Significant scope for public sector cat bond market development, says DBRS Morningstar

For low and middle income countries with an elevated exposure to natural disasters, catastrophe bonds can be a useful tool for financial planning, but the public sector side of the market needs to grow in order for governments to fully realise the potential benefits, according to analysts at DBRS Morningstar.

The potential fiscal cost of natural disasters can be meaningful in even the most insured parts of the world, such as parts of the U.S., but for those countries vulnerable to catastrophe events that also exhibit low levels of insurance penetration, it can be truly significant.

While governments often step in to aid in recovery and reconstruction, for low and middle income countries the fiscal headroom may not be sufficient to deal with a large natural catastrophe event, which makes post-event recovery even more of a challenge.

In response, some governments have looked to the insurance-linked securities (ILS) market, specifically the catastrophe bond product, to mitigate post-event stress on public finances.

This includes Mexico, Chile, Colombia, Peru, the Philippines, and Jamaica, all of which secured disaster insurance through the World Bank’s International Bank for Reconstruction and Development (IBRD), which is the largest multilateral development bank in the world.

Further, government-related entities or entities fulfilling a public sector mandate, such as the Turkish Catastrophe Insurance Pool (TCIP), the California Earthquake Authority (CEA), and the Caribbean Catastrophe Risk Insurance Facility (CCRIF), have also tapped the capital markets for disaster insurance.

“While the potential occurrence of such natural events will be negative for a sovereign’s credit profile, especially for smaller countries and islands highly exposed to these types of catastrophe, the use of funding mechanisms such as CAT bonds, issued prior to, rather than public debt issued in the midst of a crisis, provides a useful tool for raising fiscal preparedness,” say DBRS analysts.

However, the analysts go on to warn that, while cat bonds might prove to be a useful and effective risk management tool for these countries, in isolation, they’re unlikely to “materially improve the credit profile of a country today, since its use is still marginal.”

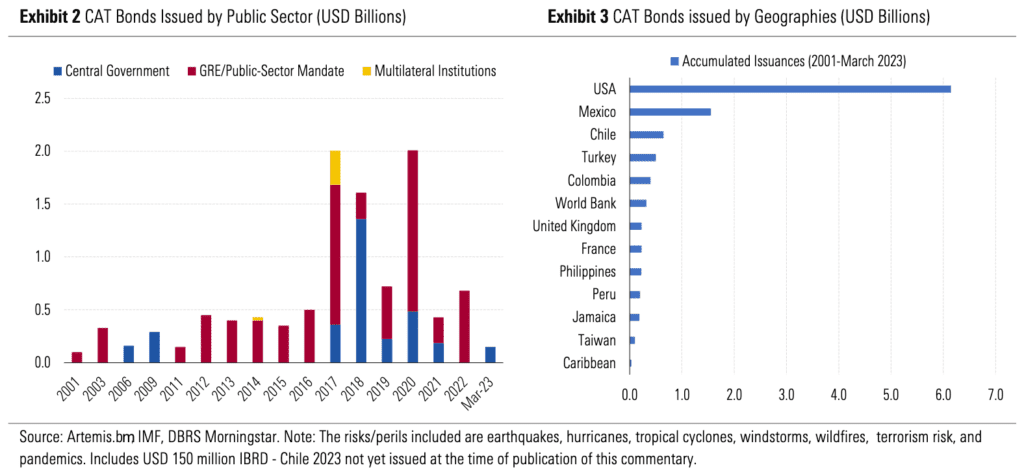

The charts below, provided by DBRS, leverages Artemis’ and other data, and shows the volume of cat bonds issued by the public sector since 2001.

As the chart shows, the public sector’s use of cat bonds has been on the rise over time, and while the likes of the CEA and the TCIP have been the largest players in the cat bond market, in terms of the public sector, the number of countries has grown.

Nevertheless, the market for public sector cat bonds remains relatively shallow, and DBRS highlights some challenges this market faces that could prevent it from scaling up.

“The IMF considers the main barriers to be high transaction costs, complicated underlying catastrophe models, and a narrow investor base (which might be a consequence of the first two factors). The catastrophe risk modelling of expected losses, which is performed by third-party risks modelers, is a noteworthy difference between CAT bonds and plain vanilla bonds,” say analysts.

As highlighted above, the World Bank plays a crucial role in mediating the transfer of risk from a country to the capital markets, as it helps to simplify the process and eliminates the need to create an offshore special purpose vehicle (SPV) to issue the bond, which DBRS notes might not even be legally possible for some, while for others is potentially far too costly.

All in all, DBRS takes the view “that there is significant scope for development in the public-sector CAT bond market in the coming years, although its size is likely to remain relatively small in the near term. In fact, sovereigns can leverage the World Bank’s Capital at Risk Notes program, expertise, and track record in CAT bonds to enter into an insurance or derivative contract against natural disasters.”

The countries that could benefit the most from cat bonds are low and middle income countries with exposure to natural disasters, as these regions typically have weaker credit fundamentals than advanced economies and therefore face higher pressure from capital markets post-catastrophe, says DBRS.

Other reasons include the fact these countries usually have high current investment needs that could boost potential output. By using cat bonds, governments could free up resources that would otherwise have been left unused in a reserve fund, explains DBRS.

The analysts also note that several countries in this group face high disaster risks, such as small countries or islands in the Caribbean.

“Should the market grow, CAT bonds could reduce general government debt refinancing risks in the immediate aftermath of a natural catastrophe. For now, international aid and support mechanisms will remain the most important supportive factors,” say analysts.

You can view details of every public sector and sovereign sponsored catastrophe bond in the extensive Artemis Deal Directory.