Significant increase in weather-related catastrophe insured losses: CRESTA

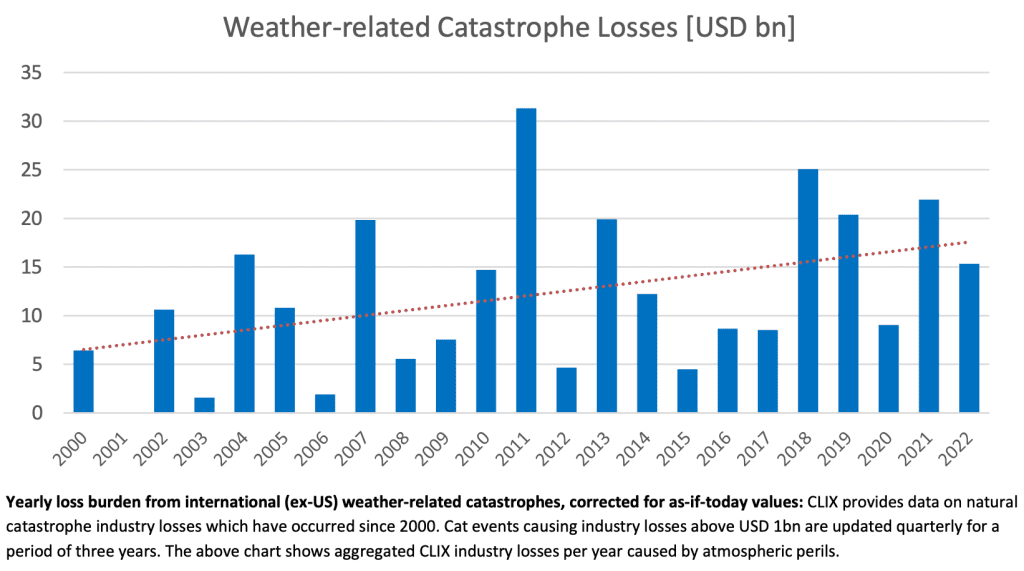

There has been a “significant increase” in insured losses from weather-related catastrophe events over the last 20 or so years, with new data from CRESTA showing the total continues to rise into the 2020’s.

CRESTA’s latest update on international insured catastrophe losses it tracks shows the rising burden from weather-related events over the last two full decades.

According to CRESTA, insurance and reinsurance industry losses from major weather catastrophes occurring between the years 2000 and 2009 totalled US $81bn (adjusted to reflect current values).

In the following decade, 2010 to 2019, the total insured losses from weather-related catastrophe events nearly doubled to US $150bn, CRESTA explained.

The trend appears to be continuing as well, as for the first three years of the current decade, US $46bn of weather-related catastrophe losses have been incurred by the insurance and reinsurance industry so far, due to these atmospheric perils (visible in the chart below).

Matthias Saenger, Technical Manager of the CRESTA Industry Loss Index (CLIX), stated, “The CRESTA CLIX industry loss database goes back to 2000 and therefore allows users to analyse trends in the frequency and severity of major natural catastrophe events. This is critical information for underwriters who are addressing a dynamic risk landscape driven by climate change and the growth in insured values. Only by properly understanding these trends, can natural catastrophe insurance and reinsurance be offered on a sustainable basis, helping to alleviate the capacity constraints currently observed in the market.”

Looking back at international (ex-US) catastrophe events that have caused over $1 billion of insurance and reinsurance market losses in 2022, CRESTA notes that the Australian flooding from February and March remains the most costly event, at roughly US $4.7 billion.

The next largest insurance market loss was the European Windstorm Series (Dudley, Eunice, Franklin) from Feb 2022, at US $4.2 billion, followed by the Fukushima Earthquake in March of US $3.9 billion.

Severe flooding in South Africa in April and hailstorms affecting France in June were the other major catastrophe loss events of the year, CRESTA said.

But the most important detail from CRESTA’s update is not the losses from these larger events, but the aggregation of weather-related catastrophe losses that the insurance and reinsurance industry is suffering.

This has been a key driver for price increases seen at the January reinsurance renewals, as reinsurers and ILS markets look to ensure they are covering their loss costs.