Smart Choice swoops for Tennessee firm

Smart Choice has announced the acquisition of Tennessee-based Carriage Hill Insurance and three key leadership appointments for Smart Choice Partners (SCP). SCP identifies acquisition opportunities that complement Smart Choice’s existing network of more than 9.500 independent agencies.

Carriage Hill is a $4-million-revenue, multi-office agency with offices in Lenoir City, Brentwood, Oak Ridge and Athens, Tenn. The Carriage Hill transaction was Smart Choice’s 22nd agency acquisition since the SCP program began in 2019.

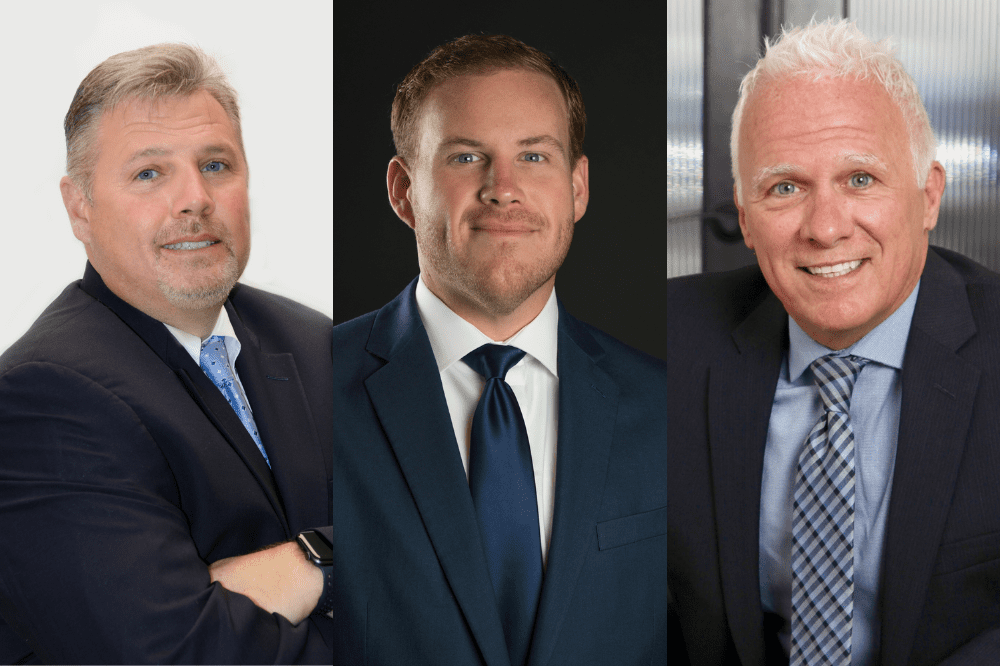

Smart Choice acquired Carriage Hill due to its 10-year partnership with the agency, Carriage Hill’s significant growth, and the opportunity to recruit Carriage Hill’s executive team to lead the SCP program. The owner of Carriage Hill, Todd Henderson (pictured above left) has been named SCP president. Chase Scott (pictured above center) has been named director of operations, and current SCP executive Jeff Huff (pictured above right) has been named vice president of operational strategy.

Read next: Smart Choice reports breakthrough growth, key hires

“We analyzed the growth opportunities that the acquisition would provide Carriage Hill and how well it would align with our long-term objectives, which made it a compelling decision,” Henderson said. “There was also cultural compatibility, in that Smart Choice had been a proven partner for our agency that helped us to grow and better serve our clients’ needs.”

“Smart Choice Partners provides independent agency owners an opportunity to expand their partnership with Smart Choice when they are looking to sell their agency,” said Andrew Caldwell, president of Smart Choice. “We respect and acknowledge the value that has accrued, and the congruent relationships cultivated with clients, staff and carriers. SCP evaluates agencies based on the opportunity to partner with the current agency owner and strives to retain the structure that made the agency a success.”