Risk adjusted cat bond yields seven times higher than 2016: Twelve Capital

Specialist insurance-linked securities (ILS) and reinsurance investment manager Twelve Capital believes the catastrophe bond investment opportunity to be particularly compelling for 2023.

Higher pricing of reinsurance and retrocession, alongside stricter documentation of coverage in cat bonds, means the sector has about the highest return potential in its history.

These factors “Make the current environment an interesting entry opportunity for investors,” Twelve Capital explained.

A significant pipeline of maturities means those cat bonds with widened spreads that do not end up facing any losses are likely to mature close to their par valuations.

“Any spread widening resulting in bonds trading below par will lead to significant performance generation if those bonds mature at par within the envisioned timeframe,” Twelve Capital points out.

The manager states that around 20% of the outstanding stock of catastrophe bonds are scheduled to mature in 2023, with another 30% in 2024 and around 35% in 2025.

With the vast majority of cat bonds set to mature within the next three years, the fact many names already have wider spreads implies there is a particularly good entry point based on valuations.

But with a busy pipeline of new cat bonds expected, all of which will come bearing higher yields given the higher pricing across reinsurance and ILS, while at the same time the terms of coverage are stricter, the opportunity looks even better.

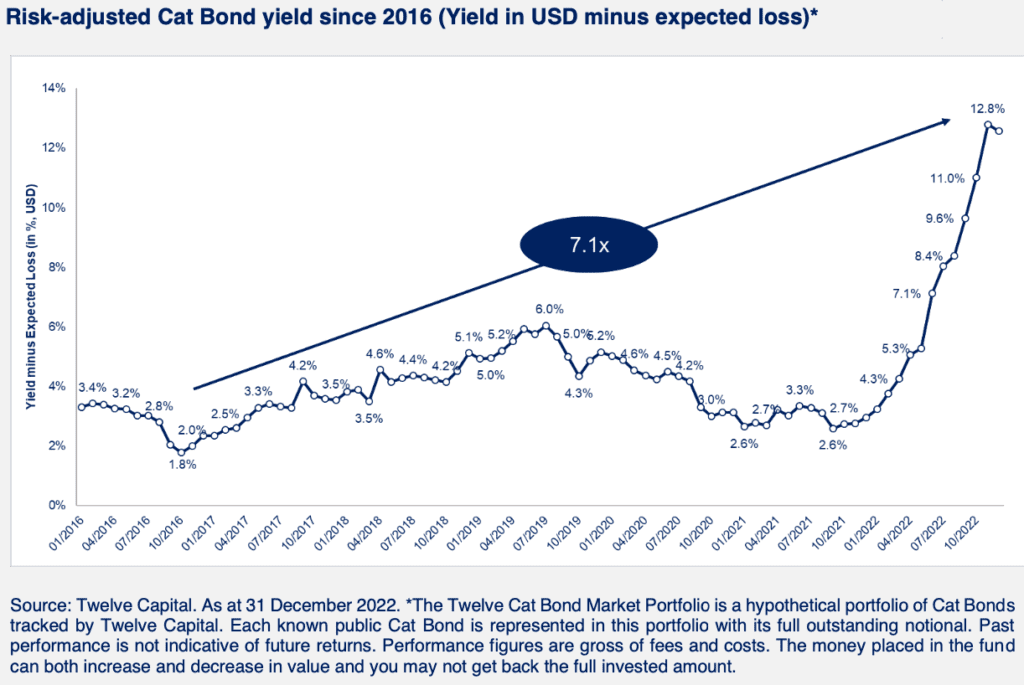

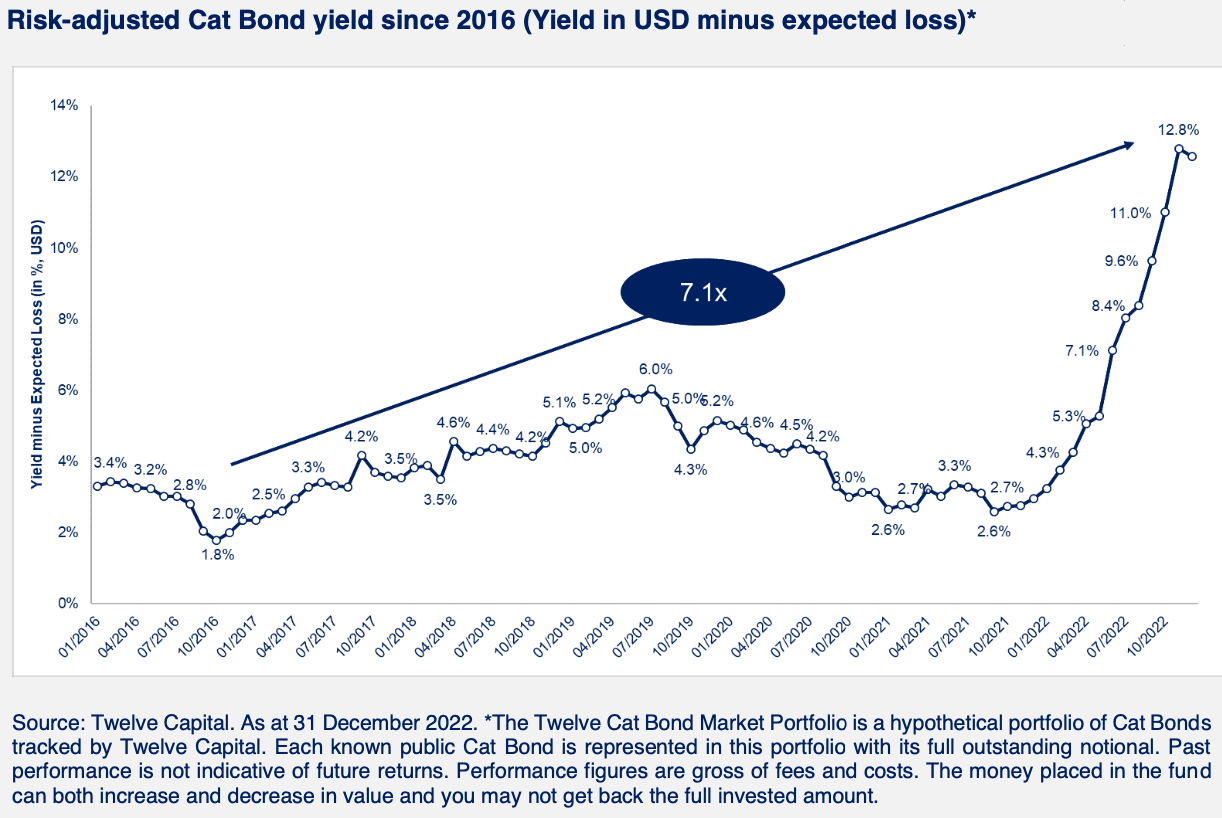

This has led to a situation where risk-adjusted cat bond market yields are at or near all-time-highs, see Twelve Capital’s chart below for context.

“With risk-adjusted Cat Bond yield levels in the market of currently around 12%, almost no interest rate duration and fundamentally low correlation to broader financial markets, the opportunity set in Cat Bond looks compelling,” Twelve Capital said.

As Twelve Capital’s chart shows, the risk-adjusted yield of the cat bond market is now over seven times higher than seen in 2016, implying significant return potential for investments into catastrophe bonds at this time.

You can analyse data on catastrophe bond issuance by year and by quarter, their average pricing, spread and risk level in terms of expected losses, in Artemis’ interactive chart.