference now is that when we say low attaching auto, that definition, I think, has changed. To to to Brent’s point. But but even access to 5 million on some of these risks, whether it’s auto or wildfire exposed, you know, I don’t think ten years ago that the actuaries and maybe I’m wrong, I’ve never been an actuary, but I don’t think they were modeling excess layers above 25 million. And I think now there’s a need for that. And with the amount of data aggregation that we have and the ability to aggregate that, data carriers are looking at that data and those layers and then trying to model it all correctly, which I don’t think has been done in the past within those higher excess layers.

Bethan: [00:14:19] And that’s interesting. Thank you. And Chris, just to finish this off. Any lines that you would add is particularly challenging.

Chris: [00:14:26] I agree with everybody. The auto hab. Violent crime, municipalities, wildfire. But we write billions and billions of dollars. Everything we do is in this market because there’s problems. So I don’t think we should always say these five. We talk about that a lot, but anything that sneaks in, any little separate account that’s not in these classes, they’re there because, you know, tough things have happened and we have to find solutions. So it’s all over the board.

Bethan: [00:14:53] Thank you. Now, with capacity in demand, the excess casualty market is attracting new entrants. It has been for a few years. How impactful have these new markets been and what is it that wholesale brokers are looking for in carrier partners? Brent, I’ll come to you first.

Brent: [00:15:11] I think that the capacity has been necessary. You know, there’s been a lot of reduction of limits from the carriers that have been in the marketplace for a while. They’ve been re underwriting their books, as we discussed earlier. And so I think the capacity that’s come into the marketplace in the past couple of years and continues to come into the marketplace now has been necessary and needed. I think that that capacity has, for the most part, been responsible capacity. The majority of these new entrants are deeply experienced insurance veterans. So I think they understand and have experience in the marketplace.

Bethan: [00:15:48] And Chris, what are your thoughts on that?

Chris: [00:15:50] Yeah, I think it’s been it’s been great and very helpful. Everybody saying the same word to make sure the market is stable. They’ve seen a need. Capital has come in surplus lines is such a great part of the market because that capital can react quickly and fill those gaps quickly. So we keep the market stable. So I think it’s been very helpful. Wholesale brokers, when these new entrants come in to back that up, we need to vet these new entrants with their MGAs, look at their reinsurance, look at their forms, exclusions, etc., to claim channel ability to make sure there are going to be long term entrants. And it’s up to us to vet that.

Bethan: [00:16:32] Excellent. And Tom, do you agree with your wholesale colleagues?

Tom: [00:16:36] Yes, I do, absolutely. I think that the new capacity has definitely had an effect on the marketplace, I think. Simple supply side economics would tell you that supply will drive demand and in which it had, which it has. And it’s also helped stabilize the marketplace. I think the market would have stabilized regardless. But I do think that this added an additional variable to that equation. To Brent’s point, it’s not naive capacity coming into the marketplace. Most of the direct carrier partners are experienced veterans within the industry. And but that being said, you know, I know we as an industry are firms, I should say, all have vet the new capacity coming into the marketplace and to make sure that we are placing cover with with stable capacity, long term capacity. And from a compliance perspective, we all pay close attention to that. And with the MGAs that are coming into the marketplace, we are not just vetting the paper but the reinsurance behind it. And also the individuals who are running the MGAs to make sure that these are long term plays for our insureds and clients.

Bethan: [00:17:59] That’s great. So, Mike, we’ve heard from three of the largest wholesalers in the US wholesale brokers. What’s your view from an underwriting career standpoint?

Mike: [00:18:09] I would agree with our wholesale broker partners in that because of the changes in the market, new capacity was needed and new capacity has come forward in the market and been impactful. I would just caution everyone that not all capacity is of like quality. There are company affiliated underwriters with dedicated claims departments and with with proven legacies of success in the marketplace. And then alternatively, there are some pop up MGAs that don’t have the same legacy and have great uncertainty around the longevity of the underwriting and even the claims handling. So, you know, like in any marketplace, in any part of the cycle, we have to examine the quality of the carrier, the consistency, the longevity, the stability, the quality of claims handling. And those are all significantly important in this product area.

Bethan: [00:19:11] Great. Thank you. So, Mike, I’m going to stay with you for this next question. As the market dynamics change, are carriers changing their asks of brokers and customers? And if so, why?

Mike: [00:19:24] Fundamentally, I don’t know that we’re asking for significant changes from our brokers. I mean, we still look for the partnership. We look for the presentation, good presentation of risk with the appropriate exposure information, loss information, etc.. So fundamentally, the relationship remains the same. But I think in this market, which has been a very challenging, tough marketplace, the importance of communication, the importance of working closely between broker and underwriter, the importance of getting ahead of some of our renewal counts. It’s all more important now than ever. Avoiding surprises is very significant. And if changes need to be made on a count on an account, we need to communicate as early as we can with our broker partners. And I think the stress of this type of market puts a real emphasis on working closely with your market partners now more than ever.

Bethan: [00:20:31] Thanks. And Tom, what are your thoughts on that? Are carriers changing their US brokers?

Tom: [00:20:37] You know, as Mike said, fundamentally, I don’t think so. I think we’ve always had a very high standard of of information needed in order to properly underwrite an account and properly broker the account. And I think to Mike’s point, communication is key technology and data is giving us the ability to be more efficient. So those built in efficiencies and submission quality. It’s no secret that submission count is at record levels, and for an underwriter to identify good opportunities is key. And it’s our responsibility as brokers to provide the best information to help the underwriters make a quick and educated decision.

Bethan: [00:21:26] Great. And Brent, over to you.

Brent: [00:21:28] Not sure that this is driven by the carriers, but I think that with the increase in pricing that we’ve seen over the past couple of years, I think that a lot of insurers have decided to implement various loss control programs, practices, telematics to better their risks. And so I think it’s incumbent upon us as brokers to explain those changes that these insurers have made. They’ve expended a lot of money to improve the quality of their risk. And I think it’s better it’s incumbent upon us to better explain that to our underwriters and also, I think to explain some exposure changes because a lot of the exposure changes that we’re seeing today are really inflation driven. And so the revenues are up, not necessarily because they sold more product or built more buildings, but just because it costs more to do so. And I think it’s incumbent upon us to offer those explanations up to advocate for our insureds, to the carriers, and have them generate a better understanding of the loss control measures that these insurers have taken to better their risks.

Bethan: [00:22:34] Great. And finally, Chris, what are your thoughts on this one?

Chris: [00:22:37] Yeah. I’m not sure if the term is asking for. What are they reacting to and they’re reacting to? Due to the high submission flow has been said, they’re reacting to great submissions, detailed submissions, expertise in that field. So a broker that says, I am an expert in this field, bringing that information to them, knowing that the pricing they need, knowing the layers they want that particular carrier to be on and having confidence of why it’s a good right for that for that underwriter. And that underwriter feels that and feels that expertise more willing to quote. And then they see with that expertise that that quote to buying ratio is a lot higher. They start paying attention to those type of brokers and those brokers become more successful. So they react to quality submissions and expertise.

Bethan: [00:23:27] Thank you very much. So moving on to the final question of this roundtable today, and it’s a bit of a look ahead. So with more uncertainty ahead in the marketplace, how is the excess casualty market preparing for the impact this is likely to have on customers? And what is Axis doing? Tom, I’ll come to you first.

Tom: [00:23:47] The technology and data data aggregation is going to play a key role in in the future success of the E&S marketplace. yOU Know a lot of our most of our carriers are aggregating that data to improve underwriting results to a to a different degree than what they’ve done in the past. Secondly, is is the talent game. I think what what COVID has taught us and the change that’s marketplace is that there is a major need for talent. And I think we realize that in 2019 and new capacity coming into the marketplace had a major effect on that. And most of our carrier partners have done an excellent job in filling those seats with with with talented individuals. Now, the next step, I believe, is training and development of those individuals, both on the underwriting side and on the brokerage side. I believe over the past ten years, the training and development hasn’t been a major focus, but I do now think it’s on the forefront of all of our minds for the sustainability of our industry, especially within the sector.

Bethan: [00:25:02] Thank you. And Chris, over to you.

Chris: [00:25:04] You used a key word, hot with uncertainty. How are you acting with uncertainty? You need transparency. And transparency is getting ahead of the risk, being open with your retailers so they can keep the insured, update it. And that’s talking about where the market’s at with the individual account, where the pricing might be going to. Even if there’s a spike in pricing, let them know early. You don’t want to wait till the last minute. So the worst thing you can do for for everybody involved in the transaction, take the heat early, even if there’s bad news to give, give the bad news early. So that eliminates uncertainty by being transparent. It’s important for also our underwriting partners to have that transparency, too, and try to give us their thoughts, especially on the renewals early. We can’t wait till the last minute where they make changes or say, I just went to get it referred and my referral said no when we’re getting positive signs the whole time. So we need to make sure the message is constant early so our insureds know what to expect. And I think no matter what happens at the end, they’ll at least know that we’ve did our best and respect the process. And then finally, like I said, with access, they’ve been great, they have enough underwriters, their referral system is set up to react quickly because there’s the other thing. We need speed in our business and the speed of issuing those quotes early and not waiting last minute. So I think Axis does a good job with their referral levels and the amount of underwriters and consistency of underwriting. We cannot have a carrier all of a sudden do a one off over here. It messes up the market, it messes up their summit flow. So consistency and early ideas of where we’re going.

Bethan: [00:26:50] Thanks, Chris and Brent. Staying with the wholesale brokers to finish, what are your thoughts on this?

Brent: [00:26:57] I agree with what Tom and Chris said. I think that our marketplace is interesting because we need some consistency in our marketplace with our underwriters so that we know what risks they’re targeting and what risks they’re great at and what risk they really don’t like. So that helps the efficiency of the market. On the other hand, we also need them to be flexible. So so when there are gaps in the marketplace, we need them to be able to step up. So it’s a tough ask that we place upon our carriers. We want them to demonstrate some consistency, but we also want them to be somewhat flexible. I think that Axis in particular, I think Mike will address this in some closing comments. But I think they’ve always been seen as a market that is willing to underwrite the toughest of the risks and offer solutions, whether that be with limited capacity, higher attachment points, increased pricing. But they’ve been a flexible market, I think, over the years and that’s sort of been their what they’ve sold into the marketplace and I think they’ve done a good job of that. I would agree with with Tom and Chris that I think access makes decisions quickly and that’s very helpful to us. And I hope that that continues with access and with other markets going forward because that’s key to us being able to respond to the changes in the marketplace.

Tom: [00:28:12] Brent, I think that’s a great point in terms of access from an appetite perspective has always been very consistent. Very rarely are they are they jumping out of a certain segment of the industry. Their pricing structure might change and we might not like it, but we understand it. But it’s really that consistency that that’s that’s a super relevant factor in our ability to confidently promote the product.

Bethan: [00:28:41] Well, that’s great, Mike. Lots of good feedback for access there. So tell us a bit about what Axis is doing to prepare for the uncertainty ahead.

Mike: [00:28:50] Well, first, I’d like to thank our broker broker partners for those very nice compliments. And I can’t speak for the entire market, but I can certainly speak for access. And I would say is one of the things we’ve always strived to do is to step up and consistently offer solutions for challenging and difficult business. And that’s been our predominant goal since day one, and I think we’ve done that well. And along with that goes, you know, good service, proper levels of staffing, efficiency of operation, getting quotes out quickly, you know, an efficient peer review and referral process. All those things have to go along with it. And transparency, as Chris alluded to, I think we’ve strived to do all of those things. And, you know, 20 years ago when I sat down to create this department, my number one goal was consistency of stepping up and providing solutions on tough and challenging situations for our wholesale brokers. And that’s always what we’ve strived to do. And while I’m at it, I’ll throw in a little advertisement for what’s coming in the future is we’ve been known as as a a key market for the large and tough challenging risk. Well, I just want to put it out there that we’re going to expand that appetite down to the medium and smaller risk as we go forward. And we want to help our broker partners in that area moving forward and not just be the solution for the larger, tougher, but to include the medium and smaller and sometimes even lesser hazards. So we will that’s something to look forward to going forward. But again, just I can’t thank these three gentlemen enough for the support of them in their firms. They’ve been incredibly great partners to access. And we appreciate their being here today and participating and we appreciate their support. They lend us on a daily basis.

Bethan: [00:30:54] Well, thank you, Mike, and congratulations on what access has become in the past 20 years. It’s great to see. I think that’s an excellent place to end this discussion today. So, Mike, Tom, Brent and Chris, thank you very much for joining me and for sharing your insights on IBTV.

Tom: [00:31:12] Thank you.

Brent: [00:31:12] Thank you.

Chris: [00:31:13] Thank you.

Mike: [00:31:14] Thanks, guys.

Bethan: [00:31:16] Thanks also to our viewers for tuning in. I’m Bethan Moorcraft, senior editor at Insurance Business, and this was IBTV. Thanks, everybody.