Suncorp lifts top of catastrophe reinsurance tower to $6.75bn at renewal

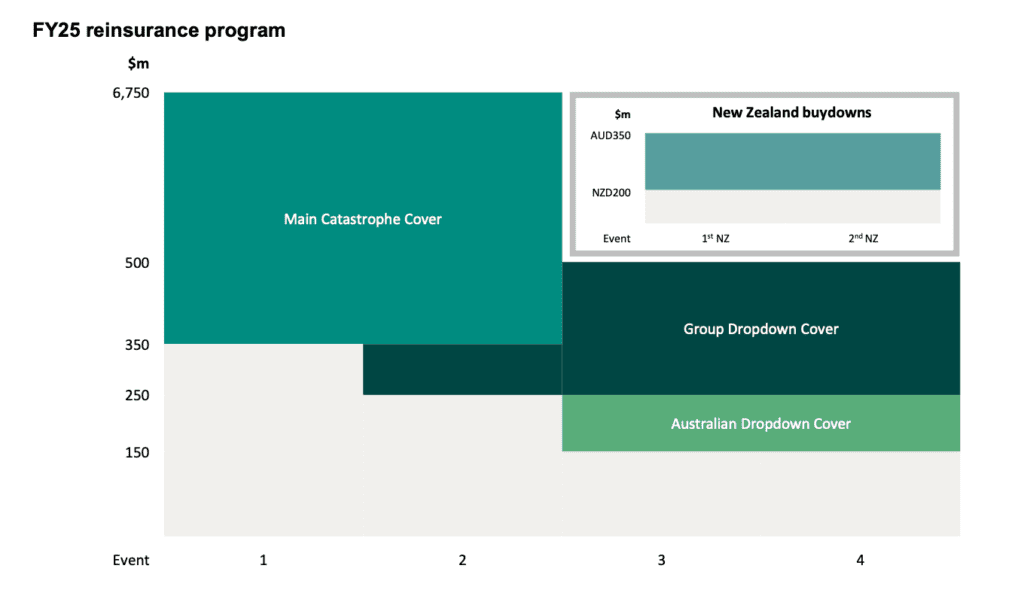

Australian primary insurance giant Suncorp Group has renewed its main reinsurance program arrangements for its fiscal year 2025, adding $350 million to the top of its catastrophe reinsurance tower, taking it to $6.75 billion.

A year ago, Suncorp had a main catastrophe reinsurance arrangement that provided cover from an attachment of $350 million up to exhaustion at $6.4 billion.

That’s been increased, while the retention hasn’t changed, so for the new fiscal year, that runs from July 1st 2024, Suncorp will have catastrophe reinsurance that protects it for major events from the same $350 million, but now up to $6.75 billion.

Suncorp Group CEO Steve Johnston highlighted that the reinsurance program seeks to deliver on a balance between costs, earnings and capital volatility, and appropriate returns.

He commented that, “It is pleasing to see stability return to global reinsurance markets after three years of disruption.

“Reinsurance is a major input cost to the price of insurance products and this, along with broader economy-wide inflation, have driven up the cost of insurance premiums for customers in Australia and New Zealand.”

Earlier this year, the insurer noted a stabilisation in the reinsurance market and its hopes for an easier renewal this year, especially as it had not tapped into its reinsurance by that stage in late February.

Last year, Suncorp dropped its aggregate reinsurance cover, as reinsurers shied away from those secondary and weather peril impacted covers.

Now though, Suncorp’s CEO is perhaps hinting that he hopes some frequency protection might come available, if reinsurance conditions continue to remain stable, or improve further.

Johnston said, “With the completion of the Bank sale scheduled for 31 July and the reinsurance program successfully renewed, we will now be in a position to consider other reinsurance covers that may be appropriate.”

Suncorp continues to have dropdown reinsurance covers in place that will reduce its second, third and fourth event retention to $250 million, while the catastrophe reinsurance tower to $6.75 billion comes with one prepaid reinstatement.

In fact, also the same as last year, Suncrop continues with its Australian dropdown reinsurance program that lowers the retention for a third and fourth event in Australia to $150 million.

Suncorp has not renewed its quota share agreement relating to the Queensland home portfolio, saying this is in response to a comprehensive review and the implementation of the Federal Government’s Cyclone Reinsurance Pool (CRP).

In New Zealand, Suncorp’s retention rose, but as a result it could fully place its buydown reinsurance covers there, but noted that, “The increase in retention reflects the continued impacts of the weather events in early calendar year 2023 on the economics and availability of reinsurance cover in the New Zealand market.”

In terms of costs of the reinsurance renewal, Suncorp said that overall it will be comparable with the previous year, despite the increased main cat tower limit and considering the removal of some quota share protection.

The insurer said that its natural hazard allowance for FY25 is expected to increase to $1.565 billion (up from FY24’s $1.36 billion), reflecting unit growth, ongoing inflationary pressures across the insurance industry, and increased risk retention as a result of updates to the reinsurance program structure.

Suncorp also updated on natural hazard costs in the current fiscal year, estimating them to be approximately $1.23 billion, so still under its allowance of $1.36 billion.

Reinsurance conditions remain challenging for the large Australian reinsurers, which had benefited greatly from the last soft market and previously had significant aggregate covers in place.

But, as the reinsurers and ILS funds backing those aggregate arrangements took significant and repeat losses over a number of years, thanks to floods, east coast storms, wildfires and other severe weather, the availability of those covers diminished, since when the Australian carriers have had to make do with large occurrence reinsurance towers and second event covers provided by dropdowns.

There are signs of easing, but the appetite to resume taking on the weather frequency risk is minimal and so any re-emergence of aggregate cover for these carriers is likely to be on a far more restrictive basis than was previously seen.