Swiss Re sidecar & ILS fund AuM rises 29% in 2022, alt capital fees rise 36%

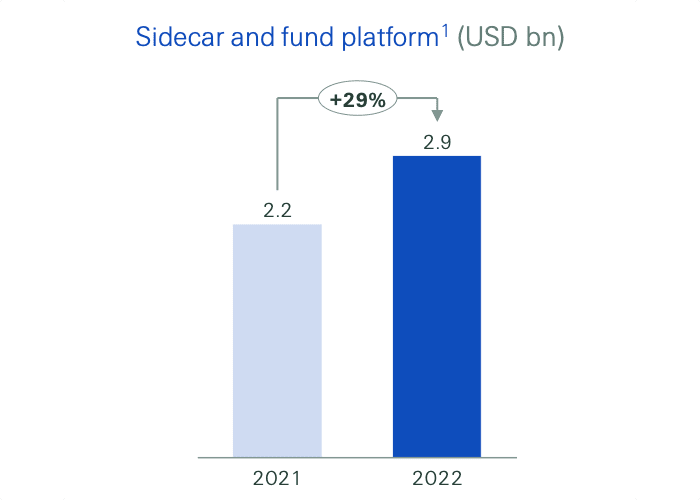

Global reinsurance company Swiss Re grew its collateralized reinsurance sidecar and insurance-linked securities (ILS) fund assets under management by 29% in 2022, lifting the total to $2.9 billion.

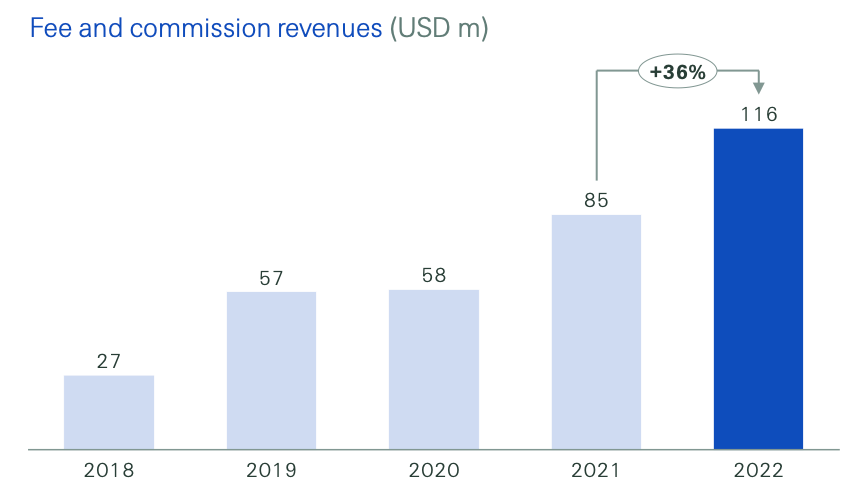

At the same time, Swiss Re has also disclosed this morning that its Alternative Capital Partners business delivered 36% more in annual fee income earned from alternative reinsurance capital activities and insurance-linked securities (ILS) management.

The company explained that, “Despite a challenging capital raising environment, risk sharing sidecar and fund platform increased assets year-on-year.”

The total assets under management, across the sidecar platform that includes Sector Re and single investor vehicles such as Viaduct Re, and the ILS funds managed by Swiss Re entities, rose 29% from $2.2 billion at the end of 2021, to $2.9 billion at the end of 2022.

Swiss Re continues to integrate these alternative capital assets into its underwriting capabilities through its quota share sidecar structures, as well as its ILS fund platforms.

On the ILS fund side, Swiss Re now has the more collateralised reinsurance focused Swiss Re Insurance-Linked Investment Management Ltd. (SRILIM) investment management unit and 1863 Fund platform, as well as the more recently launched and catastrophe bond focused SEC registered investment adviser, Swiss Re Insurance-Linked Investment Advisors Corporation (SRILIAC).

Overall assets under management of Alternative Capital Partners (ACP) have now reached $3.8 billion, including Swiss Re’s investment shares in the vehicles.

While the assets under management (AuM) of these strategies have been rising, Swiss Re has also been earning higher fee income from its Alternative Capital Partners (ACP) division, from the asset management and also structuring related activities.

Swiss Re’s ACP fee income has now reached $116 million for 2022, a 36% increase on the $85 million earned in 2021.

These fees are earned through asset management fee income, commissions and service provision fees as well.

More specifically, fee income is earned through proportional cessions via ceding and profit commissions, which is relevant to the sidecar platform at Swiss Re.

On top of this are fees based on assets under management in the ILS fund operations.

While structuring fees, for Swiss Re Capital Markets work in the catastrophe bond and broader insurance-linked securities (ILS) sector, also contribute to this total. Swiss Re Capital Markets remains third in our leaderboard of catastrophe bond banks and brokers.

$116 million of fee income for its engagements with alternative capital and the ILS industry is a really significant contributor to Swiss Re’s earnings.

As the reinsurance firm grows the AuM of its ILS fund platform, these fees will grow further and become an even bigger source of earnings for Swiss Re.