Reinsurer underlying ROE back above cost-of-capital in 2022: Gallagher Re

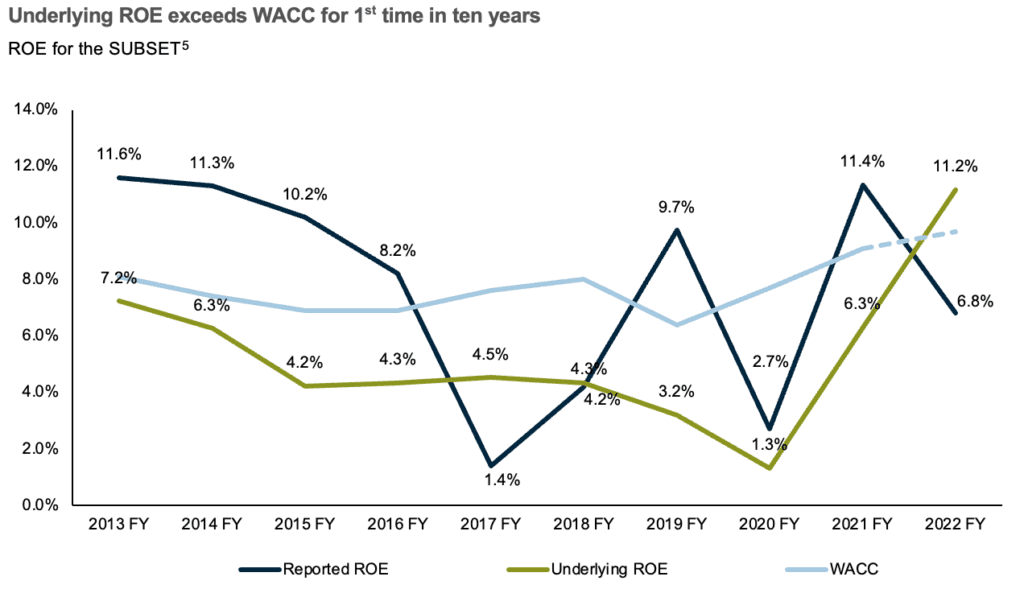

Reflecting the improved underwriting and rate conditions in the global reinsurance marketplace, for the first time in a decade the average underlying return on equity (ROE) has surpassed the sector’s weighted average cost of capital (WACC), data from Gallagher Re shows.

While global reinsurance capital levels plummeted 12% to $638 billion by the end of 2022, according to Gallagher Re data, led by traditional reinsurance capital which declined by 14% during the year.

While investment valuations were a huge driver of this and many believe a strong driver for the hardening of reinsurance rates in 2023, the underlying results of a group of reinsurers analysed by Gallagher Re perhaps show that things aren’t as dire as the headline numbers make it seem.

Gallagher Re explained that while the average return on equity (ROE) reported by reinsurers declined from 11.4% to 6.8%, on an underlying basis the ROE jumped from 6.3% to 11.2%.

“For the first time in the past ten years, reinsurers’ average underlying ROE surpassed the industry’s weighted average cost of capital (WACC),” the broker said.

Brian Shea, Global Head of Strategic & Financial Advisory, Gallagher Re, commented, “It would be easy to misinterpret 2022, both in terms of reinsurers’ capital positions and earnings.

“While capital, as measured on an accounting basis, and the average reported ROE both declined materially, economic measures of solvency remain strong, and reinsurers have achieved a strong improvement in underlying performance such that the underlying ROE has finally moved above the industry’s cost of capital.”

The chart above shows that weighted average cost of capital for the reinsurance industry has risen somewhat, as you’d expect, but also shows that this has generally been on an upward trajectory anyway.

An elevated cost-of-capital has also been cited as one of the key drivers for the current reinsurance hard market.

Gallagher Re explains some of the reasons for the rise in underlying reinsurer return on equity through 2022, “This improvement has been driven by better underwriting results, stronger investment income and, for 2022, more operating leverage as shareholders’ equity reduced due to the decline in the value of investments.”

So, it’s not so clear-cut as simply being driven by higher rates on the inwards side and better underwriting results, economics are a big factor here, it seems.

But, it does imply reinsurers are in a position where, as long as underwriting results remain positive and macroeconomic conditions don’t worsen, the returns on reinsurance business should be higher for a time.

Which could imply reinsurers have room to soften rates a little, without denting their hopes of profits and this combined with the softening trend seen to begin in catastrophe bonds, could also be a sign that rates had perhaps risen faster and further than necessary, in order for adequate returns to be delivered.

Of course, loss activity is the big unknown and the really critical thing, for both reinsurers and ILS funds, will be how much of a buffer above an average annual amount of loss activity they have in the new, harder rate environment, enabling them to deliver the positive returns their capital providers are now demanding.