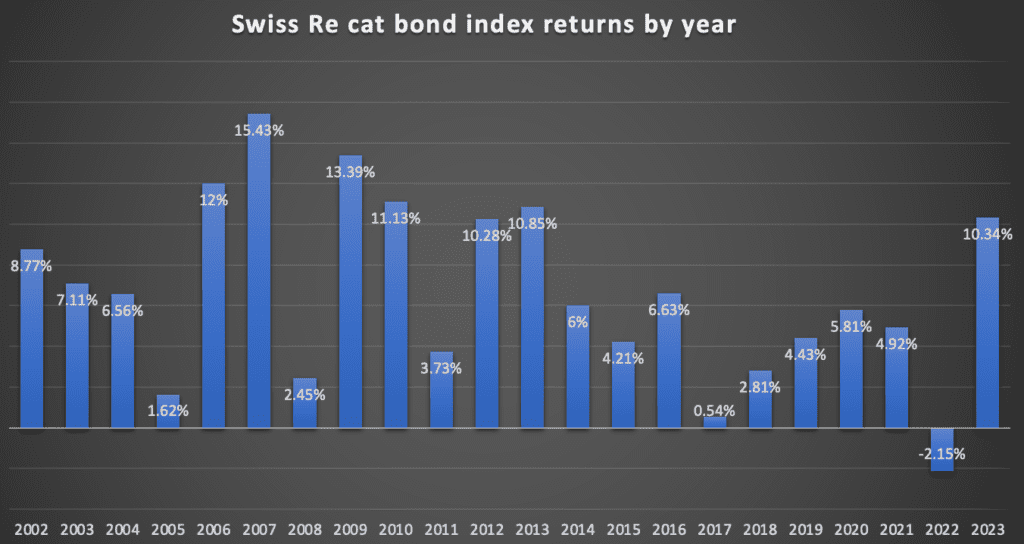

Swiss Re cat bond Index delivers highest half-year return ever at 10.34%

Thanks to a very strong first-half of investment returns from the catastrophe bond market, the Swiss Re cat bond Index, probably the most widely used benchmark in the insurance-linked securities (ILS) space, has delivered a record performance for any half-year on record.

The Swiss Re catastrophe bond Index provides a widely used benchmark for the total returns delivered by the outstanding cat bond market.

Reflecting the higher spreads available in catastrophe bonds and some performance delivered by the continued recovery in values of some cat bond positions that proved unaffected by last year’s hurricane Ian earlier this year, the Swiss Re cat bond Index has soared to a record level.

By the end of the first-quarter of 2023, the total return of the Swiss Re cat bond Index reached 5.00%.

Then, when we reported on the Index around the middle of May, the return had increased to 7.55%, which was already the highest return for the Swiss Re Global Cat Bond Index in any year since 2013.

Now, after a strong full month for both May and June, now at 10.34% at the middle of the year, the return for the Swiss Re cat bond Index in 2023 so far is approaching the level seen in that 2013 year and will soon overtake it.

Which will make this year the best performance for the Index since 2010 and tracking to approach or better the highest ever recorded, depending on how the second-half pans out.

For the first-half of 2023, the impressive 10.34% return of the Swiss Re cat bond Index has surpassed the previous half-year high, which was the second-half of 2009 where the index return reached 9.65%

It’s important to note that the Swiss Re Index incorporates all outstanding cat bonds, so is not a precise representation of a portfolio managed cat bond fund strategy.

It also doesn’t contain any cash, so there’s no drag when maturities are high, as has been seen at times this year.

But, it accurately represents what’s possible from cat bond investments, with some of the highest returns ever available in the cat bond market available to those allocated today.

For other ILS performance benchmarks, UCITS catastrophe bond fund strategies were already at a 7.66% return on average by June 23rd, according to the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format

In addition, ILS funds as a sector have continued to deliver their best returns since 2007, 5.48% to the end of May, as measured by the Eurekahedge ILS Advisers Insurance Linked Securities Fund Index.

As ever, second half cat bond and ILS returns will depend on any catastrophe loss activity, as well as any broader macro effects that impact the capital markets during the period.

But right now the returns are tracking at record levels, despite the evident softening in catastrophe bond spreads during the second quarter, which you can see evidence of here in our charts displaying cat bond pricing and spreads, as well as cat bond multiples-at-market, by years and quarters.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature.

Swiss Re cat bond Index delivers highest half-year return ever at 10.34% was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.