Stone Ridge’s flagship ILS fund returns 92% in two years, casualty reinsurer Longtail Re outperforms

Stone Ridge Asset Management, the New York based alternative risk premia focused investment manager, had another strong year for its reinsurance investment strategies and ventures in 2024, which CEO Ross Stevens describes in his latest investor letter while also explaining some of what makes the firm so interesting.

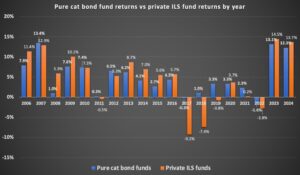

Having delivered record returns to investors in its insurance-linked securities (ILS) funds in 2023, the strong performance continued in 2024 for Stone Ridge’s strategies, as hard catastrophe reinsurance market pricing and improved terms of capital deployment continued to drive returns.

A year ago, the Stone Ridge investor letter explained that the investment manager generated more than $1 billion in trading profits from its reinsurance and ILS investment businesses in 2023.

An equivalent figure is not provided in the 2024 letter, but Ross Stevens, Stone Ridge Asset Management Founder and CEO does explain that, across the company, Stone Ridge made around $4 billion in firm-wide trading profits in 2024, a very impressive figure.

It’s no doubt that reinsurance and the ILS investing offering at Stone Ridge will have generated a significant proportion of this, accounting for a large amount of the assets under management at the firm.

As we reported back in September 2024, the company reached US $10 billion in assets under management across its reinsurance, catastrophe bonds and insurance-linked securities (ILS) operations and fund strategies.

The annual investor letter from Ross Stevens, Stone Ridge Asset Management Founder and CEO, is a must-read for insights into the company and how he and the firm think about the sectors they operate in.

Most interesting to us though, are the insights and hints given into how Stevens and Stone Ridge think about redesigning or optimising the rails that finance run on. Evidenced through the way the company is utilising structuring to develop opportunities that deliver benefits across multiple angles to the way the company faces the insurance and reinsurance market.

Stone Ridge is using its suite of asset class solutions and financial structuring technology to create fixed income replacement products that benefit the insurance and reinsurance company balance-sheet, for clients but also including their own, being Longtail Re we assume.

Stone Ridge is reimagining the rails of financing from the inside, through hard work and structural innovation, which is generating insights and opportunities for the company into new ways to optimise and lever a reinsurance balance-sheet, while maximising the cross-business profits within the different Stone Ridge profit centres.

Our readers know Stone Ridge best for its ILS fund offerings, where it creates portfolios for investors that want to access the relatively uncorrelated returns of natural catastrophe underwriting.

The company achieves this in its flagship fund through a quota share partnership approach, as well as in another fund through largely catastrophe bond investments.

In both cases, as well as with other collateralized reinsurance instruments Stone Ridge allocates to, partnership comes through provision of efficient capital to support insurance and reinsurance balance-sheet enterprises.

But, at the same time, Stone Ridge is writing casualty reinsurance business, for casualty reinsurers, through Longtail Re, its Bermuda-based reinsurer.

Longtail Re operates differentiated strategies on the capital inwards side, being backed at least in part via private investor funds, as well as in its asset management, but it’s far from the typical hedge fund reinsurer approach it seems.

Stevens letter explains how Stone Ridge constructs fixed income replacement investment opportunities, which it sells to other major insurers and reinsurers, to help improve their balance-sheet situation through high-performance, secure, investment grade assets, but it also seems these instruments benefit Longtail Re as well.

CEO Ross Stevens wrote in the investor letter how these fixed income replacements benefit re/insurers, “The benefits of higher investment income get passed on to policyholders in the form of more insurance for less money, a larger annual dividend, and a larger surplus, which helps make already super-super-safe firms even safer.

“At Stone Ridge, we run to work to help all Americans, including our own families, get more, and more reliable, life, property, and casualty insurance for less money.”

It’s this kind of cross-pollination of ideas and strategies at Stone Ridge that sees the company increasingly viewed as one of the more innovative financial and investment firms in existence today.

The letter penned by Stone Ridge CEO Stevens provides some insights into how the firm thinks about the Longtail Re casualty reinsurance strategy (which Stevens calls a casualty reinsurer of reinsurers), as well as into its performance.

At a time when casualty insurance-linked securities are increasingly in-focus across the industry (we have a casualty ILS panel at our upcoming NYC conference for the first time in Feb 2025), we thought these worth highlighting.

Stevens explains that two fundamental insights led to the creation of Longtail Re.

First that, “combining positively selected, aligned, and hyper-diversified liabilities of multiple casualty reinsurers into a single entity could deliver industry-changing improvement in the level and variability of float expense (i.e., minimal variability in the “interest rate” at which Longtail Re “borrows”),” Stone Ridge’s CEO wrote.

Second the understanding that, “access to superior short-duration fixed income replacement strategies that reliably

outperform traditional long-duration fixed income strategies and distribute high monthly cash flows to pay ongoing claims – strategies Stone Ridge was already proprietarily producing at scale – could deliver industry-leading book value growth,” Stevens continued.

Which speaks to the fact Stone Ridge is leveraging its financial market origination, structuring and investment acumen and innovation to bring together the outputs of different centres of expertise within the business to reimagine the way casualty reinsurance is being managed.

Which is delivering impressive results, it seems, as Stevens explains Longtail Re’s outperformance.

“In its first five years of life, Longtail Re’s all-in “borrowing costs” have fluctuated in an industry-leading range of -1% to -3% – not a lot – while our return-on-assets (ROA) has annualized at an industry leading 6.3%, ~3x the average of the top three global reinsurers (it has been a particularly challenging period for traditional fixed income strategies). Combining our two fundamental insights, Longtail Re’s 20% annualized ROE has been 4x the average of the top three global reinsurers,” Stevens explained.

Adding that, “I expect Longtail Re to end 2025 with ~$4B of assets, and continue its responsible growth trajectory from there, provided the market stays attractive. It certainly is right now.

“Like everything we do at Stone Ridge, in casualty reinsurance we have skin in the game. Stone Ridge owners/employees own more than 40% of Longtail Re and have more than $1B invested in our various reinsurance strategies.”

It’s interesting to think back to how Stevens explains the Stone Ridge ILS funds in the years just after their launch, where he explained how the firm saw delivering quota share, catastrophe bond and collateralized reinsurance capacity to insurer and reinsurer clients as a partnership approach, making his funds a key source of capital for the world’s largest players.

Longtail Re is becoming a key source of casualty capital for the world’s largest reinsurers of casualty risks, with Stone Ridge again positioning its strategy at the heart of the industry, then using its financial wizardry to extract outsized returns from the sector, which ultimately levers the whole business and enables it to do more, do it more capital efficiently, and generate attractive returns.

Which is very similar to the Stone Ridge approach in catastrophe bonds, ILS and reinsurance investing as well.

Stevens goes on to explain in the investor letter that Stone Ridge aims to “underwrite the underwriters (partner with asset originators)” not compete with them.

“Our approach is to partner, not compete, with the best underwriters in the world. With deliberate practice, high cadence connectivity, and internal private scorecards that matter deeply to us, we seek to earn and re-earn the right to be the most strategic, long-term risk sharing partner to each of our cherished underwriting partners,” he wrote.

Moving on Stevens discusses the catastrophe reinsurance funds, so the mutual 40’s Act cat bond and quota share focused ILS funds, as well as the private ILS funds that are also very quota share focused as well.

“Our catastrophe reinsurance franchise, our first, has purchased ~$9B of cat bonds and supported ~$110B of cat limit via quota shares, in partnership with the leading global reinsurers,” Stevens explains.

“We, uniquely, see the historical results of all partner reinsurers, across all perils, geographies, attachment points, and business lines (including experimental initiatives for which we are often the only capital).

“This valuable proprietary data guides our active management – that is, our active underwriting – of the underwriting of our partners.

“While we don’t call it a comeback, our flagship fund has cumulatively returned net 92% the last two years (and, yes, it has been here for years).

“When we lose money, which we do at scale from time to time, we stand behind people as they rebuild their homes in their darkest hour.”

Throughout the letter, Stevens mentions the “stack” of products created at Stone Ridge and how new business avenues researched, explored and added to the stack increase the utility of it for the rest of the Stone Ridge offering.

Which is one of the fascinating things about the company.

While many of our readers may think of Stone Ridge through the lens of its insurance-linked securities (ILS) funds, but others may know the Longtail Re casualty reinsurance strategy better, few properly understand how the company is bringing together financial technology to reimagine the rails and plumbing of sectors such as catastrophe and casualty underwriting.

Ross Stevens closes his letter with the statement, “We innovate to prepare for an uncertain future, in pursuit of our mission: financial security for all.”

You can access the full letter via one of Stone Ridge’s businesses here.