Sydney, Australia flood loss estimate rises to $122m

Insurance claims from the severe flooding that struck the New South Wales region of Australia this month have risen again over the weekend, with another 25% added to take the total to 10,526, but the estimate for insurance and reinsurance market losses remains low at $122 million.

Flood waters continued to recede in the Sydney area and the sun came out over the weekend, providing much-needed respite to flood affected residents.

Now, the impacts further north have also stopped and some towns that have been flooded for days are now seeing roads passable again.

While the forecast is for more rainfall over the next week or so, at this time there aren’t any concerns over flood waters rising as rain totals are expected to be lower. Although there are warnings that surface flooding is possible given how saturate the ground is now.

Given the slow pace of claims being filed, compared to the floods earlier this year in Australia, we’ll likely drop down to reporting on these floods just once or twice per-week after this article, unless anything of note occurs or the number of claims filed jumps unexpectedly.

To recap:

As we reported last Sunday, parts of eastern Australia have been flooding again after an East coast low brought torrential rains and strong winds to the country.

Sydney and its suburbs were particularly badly impacted this time, with households evacuated and flood warnings in place, as well as property damage being reported.

The Insurance Council of Australia (ICA) declared a ‘significant event’ on Tuesday for the still developing severe flooding in Sydney and the surrounding region of the country, with over 50,000 people under evacuation orders at the time.

Yesterday, the ICA said that insurance claims from the Australian flooding in July had reached 4,160 since July 1st, in terms of filed claims.

While evacuation orders covered 85,000 people as of Wednesday morning.

As of Thursday morning, the number of insurance claims has risen further to 6,853 as of early this morning, a 57% increase.

The figure jumped again to 8,415 last Friday, while an initial insured loss estimate of $97.9 million was reported by the ICA.

The Insurance Council now puts the number of claims filed at 10,526, another 25% increase to Friday’s figure.

But losses are also rising slowly, with the Monday update from the ICA reporting its initial estimate of insured losses as now just $122 million.

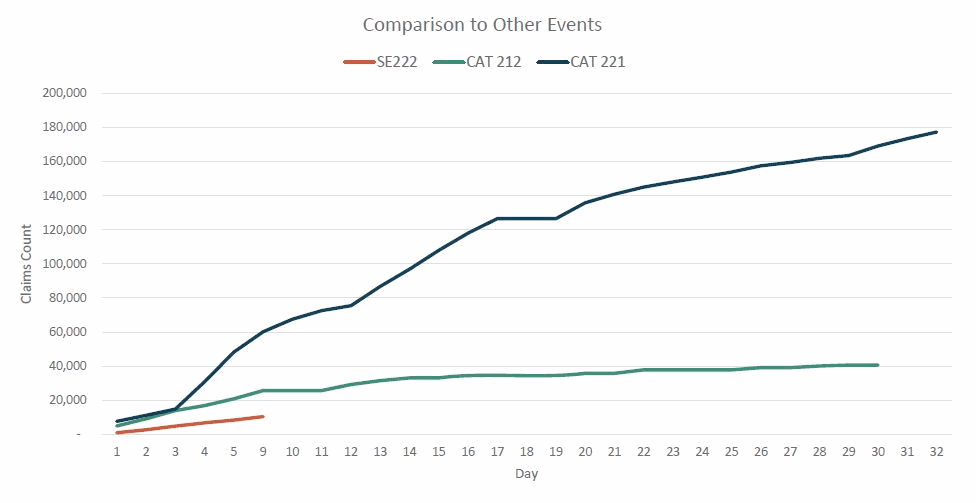

Claims from this latest July 2022 flood event in Australia are still tracking well-below other recent flood catastrophe events that have affected the country (see chart below), which is encouraging for insurance and reinsurance interests that have been badly hit by losses from the country in recent years.

These 10,526 of flood insurance claims filed are still split as 84% for property damage, 14% for motor and 2% for commercial insurance claims.

The July 2022 flooding in Australia remains a “significant event” rather than an insurance catastrophe.

The longer-term outlook remains focused on the potential for more rainfall and potential flooding over the coming months, as Australia’s Bureau of Meteorology latest update forecasts a wetter August to October to be expected for much of Australia, with the east particularly exposed.

Rainfall is likely to be above median, the BOM said, with an 80% chance much of the Northern Territory, Queensland and New South Wales experienced above average rainfall over those coming months.

“Large parts of northern, central, and eastern mainland Australia (away from the southern coastline) are around 2 to 3.5 times more likely than average to have unusually high (in the top 20% wettest of all years over 1981–2018) rainfall for August to October,” the BOM said.

Recall, with the ENSO cycle in a La Niña currently, Australia tends to experience more east coast storm systems, with resulting rainfall, strong winds and also convective effects and hail.

2022 has now seen some eastern parts of the country flooding three or four times, with this latest episode set to add to the misery of residents and business owners.

These July 2022 floods in Australia have struck just as parts of the eastern and southeast coastal areas of the country are in recovery after a number of flood events that occurred earlier in the year.

The East Coast Flood from February and March 2022 is the costliest flood catastrophe in Australian history and the third most costly natural catastrophe event, according to the Insurance Council.

That outbreak of severe flooding is now counted as the third most costly extreme weather event ever recorded in the country, as the insurance and reinsurance industry loss estimate has been raised to AU $4.8 billion.

Reinsurance costs are rising for Australian property and casualty insurers, as natural catastrophe industry loss costs in the country have escalated significantly in recent years, S&P Global Ratings said recently and this flood episode will not instil any more confidence in reinsurers writing business in the country.

This latest flood event comes as Australian insurers have renewed some of their reinsurance arrangements.

As we reported last Tuesday, Suncorp renewed its towers, but its aggregate attachment point has raised significantly, while today IAG announced its renewal, again with a higher aggregate attachment point.