Singapore and China deepen financial cooperation

Singapore and China deepen financial cooperation | Insurance Business Asia

Insurance News

Singapore and China deepen financial cooperation

Initiatives for tourists, fund managers and a green transition

Insurance News

By

Kenneth Araullo

The Monetary Authority of Singapore (MAS) has unveiled new initiatives aimed at bolstering digital finance and capital markets cooperation with China. A news release, said these developments were a key focus at the 19th Joint Council for Bilateral Cooperation (JCBC) held in Tianjin.

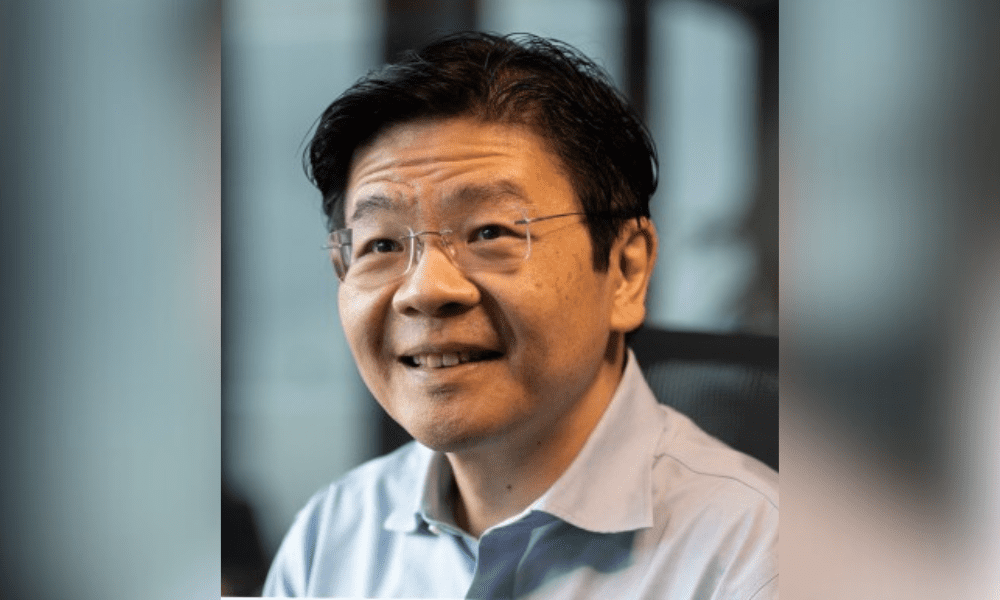

The meeting was co-chaired by Singapore’s deputy prime minister and minister for finance, Lawrence Wong (pictured above), and the People’s Republic of China’s executive vice premier of the State Council, Ding Xuexiang (pictured below, courtesy State Council, People’s Republic of China).

Cross-border E-CNY Pilot

Among the initiatives is the Cross-border E-CNY Pilot, a result of the 2020 Memorandum of Understanding (MOU) on digital finance cooperation between MAS and the Digital Currency Institute of the People’s Bank of China (PBCDCI). This pilot program facilitates the use of e-CNY for tourism expenses in both Singapore and China, thereby improving the convenience of transactions for travellers in both countries.

Additionally, the Singapore Exchange (SGX) and the Shanghai Stock Exchange (SSE) have launched the Exchange Traded Funds (ETF) Product Link. Following the successful initiation of a similar link between the SGX and Shenzhen Stock Exchange (SZSE) in 2022, the SGX and SSE signed an MOU in May 2023 to establish this new connection.

Fund manager collaboration

On December 1, 2023, the CSOP Huatai-Pinebridge SSE Dividend Index ETF and the CSOP iEdge Southeast Asia+ TECH Index ETF were introduced as the first products under this new ETF Product Link. This launch signifies a step forward in enhancing collaboration between fund managers in both markets and improving investor access to ETF products.

The SGX has also signed an MOU with the Guangzhou Futures Exchange (GFEX) to engage in mutual information exchange, visits, training, and joint product and business area research, with a focus on green development.

Banks discuss cross-border payments

Singapore’s local banks and China’s UnionPay International have also initiated preliminary discussions on a potential remittance link between Singapore’s PayNow and UnionPay. This link, subject to respective legal and regulatory frameworks, could offer secure, efficient, and cost-effective cross-border payment and remittance options between the two nations.

China, Singapore and a green transition

At the 18th JCBC, the China-Singapore Green Finance Task Force (GFTF) was established to deepen bilateral cooperation in green and transition finance. In April 2023, the GFTF conducted its inaugural meeting, where MAS and the People’s Bank of China focused on initiatives including a green corridor for green and transition financing products and capacity building in these areas.

“It has been a fruitful year of financial cooperation between Singapore and China,” said Leong Sing Chiong, MAS deputy managing director for markets and development. “MAS welcomes the new initiatives in digital finance and capital markets connectivity, as these will catalyse new financial flows between our financial centres, and deepen trade and economic relations between our economies,”

What are your thoughts on this story? Please feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!