SCS peril dominates $52bn H1 natural hazard insured losses: Gallagher Re

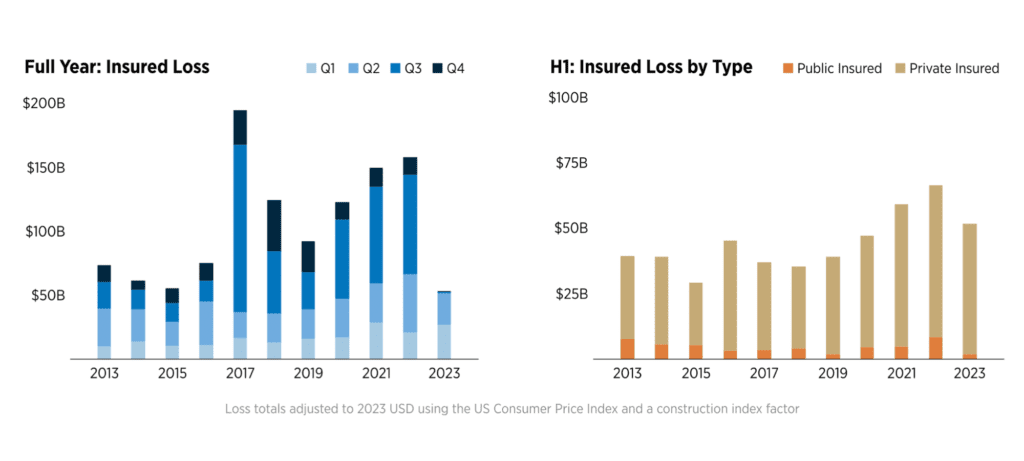

A new report from reinsurance broker Gallagher Re pegs global insurance and reinsurance industry losses from natural hazards at $52 billion for the first half of 2023, of which 69%, or $35 billion is from the severe convective storm (SCS) peril.

According to the broker’s analysis, the $52 billion insured loss total is 18% above the decadal average and 39% higher than the 21st Century average. And with economic losses from natural hazards reaching $138 billion in H1 2023, which is also above both the decadal and 21st Century average, the uninsured portion leaves a protection gap of 63%, or $86 billion.

For solely weather or climate events, so excluding earthquakes or other non-atmospheric-driven perils, Gallagher Re pegs the economic loss at $92 billion for the period, and the insured loss at $46 billion.

SCS activity during the opening six months of the year has been unusually high, and the reinsurance broker’s report confirmed this, describing the peril as “highly dominant” for the re/insurance industry in H1 2023.

In fact, all in all, insurance industry payouts for the SCS peril totalled $35 billion, or 69% of the total, and at least $34 billion of this came from the active multi-month pattern which resulted in a series of outbreaks across the U.S.

Gallagher Re notes that at least 812 confirmed tornadoes touched down in H1 2023, with hail being the dominant damage cost driver with NOAA’s Storm Prediction Center (SPC) recording at least 729 individual instances of hail larger than 2.0 inches (5.1 centimeters) in diameter striking communities across the U.S.

The particularly active period for SCS saw the U.S. minimally incur its second costliest H1 for the peril on record, according to Gallagher Re.

In terms of economic losses, the SCS peril accounts for 34% of the total, which is the same as the earthquake peril driven by the sequence of quakes that struck Turkey in February, driving economic losses of $45 billion. However, insurance penetration is low in the region, so insured losses from the event were around $5 billion, or 11% of the insured loss total for H1 2023.

Gallagher Re’s report also highlights record weather events in other parts of the world, including New Zealand, which witnessed its two most expensive weather events in January and February following torrential rainfall and the remnants of Cyclone Gabriel.

There was also prolific flooding in Italy’s Emilia-Romagna region, as secondary peril losses continue to rise.

In total, Gallagher Re states that there were at least 25 natural catastrophes events which topped $1 billion in economic damage, and at least 17 which topped $1 billion in insurance payments, during the first half of 2023.

Steve Bowen, Gallagher Re’s Chief Science Officer, commented, “The physical risks associated with natural hazards, and the financial and human costs associated with these events, continue to grow. We witnessed a series of significant events during the first half of 2023 that puts further spotlight on the need to close the protection gap by better preparing for the increasingly consequential events that the world continues to endure. The arrival of El Niño brings the potential for even more global disruption and impacts from weather and climate events through at least the rest of the year.

“While El Niño historically causes the globe to become warmer and leads to more volatile weather patterns, the ongoing influence from climate change will only amplify associated impacts to life and property. To put it simply, extreme weather / climate events are anticipated to become more severe.

“Governments and private organizations are accelerating their investments to help ensure the world is proactively prepared to handle our quickly evolving physical and non-physical hazard-related challenges. Climate change is often discussed in future tense, but we are already seeing more evidence of its effects today.”