Resilience in representation

Resilience in representation | Insurance Business America

Insurance News

Resilience in representation

RWI continues to thrive in a post-pandemic M&A landscape

Insurance News

By

Ryan Smith

Post-COVID, while many markets struggled and slowed, the world of representations and warranties insurance (RWI) remained surprisingly resilient. Why? A combination of smaller M&A deals and the product’s nimble evolution to better match client needs.

Since the pandemic there’s been something of an evolution in the RWI market, with advancements in underwriting capacity. However, it’s not been without significant challenges and “unsustainably” low rates. Speaking to Insurance Business, Phil Casper (pictured above), a principal at Euclid Transactional, said that there’s been some innovation in the field too.

“We’ve really added a lot of capacity in the industry, which allows us to ensure the most large deals in the market,” he said. “[That’s] multibillion-dollar deals, $10 billion and up deals – as well as getting to all of the much smaller $10 million deals. There’s been some great innovation by the industry overall.”

The insurance initially became popular for private company deals, primarily driven by private equity sellers who preferred to avoid escrows and other post-closing liabilities. However, there’s been a notable shift in inquiries about insuring public company transactions.

“In the most mature jurisdictions like the UK and the US, most private company deals overall use reps and warranties insurance. Now the space where we’re starting to see growth is in the public company space,” Casper said. “It’s still not used on most deals, but we’re seeing more and more buyers of public companies use the insurance to get the same protection that they would be able to get if they were buying a private company.”

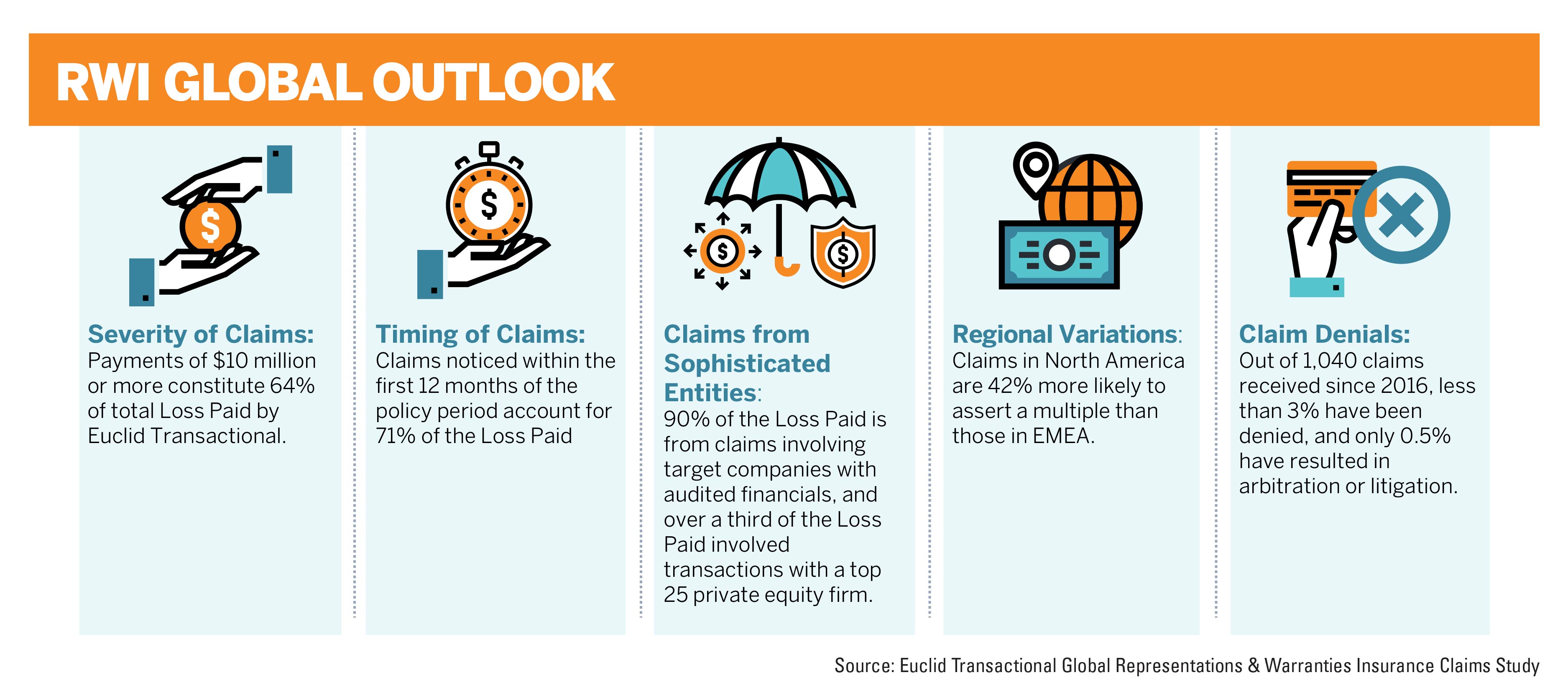

RWI simplifies negotiations, replacing complex indemnity discussions with straightforward insurance solutions. This shift not only eases the deal process but also eliminates potential conflicts between buyers and sellers post-closing. And it’s gaining momentum – according to a recent report from Euclid Transactional. In its “R&W/W&I Insurance April 2024 Update,” Euclid Transactional bound a Q1 record high 247 RWI policies globally – which is 4% more than any previous Q1 recordings. What’s more, Euclid Transactional received 1820 submissions across the same period – up a notable 18% from Q1 in the previous year.

“It’s a deal lubricant in a lot of ways,” Casper said. “Another clear demonstration of value here is around salvaging deals – [helping] buyers who acquired a company expecting one thing and receiving something else. We’re able to monetarily put them in the position they thought they were going to be in if what the seller told them about the company was true.”

In terms of the recent boom in RWI interest, Casper highlights the pandemic as instrumental in driving more M&A deals. According to Gallagher’s “2023 Representations and Warranties Insurance Outlook,” during the COVID era there was a significant interest in smaller M&A deals – with insurers initially setting a minimum deal threshold of $200 million. As a result of this, the availability of RWIs were limited which led some brokers to seek out specific markets that would look at smaller deals.

“2021 was a record year in the M&A industry,” Casper said. “By any real measure, there’s more volume in that year than ever before. Generally speaking, the reason why the product has gotten more popular is down to proof of concept. Early adopters of it got really used to doing deals using the product and it just continued to spread – to a point where I think it’s much more standard than it isn’t, at least on private company deals.”

And this isn’t set to change anytime soon. Looking ahead, Casper is optimistic about the future of RWI, especially in emerging markets and new sectors. The growth opportunities are significant, particularly in certain countries within Asia Pacific and Europe, where the firm has been expanding its presence.

“There’s a lot of white space for this product to be used,” Casper said. “We just opened an office in Paris to capture that opportunity.”

However, there are still major challenges ahead – primarily down to shifting regulations and the pricing environment in the industry – that “really needs a hard look.” This pricing issue could lead to a reduction in service quality if not addressed, as insurers might struggle to maintain high service levels without adequate compensation.

“There used to be a certain amount of premium in the market – insurers need to be getting enough rates for the limits that they’re putting out,” Casper said. “Right now, rates are probably at an unsustainably low level, and I’m concerned that if they stay at these levels for an extended period of time we’re going to have to sacrifice on service levels and on clients getting what they really want. Which is a really streamlined, efficient product with really sophisticated people helping them underwrite their deals.”

The changes in the regulatory landscape affects sellers’ ability to represent that they are in compliance with laws when the way that laws are enforced changes so significantly from one administration to the next. And, as Casper told IB, this is a value proposition for RWI.

“The uncertainty in who will be in office at this time next year may be weighing slightly on some M&A this year,” Casper said. “We have expanded our tax liability underwriting team (which is a separate line of business from RWI) to address the fact that we believe that the growth in government incentives to switch to renewable energy will increase. Tax liability insurance protects taxpayers who want to make sure they will be able to use those tax incentives in the future.”

On the technological front, Casper was enthusiastic about the potential for artificial intelligence (AI) and large language models to revolutionize the RWI space. After all, these technologies could make the underwriting process more efficient and enhance the overall service offering.

“The advances that we’ve seen in AI and large language models are fairly eye-opening over the last couple of years,” he said. “We’re going to continue to explore whether that’s something that can be used in our space. I think there’s certainly ways that those tools will start being applied in our industry over the next five to 10 years. So we’re definitely looking at that to make sure we stay on top of those trends and don’t end up being behind other folks in the industry.”

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!