Strata review: Trowbridge releases final report

Strata review: Trowbridge releases final report | Insurance Business Australia

Insurance News

Strata review: Trowbridge releases final report

“The third and final step in a journey,” says Robert Kelly

Insurance News

By

Daniel Wood

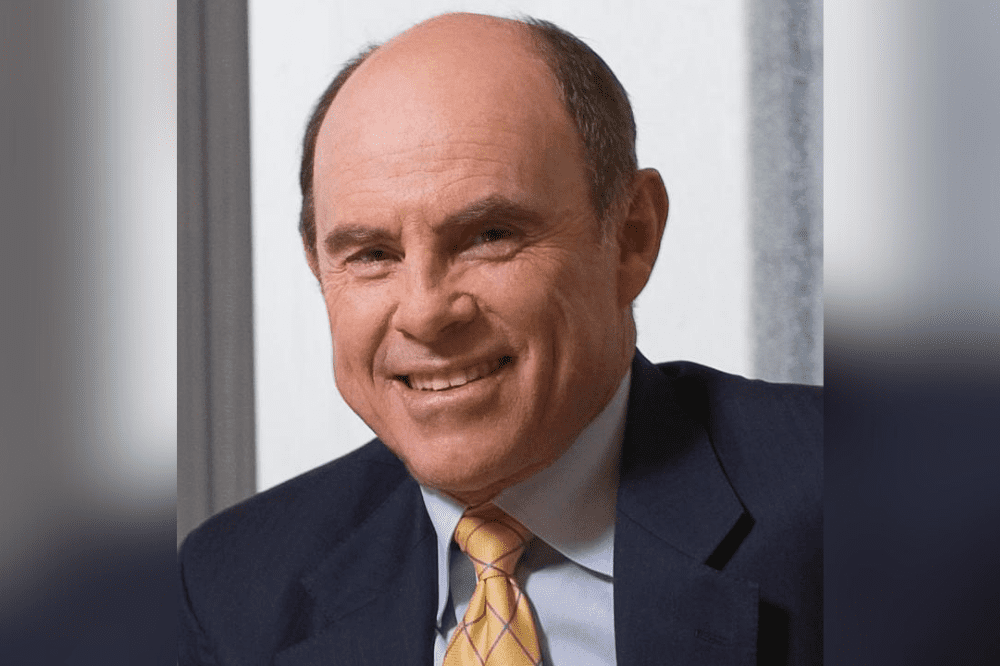

Insurance industry consultant John Trowbridge (pictured above) has released the final paper in his independent review of strata insurance. The so-called Phase 3 paper is called: “Energising the strata insurance market: a blueprint for affordability, availability and competition.”

“This paper is the third and final step in a journey intended to carry the strata management and insurance industries through a review in three phases,” said Robert Kelly, CEO of Steadfast Group in the report’s forward. Steadfast sponsored the independent review.

One focus is broker commissions and charges.

“On intermediary charges, owners’ corporations are encouraged to satisfy themselves as to the appropriateness of fees and commissions,” said Trowbridge in a media release.

He also said his Phase 3 paper identifies two priorities: “The first is an implementation of the Phase 1 disclosure regime,” he said.

Trowbridge said the Strata Community Association (SCA) is “actively pursuing” these recommendations with the broking community.

“That is a valuable initiative for the strata industry and will be enhanced by the 2022 Insurance Brokers Code of Practice which has introduced new disclosure measures for insurance brokers to address the issue of transparency,” he said.

The second priority, said Trowbridge, is insurance market capacity, which he described as “constrained.”

“The insurance industry, comprising insurers and underwriting agencies, is being urged to investigate, in collaboration with representatives of broking houses, strata management groups and owners’ corporations, what steps can be taken to alleviate the market capacity problem,” he said.

Trowbridge said an availability issue he also considered is replacement cover value. He said underwriters do not offer it despite legislation requiring it.

“There has to be a better way,” he said.

Keep up with the latest news and events

Join our mailing list, it’s free!