Quotes for car insurance: How to find the best deal

Quotes for car insurance: How to find the best deal | Insurance Business America

Guides

Quotes for car insurance: How to find the best deal

We compiled the request-for-quote (RFQ) pages of every auto insurance provider in the US that we could find. Your search for car insurance quotes just got easier

The biggest challenge when searching for the best quotes for car insurance is knowing where to look. With thousands of auto insurance companies across the US offering a wide array of policies, picking the one that matches your budget and coverage needs can be an overwhelming task.

To make your search easier, Insurance Business compiled the links to the RFQ pages of about a hundred of the country’s top car insurance carriers. By accessing these pages, you can get an idea of the kind of protection each insurer provides and receive a free quote just by answering a few questions.

Jumpstart your search for the best car insurance deal with this comprehensive guide on car insurance quotes.

With the vast number of insurance companies selling auto policies, the simplest and easiest way to shop and compare quotes for car insurance is to go online.

The US is home to about 2,000 auto insurance providers, ranging from industry giants that control the market to small regional carriers targeting a specific demographic. Each offers an assortment of policies catering to different types of motorists. almost all of these policies can be accessed through their websites.

The table below contains the links to the request-for-quote (RFQ) pages of some of the country’s leading auto insurance companies.

If you’re currently shopping for a policy, this is the place to go. Just scan the table below, pick an insurer, and click the link. This will lead you directly to the company’s RFQ page, where you can get a free quote by answering a few questions relating to your driving profile and coverage needs.

Get free car insurance quotes from the country’s top auto insurers!

Apart from insurer websites, you can use price comparison sites to shop and search for the best deal.

By using these tools, you can do a side-by-side comparison of the policies from different insurers, as well as gather quotes for car insurance to help you in your decision.

But if you prefer a more personal touch to your shopping experience, you can contact a car insurance agent or broker. These industry professionals can provide a range of options while explaining how each policy’s features and benefits work – something that may be lacking when you go the online route.

If you’re wondering what an agent’s responsibilities are and how much they earn for their services, you can check out this guide on how much car insurance agents make.

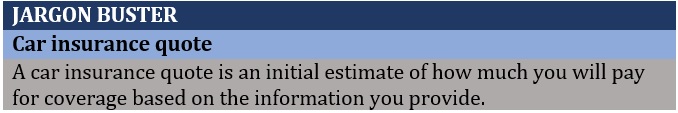

Car insurance quotes are initial estimates of the premiums you will pay for coverage based on the information you provide. Each insurer calculates quotes differently using a range of factors, which we will discuss in the succeeding section.

Car insurance quotes are free of charge, so you can get as many as you want. You can access these online through insurer or price comparison websites, or by contacting an insurance agent or broker.

The Insurance Information Institute (Triple-I) recommends comparing quotes from at least three insurers to get a clearer picture of how much coverage costs for your profile.

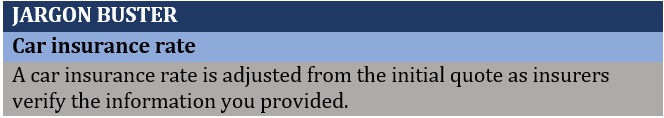

As quotes are just initial estimates, the final price of your auto insurance policy may be different. Insurance companies typically adjust quotes for car insurance as they verify the information you have disclosed to come up with the appropriate insurance rates. From here, you can pick the one that best suits your finances and coverage needs.

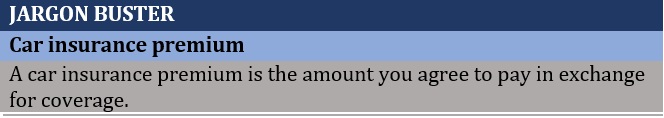

Once you’ve made your choice, you will be given a policy document to sign. This contains everything about your car insurance policy, including your premiums, which is the final price you agreed to pay for coverage.

Quotes, rates, and insurance premiums are often used interchangeably, but these are actually separate elements of your car insurance. Our jargon buster below reveals the distinction.

Jargon buster – quotes for car insurance

Jargon buster – car insurance rates vs quotes for car insurance

Jargon buster – car insurance premiums vs quotes for car insurance

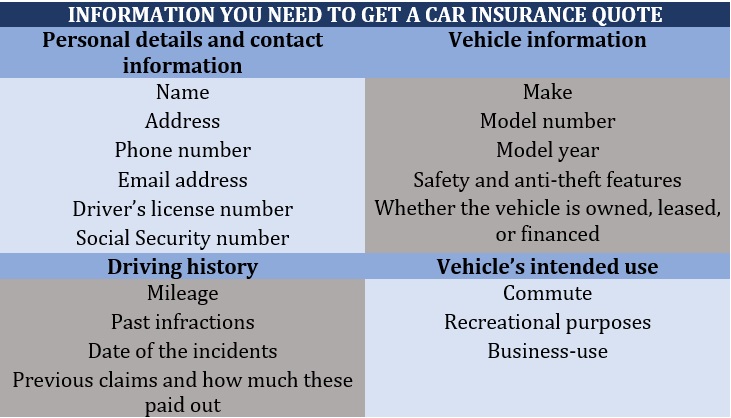

If you tried getting car insurance quotes from the links above, you will notice that there are certain personal details that insurers commonly ask for. These will help them determine an initial estimate of how much your car coverage will cost. These factors include:

Your zip code: Your quotes may be lower if you live in a relatively safe area than for those residing in cities where theft and accidents are common.

Your age: Insurers view younger drivers as inexperienced and prone to accidents, so the younger you are, the higher your quotes will be.

Your gender: Men are statistically more likely to get involved in accidents than women, which has a corresponding impact on insurance quotes. Gender and age, however, are often related and insurers treat these variables differently.

Marital status: Married couples are perceived as safer drivers and more financially stable than their single counterparts. That’s why they often get lower quotes for car insurance.

Educational attainment: Drivers with advanced degrees have been found to be less likely to file claims, allowing them to obtain cheaper quotes.

The type of vehicle you drive: Insurers evaluate quotes based on a range of parameters including how much a vehicle costs, how expensive it is to repair, and how prone it is to theft.

Homeownership: Owning a house is another indication of financial stability, which can help reduce your quotes.

Your driving history: A poor driving record shows that you’re more likely to file a claim in the future. DUI citations, speeding violations, and at-fault accidents can drive up quotes considerably.

Your credit history: Many states use credit-based auto insurance scores to help determine quotes. If you have a good credit history, you’re also seen more responsible and less likely to file a claim.

Whether you’re currently insured: Having a lapse in your insurance history can push up your quotes once you try to obtain coverage again.

Car insurance companies also ask if you own your vehicle or if it’s still under financing. Some ask if there will be other drivers included in the policy. Both have an impact on your car insurance quotes.

Insurance providers will verify all information you provide to come up with a rate that matches your driving profile and coverage needs.

If you want to know how much coverage costs for the country’s largest auto insurers, you can check out this car insurance comparison guide that we prepared.

Apart from the details mentioned above, auto insurance companies will ask you to provide additional information to ensure that you’re a legitimate person looking for car insurance quotes. The table below lists some of the information you may need to provide.

Quotes for car insurance – what information will insurers get from you

Shopping around and comparing quotes for car insurance are among the simplest and most effective ways of getting the best value for your money. However, you need to know what to look for. Here are some of the factors you need to consider in finding the best deal.

Minimum coverage requirements

Each state has different rules on the minimum mandatory coverage requirements for one to operate a vehicle. Bodily injury and property damage liability coverage are compulsory in most states. Others extend mandatory policies to personal injury protection – also called medical payments in no-fault states – and uninsured and underinsured motorist coverage.

When shopping and comparing quotes, you must ensure that the policies reflect the minimum requirements in your state. You can do this by checking the state’s insurance commissioner’s or the motor vehicle department’s websites. You can also just check out our extensive car insurance primer, where we compiled every state’s mandatory coverage requirements in one neat table.

Discount options

Most insurers allow you to lower the quotes for car insurance by offering a range of discounts. Some of the common options include:

Discounts for bundling car policies with either home or life insurance

Multi-vehicle discounts

Safe driver discounts

Good student discounts for those who get a certain GPA

Discounts for installing safety and anti-theft features

Discounts for taking defensive driving courses

Discounts for going paperless, electronic fund transfers, and annual payments

Some car insurers offer discounts to hybrid or electric vehicle owners, or those who drive cars running on alternative fuel.

Coverage limits and deductibles

Different policies come with varying coverage limits. You may also be asked to choose a deductible amount. To ensure that you’re making an accurate comparison, the coverage limits and deductible amounts must be consistent across all policies.

Company reputation

The choice of insurance carrier is also important when shopping and comparing quotes for car insurance.

Established insurers have the financial means to pay for your claims, but local carriers may be able to provide more personalized coverage.

Another factor you should pay attention to is the way the company handles claims and other client concerns. You can check out customer reviews and industry surveys for these.

One of the biggest costs of owning and operating a vehicle is car insurance. Because of this, it can be tempting to go with an insurer that offers cheaper coverage. But there’s a risk in doing so. You may end up losing more, especially if the protection the policies provide is not enough.

As with any other type of insurance, cheaper doesn’t necessarily mean better when it comes to your auto policy. It is also important to look beyond the insurance quotes and assess if the policy offers the level of protection that suits your needs.

Are there additional tips on finding the best quotes for car insurance that you want to share? Type in your suggestions in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!