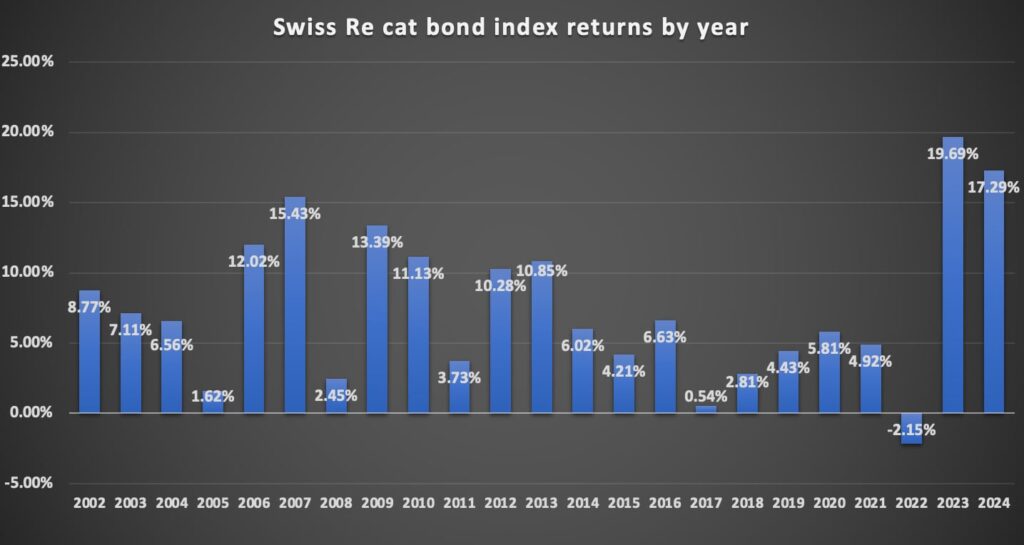

Swiss Re cat bond Index delivers 17.29% total-return in 2024, second-highest ever

The catastrophe bond market delivered the second-highest total-return in its history in 2024, reaching 17.29% for the full-year, according to data from the Swiss Re Cat Bond Performance Indices.

While the catastrophe bond market’s performance fell behind the record set in 2023, at 17.29% the full-year 2024 total-return implies very strong performance from catastrophe bond fund strategies and attractive returns for cat bond investors.

It’s important to note though, that managed cat bond funds tend not to deliver quite as high a return as the market Index that is calculated by global reinsurance firm Swiss Re, with the majority of strategies having ranged between 12% and around 15% for full-year 2024 returns, according to our sources.

It is hard to fully-replicate the index and the majority of cat bond fund managers prefer to try and generate their own shape of returns, based on their specific management and trading philosophy, rather than replicate a cat bond market beta.

The cat bond market’s performance in 2024 reflected a market running on record-high risk interest spreads above expected loss, generating significant returns for its investors again over the last year.

At a 17.29% total-return for 2024 and now having delivered just over 40% for the last two years, according to the Swiss Re Index, catastrophe bonds remain one of the outstanding performers in the fixed income, alternatives and hedge fund categories.

At a 17.29% total-return for 2024, last year was the second highest annual performance on record for the Swiss Re cat bond Index.

With just a 2.40% differential to the record year for the Index set in 2023, this amount is roughly around the level of recovered returns from price gains seen in the wake of 2022’s hurricane Ian not driving the losses that had been anticipated, that came through in the first-half of 2023, as well as certain other price related dynamics that year.

Which makes the 2024 annual return for Swiss Re’s catastrophe bond market Index all the more impressive, as that recovery post-Ian was never going to be repeated. Which underscores just how impressive the 2024 full-year total-return for the cat bond market has been.

Looking ahead, how the recent price softening seen in primary cat bond issues affects total-returns for 2025 remains to be seen.

At this stage, it seems unlikely the 2024 total-return would be equalled without a quick stabilisation of, or turn in pricing trajectory, or some other change of fortunes.

Catastrophe bond pricing has softened in-line with global reinsurance and retrocession, in some cases perhaps a little more, as the efficiency of these tradable and securitized instruments became evident again in the final quarter of last year.

You can read much more on the recent price dynamic in the catastrophe bond market in our brand new report, available to download here.

Despite the recent softening seen, catastrophe bond market returns continue to track at historically high levels, which you can see evidence of here in our charts displaying cat bond pricing and spreads, as well as cat bond multiples-at-market, by years and quarters, and in data from Plenum Investments on the catastrophe bond market yield.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature, based on the data in Artemis’ extensive catastrophe bond Deal Directory.